Improved Revenues Required Before Come Sure Group (Holdings) Limited (HKG:794) Stock's 28% Jump Looks Justified

Come Sure Group (Holdings) Limited (HKG:794) shares have continued their recent momentum with a 28% gain in the last month alone. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

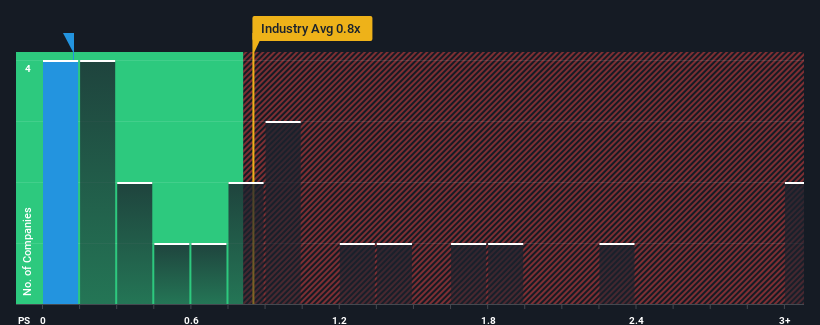

Although its price has surged higher, given about half the companies operating in Hong Kong's Packaging industry have price-to-sales ratios (or "P/S") above 0.8x, you may still consider Come Sure Group (Holdings) as an attractive investment with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Come Sure Group (Holdings)

What Does Come Sure Group (Holdings)'s P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Come Sure Group (Holdings) over the last year, which is not ideal at all. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. Those who are bullish on Come Sure Group (Holdings) will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Come Sure Group (Holdings)'s earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Come Sure Group (Holdings) would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 32%. As a result, revenue from three years ago have also fallen 32% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 16% shows it's an unpleasant look.

With this information, we are not surprised that Come Sure Group (Holdings) is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

The Key Takeaway

Despite Come Sure Group (Holdings)'s share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's no surprise that Come Sure Group (Holdings) maintains its low P/S off the back of its sliding revenue over the medium-term. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises either. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Come Sure Group (Holdings) (2 don't sit too well with us) you should be aware of.

If these risks are making you reconsider your opinion on Come Sure Group (Holdings), explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:794

Come Sure Group (Holdings)

An investment holding company, engages in the manufacture, sale, and trading of corrugated paperboards and paper-based packaging products in Hong Kong, Macau, and the People’s Republic of China.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives