Most Shareholders Will Probably Find That The CEO Compensation For China Aluminum Cans Holdings Limited (HKG:6898) Is Reasonable

Key Insights

- China Aluminum Cans Holdings' Annual General Meeting to take place on 27th of May

- CEO Wan Tsang Lin's total compensation includes salary of HK$346.0k

- Total compensation is similar to the industry average

- China Aluminum Cans Holdings' EPS declined by 2.1% over the past three years while total shareholder return over the past three years was 37%

Despite strong share price growth of 37% for China Aluminum Cans Holdings Limited (HKG:6898) over the last few years, earnings growth has been disappointing, which suggests something is amiss. These concerns will be at the front of shareholders' minds as they go into the AGM coming up on 27th of May. They will be able to influence managerial decisions through the exercise of their voting power on resolutions, such as CEO remuneration and other matters, which may influence future company prospects. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

Check out our latest analysis for China Aluminum Cans Holdings

Comparing China Aluminum Cans Holdings Limited's CEO Compensation With The Industry

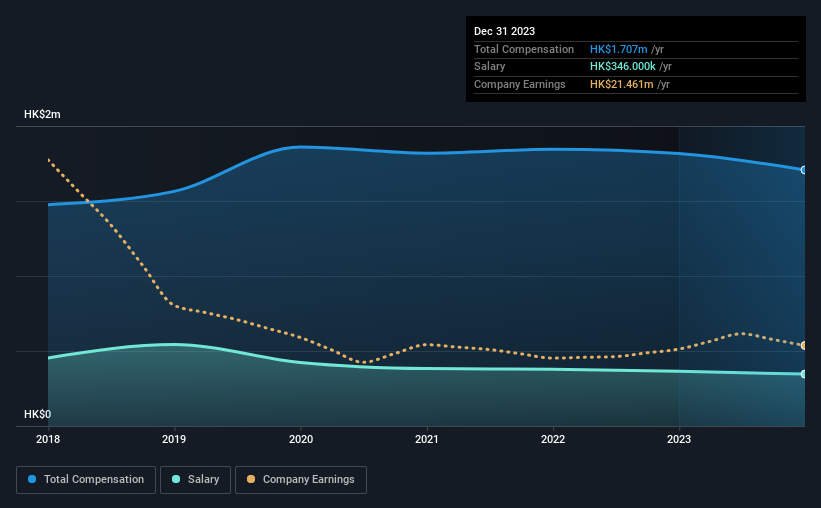

According to our data, China Aluminum Cans Holdings Limited has a market capitalization of HK$542m, and paid its CEO total annual compensation worth HK$1.7m over the year to December 2023. That's slightly lower by 6.0% over the previous year. While we always look at total compensation first, our analysis shows that the salary component is less, at HK$346k.

On comparing similar-sized companies in the Hong Kong Packaging industry with market capitalizations below HK$1.6b, we found that the median total CEO compensation was HK$1.4m. So it looks like China Aluminum Cans Holdings compensates Wan Tsang Lin in line with the median for the industry. Moreover, Wan Tsang Lin also holds HK$354m worth of China Aluminum Cans Holdings stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | HK$346k | HK$365k | 20% |

| Other | HK$1.4m | HK$1.5m | 80% |

| Total Compensation | HK$1.7m | HK$1.8m | 100% |

On an industry level, roughly 79% of total compensation represents salary and 21% is other remuneration. China Aluminum Cans Holdings sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at China Aluminum Cans Holdings Limited's Growth Numbers

China Aluminum Cans Holdings Limited has reduced its earnings per share by 2.1% a year over the last three years. Its revenue is up 12% over the last year.

Its a bit disappointing to see that the company has failed to grow its EPS. While the revenue growth is good to see, it is outweighed by the fact that EPS are down, over three years. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has China Aluminum Cans Holdings Limited Been A Good Investment?

Most shareholders would probably be pleased with China Aluminum Cans Holdings Limited for providing a total return of 37% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Despite the strong returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 3 warning signs for China Aluminum Cans Holdings (of which 1 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from China Aluminum Cans Holdings, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you're looking to trade China Aluminum Cans Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6898

China Aluminum Cans Holdings

An investment holding company, manufactures and sells aluminum aerosol cans in Mainland China, Africa, the America, and Asia.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives