- Hong Kong

- /

- Metals and Mining

- /

- SEHK:6890

Is KangLi International Holdings (HKG:6890) Using Too Much Debt?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that KangLi International Holdings Limited (HKG:6890) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

What Is KangLi International Holdings's Net Debt?

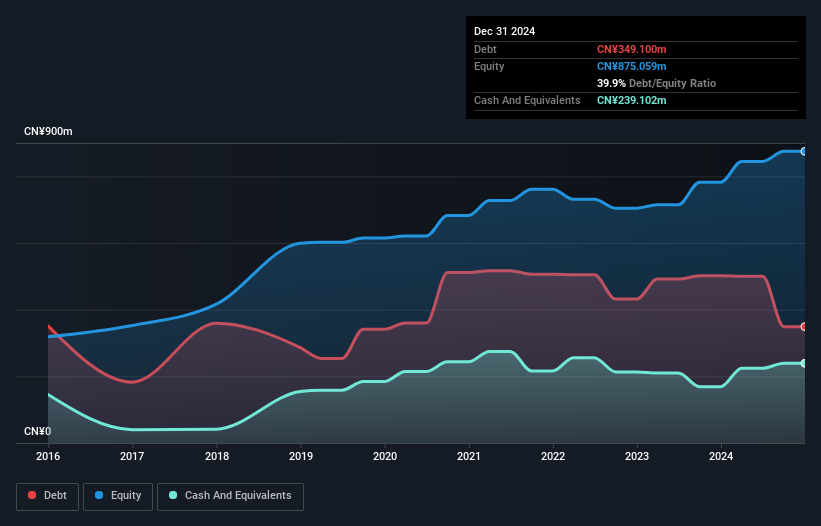

You can click the graphic below for the historical numbers, but it shows that KangLi International Holdings had CN¥349.1m of debt in December 2024, down from CN¥501.7m, one year before. However, it does have CN¥239.1m in cash offsetting this, leading to net debt of about CN¥110.0m.

How Strong Is KangLi International Holdings' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that KangLi International Holdings had liabilities of CN¥708.0m due within 12 months and liabilities of CN¥114.1m due beyond that. Offsetting these obligations, it had cash of CN¥239.1m as well as receivables valued at CN¥469.8m due within 12 months. So its liabilities total CN¥113.2m more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since KangLi International Holdings has a market capitalization of CN¥229.3m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

View our latest analysis for KangLi International Holdings

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

With net debt sitting at just 0.73 times EBITDA, KangLi International Holdings is arguably pretty conservatively geared. And this view is supported by the solid interest coverage, with EBIT coming in at 8.0 times the interest expense over the last year. Also good is that KangLi International Holdings grew its EBIT at 16% over the last year, further increasing its ability to manage debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since KangLi International Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Considering the last two years, KangLi International Holdings actually recorded a cash outflow, overall. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

KangLi International Holdings's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered cast it in a significantly better light. In particular, its net debt to EBITDA was re-invigorating. Looking at all the angles mentioned above, it does seem to us that KangLi International Holdings is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for KangLi International Holdings you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if KangLi International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6890

KangLi International Holdings

Engages in the manufacture and sale of steel products in the People’s Republic of China and Thailand.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026