- Hong Kong

- /

- Metals and Mining

- /

- SEHK:661

Does China Daye Non-Ferrous Metals Mining (HKG:661) Deserve A Spot On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in China Daye Non-Ferrous Metals Mining (HKG:661). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for China Daye Non-Ferrous Metals Mining

China Daye Non-Ferrous Metals Mining's Improving Profits

In the last three years China Daye Non-Ferrous Metals Mining's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, China Daye Non-Ferrous Metals Mining's EPS shot from CN¥0.0082 to CN¥0.017, over the last year. You don't see 109% year-on-year growth like that, very often.

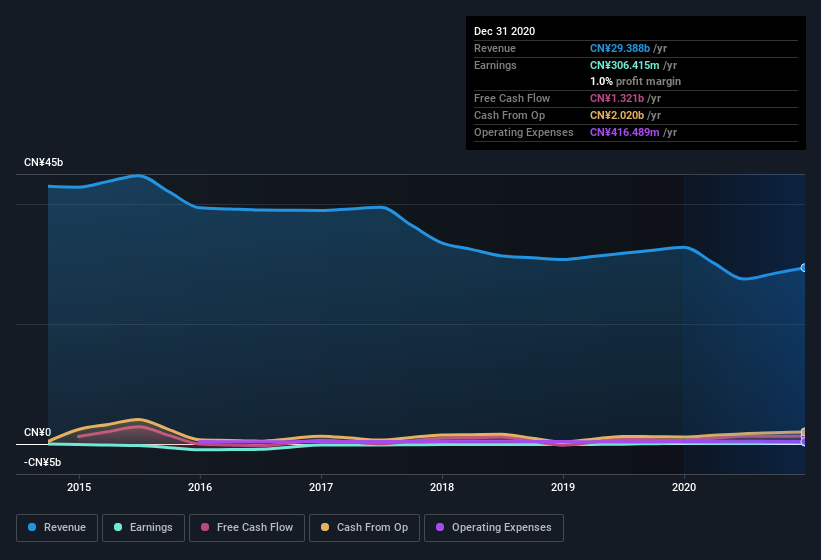

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. While China Daye Non-Ferrous Metals Mining may have maintained EBIT margins over the last year, revenue has fallen. Suffice it to say that is not a great sign of growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Since China Daye Non-Ferrous Metals Mining is no giant, with a market capitalization of HK$2.0b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are China Daye Non-Ferrous Metals Mining Insiders Aligned With All Shareholders?

As a general rule, I think it worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. I discovered that the median total compensation for the CEOs of companies like China Daye Non-Ferrous Metals Mining with market caps between CN¥647m and CN¥2.6b is about CN¥1.9m.

China Daye Non-Ferrous Metals Mining offered total compensation worth CN¥1.2m to its CEO in the year to . That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is China Daye Non-Ferrous Metals Mining Worth Keeping An Eye On?

China Daye Non-Ferrous Metals Mining's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. With rocketing profits, its seems likely the business has a rosy future; and it may have hit an inflection point. Meanwhile, the very reasonable CEO pay reassures me a little, since it points to an absence profligacy. So China Daye Non-Ferrous Metals Mining looks like it could be a good quality growth stock, at first glance. That's worth watching. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for China Daye Non-Ferrous Metals Mining (1 is significant) you should be aware of.

Of course, you can do well (sometimes) buying stocks that are not growing earnings and do not have insiders buying shares. But as a growth investor I always like to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:661

China Daye Non-Ferrous Metals Mining

An investment holding company, engages in the mining and processing of mineral ores in China, Hong Kong, Kyrgyzstan, and the Republic of Mongolia.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success