- Hong Kong

- /

- Metals and Mining

- /

- SEHK:661

China Daye Non-Ferrous Metals Mining (HKG:661) Is Doing The Right Things To Multiply Its Share Price

To find a multi-bagger stock, what are the underlying trends we should look for in a business? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Speaking of which, we noticed some great changes in China Daye Non-Ferrous Metals Mining's (HKG:661) returns on capital, so let's have a look.

What Is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on China Daye Non-Ferrous Metals Mining is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.077 = CN¥779m ÷ (CN¥17b - CN¥7.0b) (Based on the trailing twelve months to December 2021).

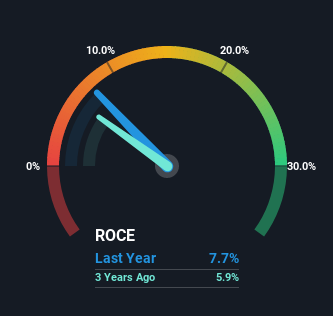

So, China Daye Non-Ferrous Metals Mining has an ROCE of 7.7%. Ultimately, that's a low return and it under-performs the Metals and Mining industry average of 14%.

See our latest analysis for China Daye Non-Ferrous Metals Mining

Historical performance is a great place to start when researching a stock so above you can see the gauge for China Daye Non-Ferrous Metals Mining's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of China Daye Non-Ferrous Metals Mining, check out these free graphs here.

What The Trend Of ROCE Can Tell Us

China Daye Non-Ferrous Metals Mining is showing promise given that its ROCE is trending up and to the right. The figures show that over the last five years, ROCE has grown 180% whilst employing roughly the same amount of capital. So it's likely that the business is now reaping the full benefits of its past investments, since the capital employed hasn't changed considerably. The company is doing well in that sense, and it's worth investigating what the management team has planned for long term growth prospects.

On a side note, China Daye Non-Ferrous Metals Mining's current liabilities are still rather high at 41% of total assets. This effectively means that suppliers (or short-term creditors) are funding a large portion of the business, so just be aware that this can introduce some elements of risk. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

What We Can Learn From China Daye Non-Ferrous Metals Mining's ROCE

In summary, we're delighted to see that China Daye Non-Ferrous Metals Mining has been able to increase efficiencies and earn higher rates of return on the same amount of capital. Given the stock has declined 42% in the last five years, this could be a good investment if the valuation and other metrics are also appealing. That being the case, research into the company's current valuation metrics and future prospects seems fitting.

On a separate note, we've found 1 warning sign for China Daye Non-Ferrous Metals Mining you'll probably want to know about.

While China Daye Non-Ferrous Metals Mining isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:661

China Daye Non-Ferrous Metals Mining

An investment holding company, engages in the mining and processing of mineral ores in China, Hong Kong, Kyrgyzstan, and the Republic of Mongolia.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.