- Hong Kong

- /

- Metals and Mining

- /

- SEHK:601

Rare Earth Magnesium Technology Group Holdings' (HKG:601) Shareholders Are Down 76% On Their Shares

As an investor, mistakes are inevitable. But really big losses can really drag down an overall portfolio. So consider, for a moment, the misfortune of Rare Earth Magnesium Technology Group Holdings Limited (HKG:601) investors who have held the stock for three years as it declined a whopping 76%. That'd be enough to cause even the strongest minds some disquiet. And over the last year the share price fell 69%, so we doubt many shareholders are delighted. The good news is that the stock is up 1.1% in the last week.

See our latest analysis for Rare Earth Magnesium Technology Group Holdings

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

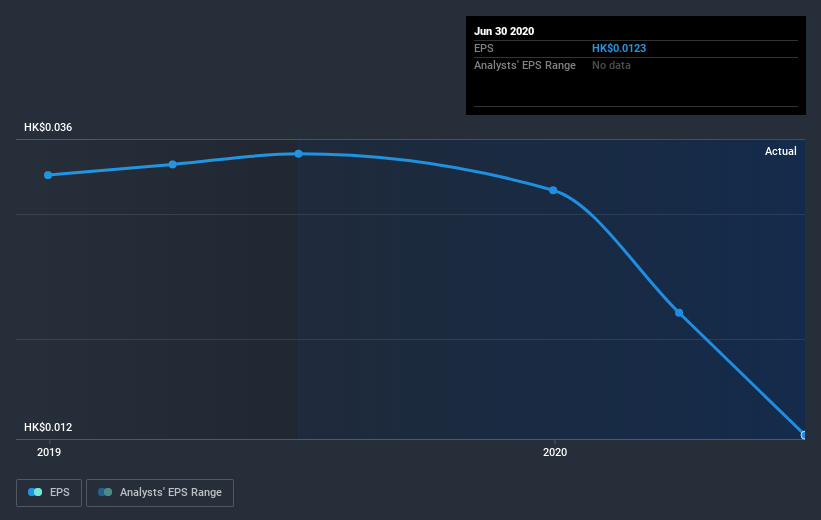

Rare Earth Magnesium Technology Group Holdings saw its EPS decline at a compound rate of 25% per year, over the last three years. This reduction in EPS is slower than the 38% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy. The less favorable sentiment is reflected in its current P/E ratio of 7.23.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Rare Earth Magnesium Technology Group Holdings shareholders are down 69% for the year (even including dividends), but the market itself is up 25%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Rare Earth Magnesium Technology Group Holdings better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Rare Earth Magnesium Technology Group Holdings (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

When trading Rare Earth Magnesium Technology Group Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:601

Rare Earth Magnesium Technology Group Holdings

An investment holding company, manufactures, trades, and sells magnesium products in Mainland China.

Slight risk and slightly overvalued.

Market Insights

Community Narratives