As global markets navigate a volatile landscape marked by mixed corporate earnings and geopolitical uncertainties, investors are increasingly focused on finding reliable sources of income. In such an environment, dividend stocks can offer a steady stream of returns, making them an attractive option for those looking to balance risk with potential rewards.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.97% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.98% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.47% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.53% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.33% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.66% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.46% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.70% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.56% | ★★★★★★ |

Click here to see the full list of 1980 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

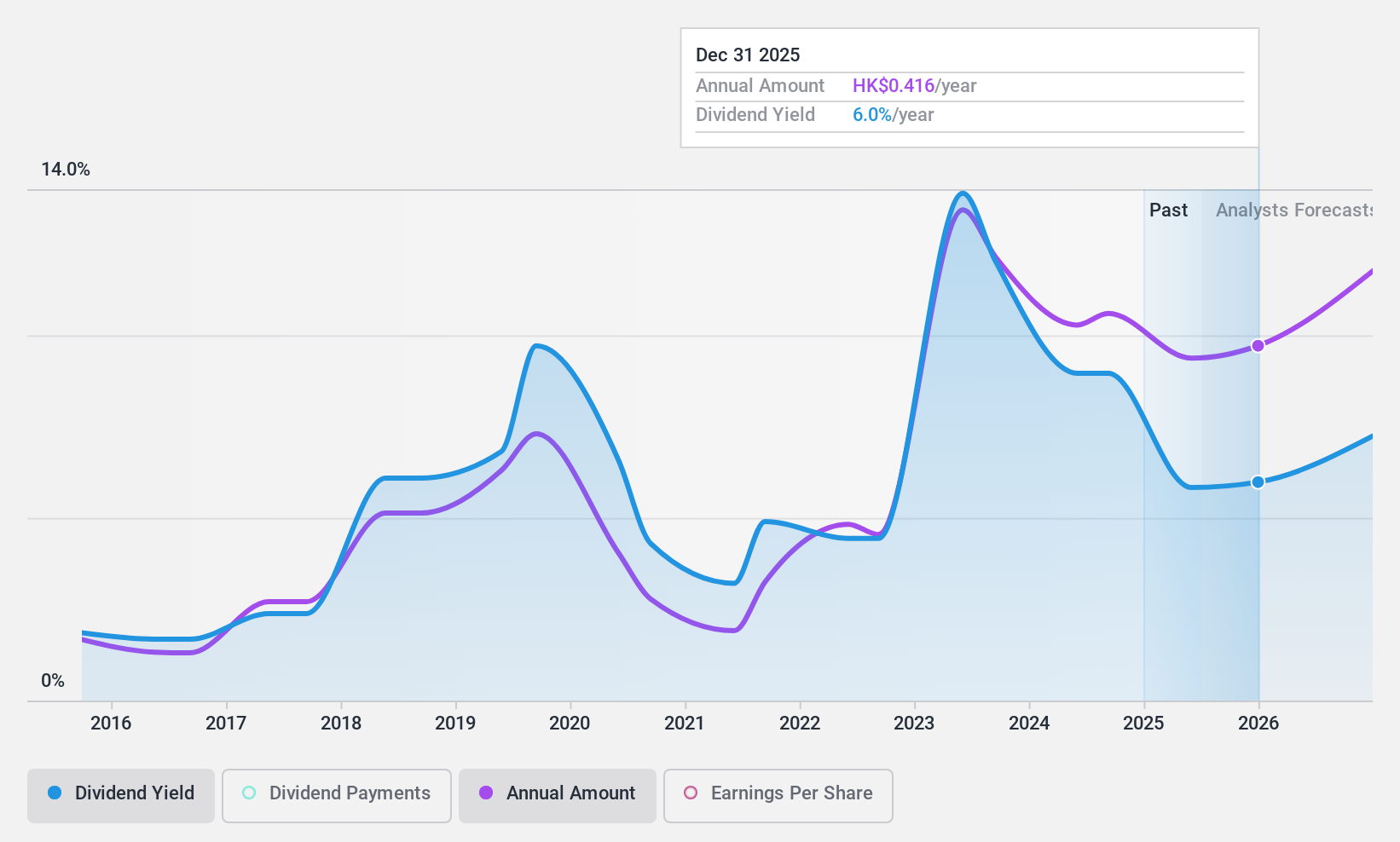

Fufeng Group (SEHK:546)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Fufeng Group Limited is an investment holding company involved in the manufacture and sale of fermentation-based food additives, as well as biochemical and starch-based products, operating both in China and internationally, with a market cap of HK$13.26 billion.

Operations: Fufeng Group Limited's revenue is primarily derived from its Food Additives segment at CN¥13.85 billion, followed by Animal Nutrition at CN¥9 billion, High-End Amino Acid products at CN¥2.22 billion, and Colloid products contributing CN¥2.09 billion.

Dividend Yield: 7.0%

Fufeng Group's dividend payments are supported by a low payout ratio of 33%, indicating sustainability from earnings, though the cash payout ratio is higher at 78.2%. While dividends have grown over the past decade, they have been volatile with significant annual drops. The stock trades below its estimated fair value and offers a dividend yield of 7.03%, which is lower than the top quartile in Hong Kong but still competitive.

- Dive into the specifics of Fufeng Group here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Fufeng Group is priced lower than what may be justified by its financials.

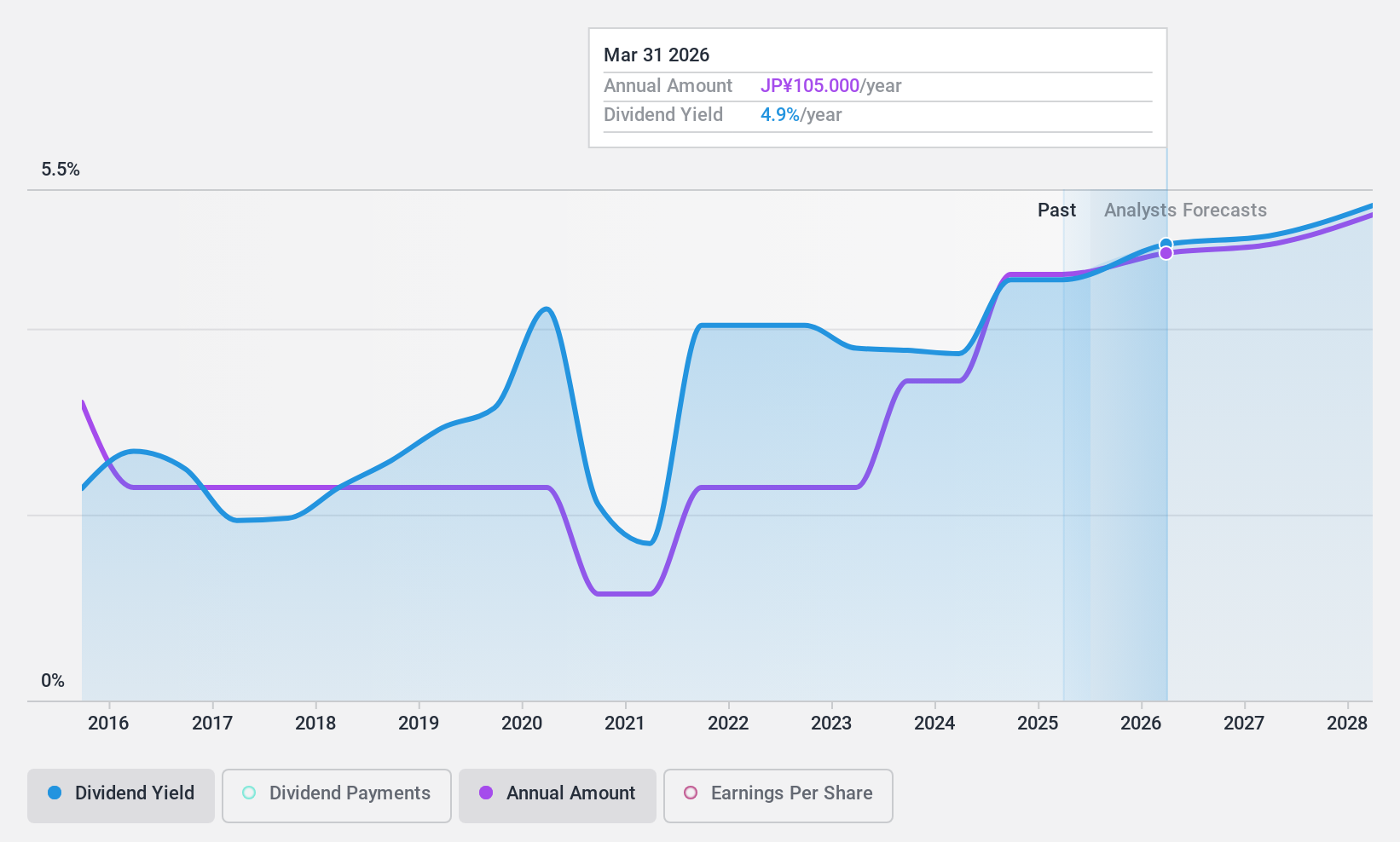

NOK (TSE:7240)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: NOK Corporation is engaged in the manufacturing, importing, and selling of seal products, industrial mechanical parts, hydraulic and pneumatic equipment, nuclear power equipment, synthetic chemical products, and electronic items both in Japan and internationally with a market cap of ¥382.08 billion.

Operations: NOK Corporation's revenue segments include the Seal Business at ¥362.33 billion and the Electronic Components Business at ¥396.13 billion.

Dividend Yield: 4.2%

NOK Corporation's dividend yield of 4.25% ranks it among the top 25% in Japan, although its track record is marked by volatility over the past decade. Despite recent earnings growth of 115.6%, large one-off items have impacted results, and insufficient data limits clarity on cash flow coverage for dividends. A reasonable payout ratio of 50.1% suggests dividends are covered by earnings, but historical instability remains a concern for investors prioritizing reliability in dividend stocks.

- Click here and access our complete dividend analysis report to understand the dynamics of NOK.

- The valuation report we've compiled suggests that NOK's current price could be quite moderate.

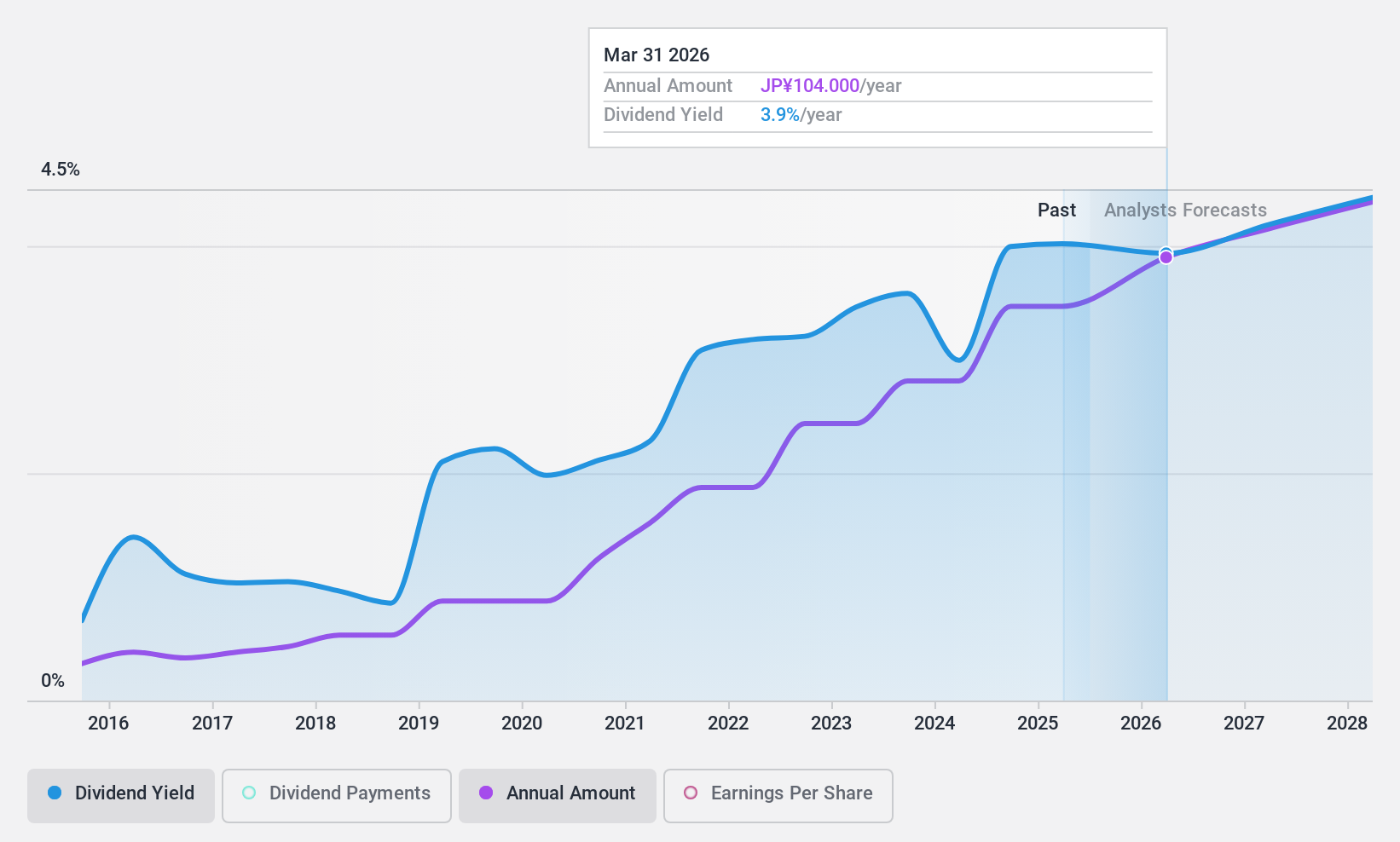

Nippon Gas (TSE:8174)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Gas Co., Ltd. operates in Japan, focusing on the supply and sale of LP gas and natural gas, with a market cap of ¥236.14 billion.

Operations: Nippon Gas Co., Ltd.'s revenue is primarily derived from its LP Gas Business at ¥88.28 billion, followed by the City Gas Business at ¥62.82 billion, and the Electricity Business contributing ¥46.09 billion.

Dividend Yield: 4.3%

Nippon Gas offers a dividend yield of 4.27%, placing it in the top 25% of Japanese dividend payers, yet its dividends have been volatile and not well covered by earnings, with a high payout ratio of 94.6%. Despite this, dividends are supported by cash flow with a cash payout ratio of 59.7%. Recent share buyback plans aim to enhance shareholder value and improve return on assets amidst anticipated earnings growth of 9.33% annually.

- Take a closer look at Nippon Gas' potential here in our dividend report.

- Our expertly prepared valuation report Nippon Gas implies its share price may be lower than expected.

Next Steps

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1977 more companies for you to explore.Click here to unveil our expertly curated list of 1980 Top Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:546

Fufeng Group

An investment holding company, engages in the manufacture and sale of fermentation-based food additives, and biochemical and starch-based products in the People’s Republic of China and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives