Three SEHK Stocks Like Yadea Group Holdings That Might Be Trading At A Discount

Reviewed by Simply Wall St

Amidst global market fluctuations and geopolitical tensions, the Hong Kong stock market has shown resilience, with the Hang Seng Index climbing 10.2% recently. This environment presents opportunities for discerning investors to explore stocks that may be trading at a discount, especially those with strong fundamentals and potential for growth despite broader economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| BYD Electronic (International) (SEHK:285) | HK$36.05 | HK$64.84 | 44.4% |

| Giant Biogene Holding (SEHK:2367) | HK$56.30 | HK$98.07 | 42.6% |

| China Ruyi Holdings (SEHK:136) | HK$2.32 | HK$4.16 | 44.3% |

| XD (SEHK:2400) | HK$27.65 | HK$47.82 | 42.2% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$31.95 | HK$56.51 | 43.5% |

| Hangzhou SF Intra-city Industrial (SEHK:9699) | HK$11.36 | HK$19.89 | 42.9% |

| COSCO SHIPPING Energy Transportation (SEHK:1138) | HK$10.32 | HK$19.13 | 46% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | HK$13.56 | HK$25.71 | 47.2% |

| Q Technology (Group) (SEHK:1478) | HK$6.20 | HK$11.07 | 44% |

| Akeso (SEHK:9926) | HK$71.40 | HK$135.25 | 47.2% |

Let's explore several standout options from the results in the screener.

Yadea Group Holdings (SEHK:1585)

Overview: Yadea Group Holdings Ltd. is an investment holding company that develops, manufactures, and sells electric two-wheeled vehicles and related accessories in the People’s Republic of China with a market cap of approximately HK$46.72 billion.

Operations: The company's revenue primarily comes from the sale of electric two-wheeled vehicles and related accessories, totaling CN¥31.76 billion, and batteries and electric drive systems, contributing CN¥5.23 billion.

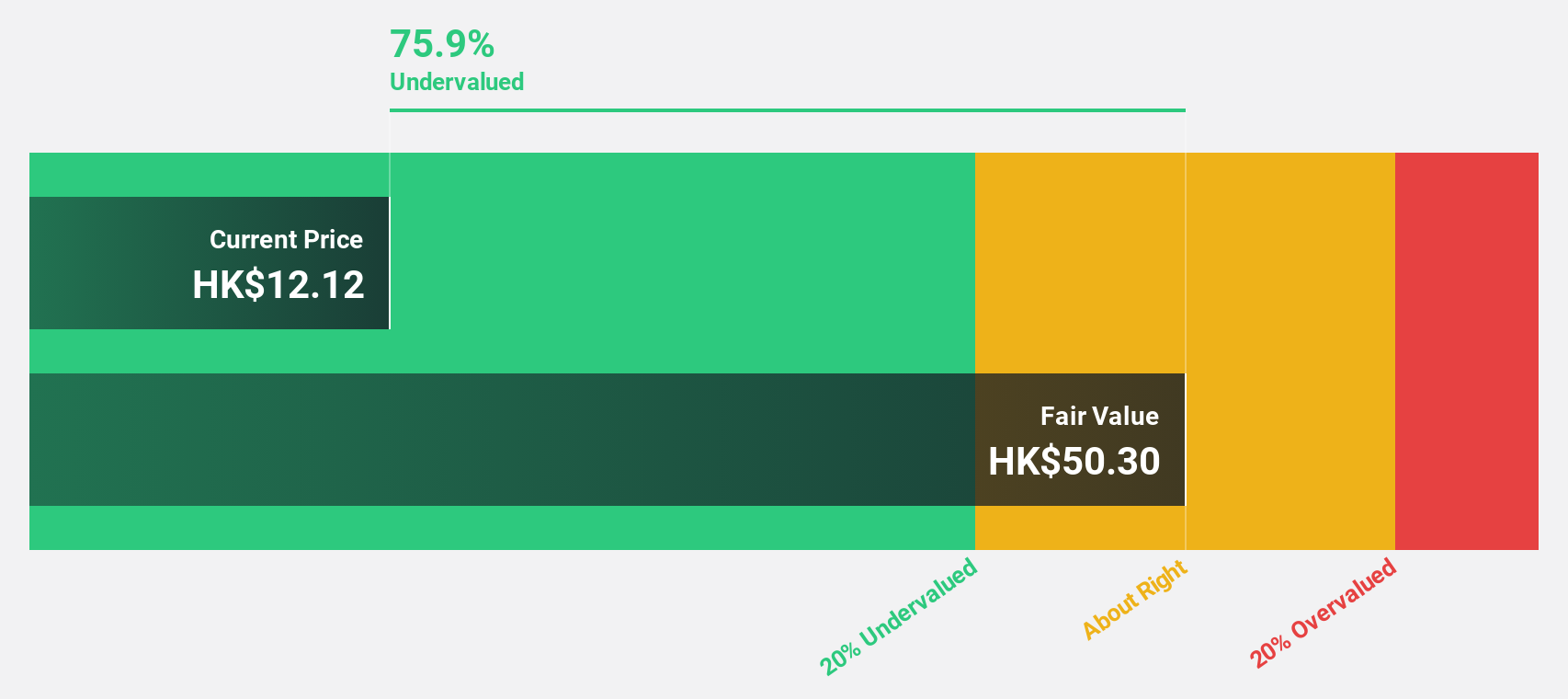

Estimated Discount To Fair Value: 33.8%

Yadea Group Holdings is trading at HK$15.36, significantly below its estimated fair value of HK$23.2, suggesting potential undervaluation based on cash flows. Despite a recent decline in sales and net income for the first half of 2024, Yadea's earnings are forecast to grow faster than the Hong Kong market at 17.1% per year. The company is expanding internationally with new stores in Thailand and Indonesia, aiming for sustainable growth in the electric vehicle sector.

- According our earnings growth report, there's an indication that Yadea Group Holdings might be ready to expand.

- Dive into the specifics of Yadea Group Holdings here with our thorough financial health report.

United Company RUSAL International (SEHK:486)

Overview: United Company RUSAL International is involved in the production and trading of aluminium and related products in Russia, with a market cap of HK$41.10 billion.

Operations: The company generates revenue from aluminium at $10.48 billion and aluminous products at $4.49 billion.

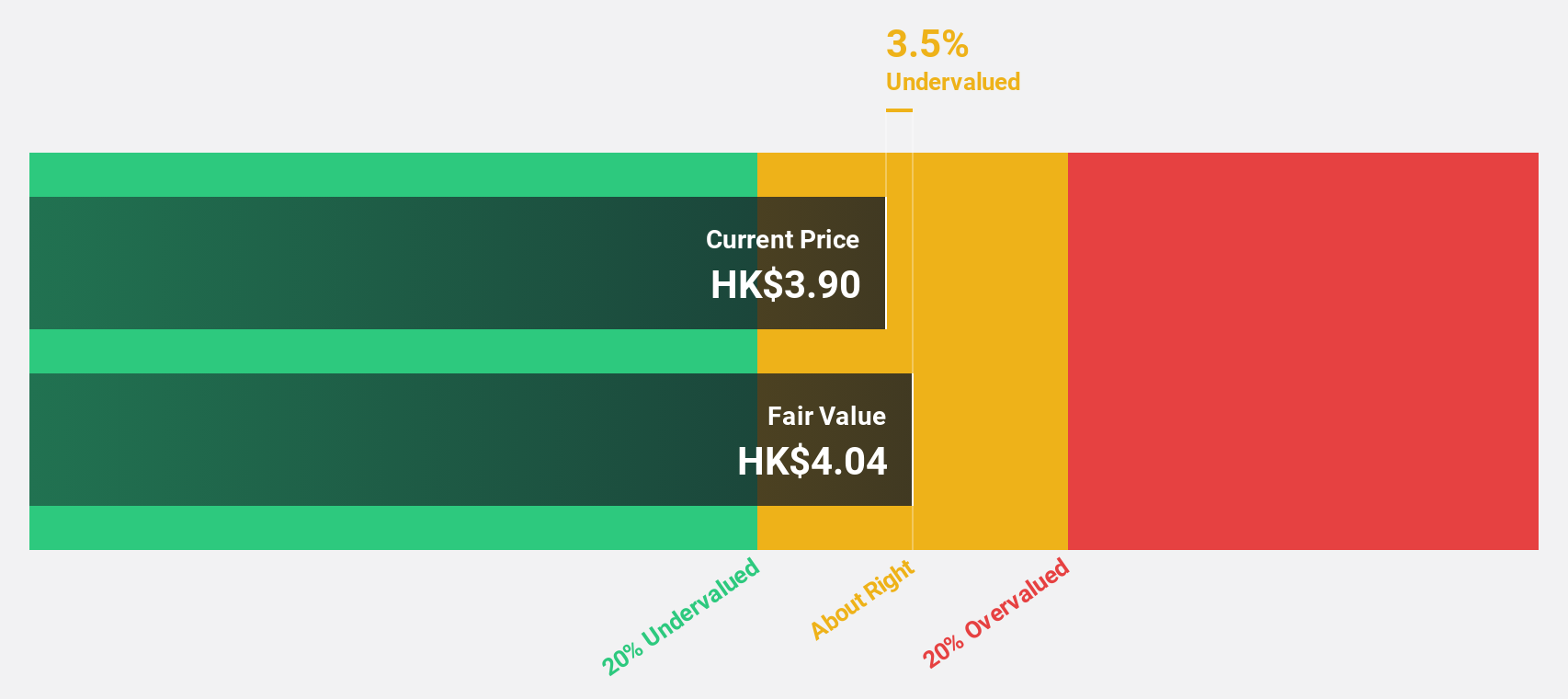

Estimated Discount To Fair Value: 37%

United Company RUSAL International is trading at HK$2.7, well below its estimated fair value of HK$4.28, highlighting potential undervaluation based on cash flows. Despite a decrease in sales for the first half of 2024 to US$5.70 billion from US$5.95 billion a year ago, net income increased to US$565 million from US$420 million. Earnings are expected to grow significantly faster than the Hong Kong market over the next three years, although debt coverage by operating cash flow remains a concern.

- Our comprehensive growth report raises the possibility that United Company RUSAL International is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of United Company RUSAL International.

Digital China Holdings (SEHK:861)

Overview: Digital China Holdings Limited is an investment holding company that offers big data products and solutions to government and enterprise customers mainly in Mainland China, with a market cap of approximately HK$6.48 billion.

Operations: The company's revenue is primarily derived from three segments: Big Data Products and Solutions (CN¥3.39 billion), Software and Operating Services (CN¥5.31 billion), and Traditional and Localization Services (CN¥10.03 billion).

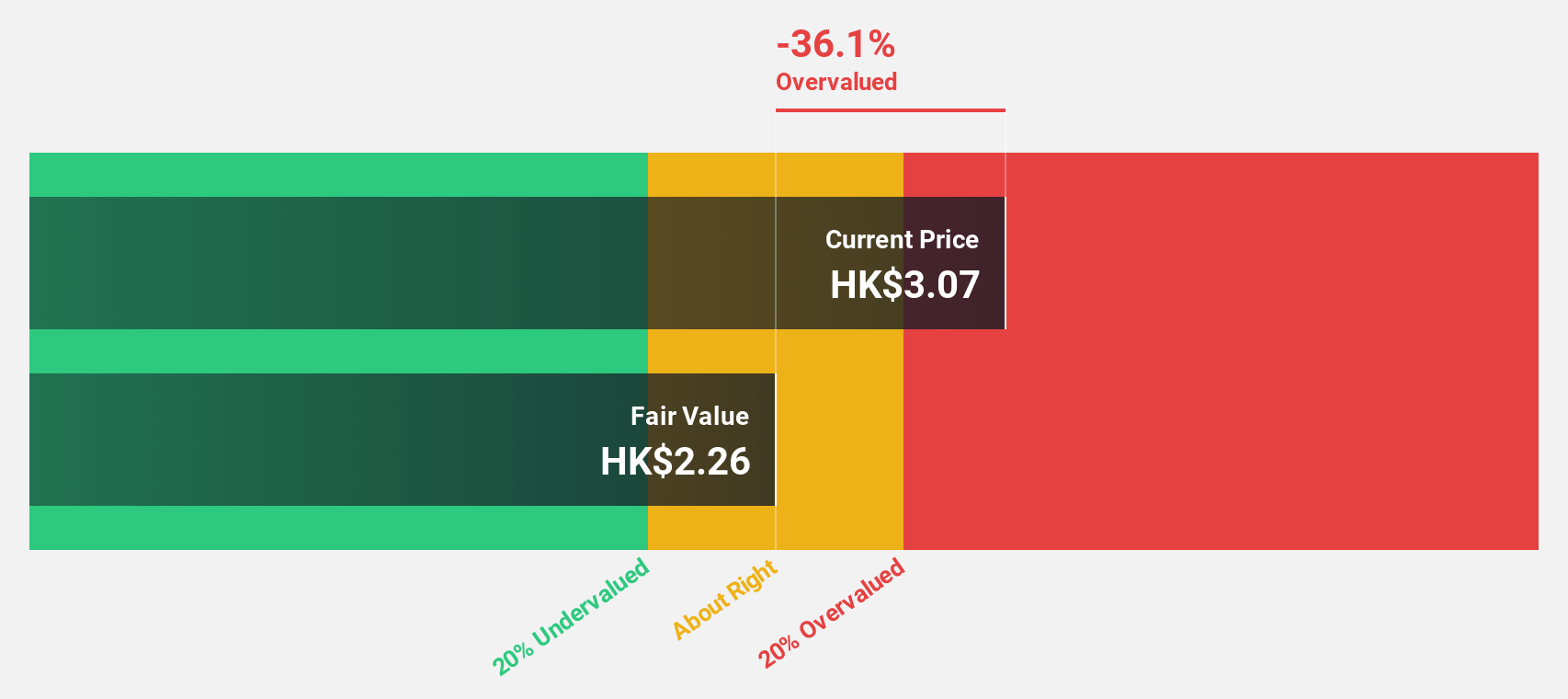

Estimated Discount To Fair Value: 39.9%

Digital China Holdings is trading at HK$3.87, significantly below its fair value estimate of HK$6.44, suggesting undervaluation based on cash flows. Despite a decrease in net income to CNY 10.81 million for the first half of 2024 from CNY 40.36 million a year ago, earnings are forecasted to grow substantially over the next three years. The company's revenue growth is expected to outpace the Hong Kong market average, although return on equity remains low at 7.6%.

- The analysis detailed in our Digital China Holdings growth report hints at robust future financial performance.

- Take a closer look at Digital China Holdings' balance sheet health here in our report.

Seize The Opportunity

- Get an in-depth perspective on all 38 Undervalued SEHK Stocks Based On Cash Flows by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1585

Yadea Group Holdings

An investment holding company, engages in the development, manufacture and sale of electric two-wheeled vehicles and related accessories in the People’s Republic of China.

Good value with reasonable growth potential.