- Hong Kong

- /

- Metals and Mining

- /

- SEHK:486

Auditors Are Concerned About United Company RUSAL International (HKG:486)

Unfortunately for shareholders, when United Company RUSAL, International Public Joint-Stock Company (HKG:486) reported results for the period to December 2022, its auditors, TSATR Audit Services LLC, expressed uncertainty about whether it can continue as a going concern. Thus we can say that, based on the results to that date, the company should raise capital or otherwise raise cash, without much delay.

Since the company probably needs cash fairly quickly, it may be in a position where it has to accept whatever terms it can get. So shareholders should absolutely be taking a close look at how risky the balance sheet is. The big consideration is whether it can repay its debt, since in the worst case scenario, creditors could force the company to bankruptcy.

Check out our latest analysis for United Company RUSAL International

What Is United Company RUSAL International's Debt?

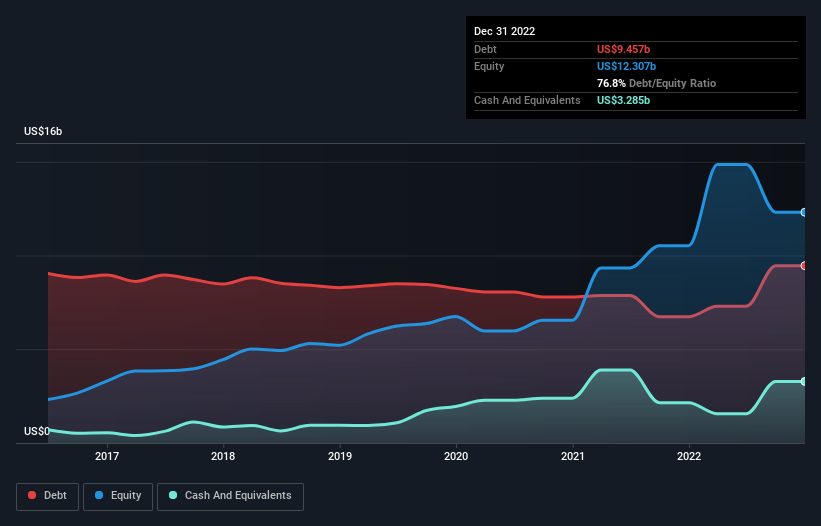

The image below, which you can click on for greater detail, shows that at December 2022 United Company RUSAL International had debt of US$9.46b, up from US$6.73b in one year. However, it also had US$3.29b in cash, and so its net debt is US$6.17b.

How Strong Is United Company RUSAL International's Balance Sheet?

We can see from the most recent balance sheet that United Company RUSAL International had liabilities of US$4.59b falling due within a year, and liabilities of US$7.73b due beyond that. On the other hand, it had cash of US$3.29b and US$1.74b worth of receivables due within a year. So its liabilities total US$7.30b more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's US$6.60b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

United Company RUSAL International has a debt to EBITDA ratio of 3.1 and its EBIT covered its interest expense 5.1 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Importantly, United Company RUSAL International's EBIT fell a jaw-dropping 28% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since United Company RUSAL International will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, United Company RUSAL International saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

On the face of it, United Company RUSAL International's conversion of EBIT to free cash flow left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. Having said that, its ability to cover its interest expense with its EBIT isn't such a worry. After considering the datapoints discussed, we think United Company RUSAL International has too much debt. While some investors love that sort of risky play, it's certainly not our cup of tea. While some investors may specialize in these sort of situations, it's simply too risky and complicated for us to want to invest in a company after an auditor has expressed doubts about its ability to continue as a going concern. Our preference is to invest in companies that always make sure the auditor has confidence that the company will continue as a going concern. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 4 warning signs for United Company RUSAL International (2 are concerning!) that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:486

United Company RUSAL International

Engages in production and sale of aluminium and related products in Russia.

Adequate balance sheet slight.

Similar Companies

Market Insights

Community Narratives