Is Now The Time To Put Hung Hing Printing Group (HKG:450) On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Hung Hing Printing Group (HKG:450). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Hung Hing Printing Group with the means to add long-term value to shareholders.

See our latest analysis for Hung Hing Printing Group

Hung Hing Printing Group's Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. We can see that in the last three years Hung Hing Printing Group grew its EPS by 7.3% per year. This may not be setting the world alight, but it does show that EPS is on the upwards trend.

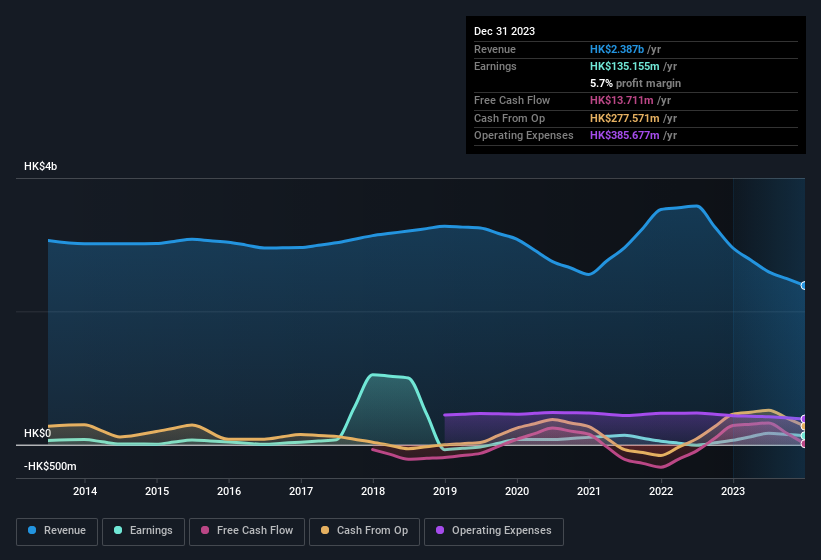

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Despite consistency in EBIT margins year on year, Hung Hing Printing Group has actually recorded a dip in revenue. While this may raise concerns, investors should investigate the reasoning behind this.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Hung Hing Printing Group isn't a huge company, given its market capitalisation of HK$994m. That makes it extra important to check on its balance sheet strength.

Are Hung Hing Printing Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Belief in the company remains high for insiders as there hasn't been a single share sold by the management or company board members. But more importantly, Executive Director Carson Christopher Yum spent HK$1.4m acquiring shares, doing so at an average price of HK$1.14. Purchases like this clue us in to the to the faith management has in the business' future.

The good news, alongside the insider buying, for Hung Hing Printing Group bulls is that insiders (collectively) have a meaningful investment in the stock. As a matter of fact, their holding is valued at HK$173m. This considerable investment should help drive long-term value in the business. That amounts to 17% of the company, demonstrating a degree of high-level alignment with shareholders.

Should You Add Hung Hing Printing Group To Your Watchlist?

As previously touched on, Hung Hing Printing Group is a growing business, which is encouraging. Better yet, insiders are significant shareholders, and have been buying more shares. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. We should say that we've discovered 2 warning signs for Hung Hing Printing Group that you should be aware of before investing here.

The good news is that Hung Hing Printing Group is not the only stock with insider buying. Here's a list of small cap, undervalued companies in HK with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hung Hing Printing Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:450

Hung Hing Printing Group

An investment holding company, engages in book and package printing, consumer product packaging, corrugated box, and paper trading businesses in the People’s Republic of China, the United States, Hong Kong, the United Kingdom, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives