- Hong Kong

- /

- Metals and Mining

- /

- SEHK:3833

Do Xinjiang Xinxin Mining Industry's (HKG:3833) Earnings Warrant Your Attention?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Xinjiang Xinxin Mining Industry (HKG:3833). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Xinjiang Xinxin Mining Industry with the means to add long-term value to shareholders.

See our latest analysis for Xinjiang Xinxin Mining Industry

How Fast Is Xinjiang Xinxin Mining Industry Growing Its Earnings Per Share?

Xinjiang Xinxin Mining Industry has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. Thus, it makes sense to focus on more recent growth rates, instead. Impressively, Xinjiang Xinxin Mining Industry's EPS catapulted from CN¥0.20 to CN¥0.40, over the last year. It's not often a company can achieve year-on-year growth of 101%.

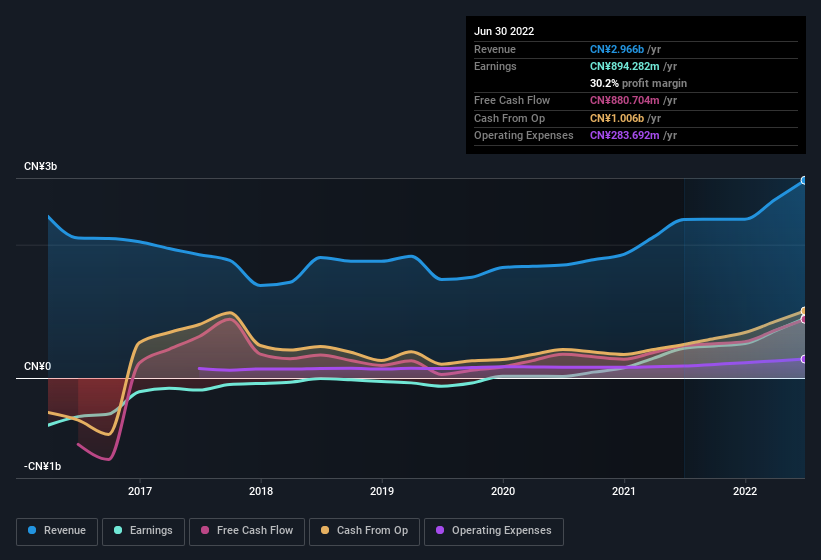

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that, last year, Xinjiang Xinxin Mining Industry's revenue from operations was lower than its revenue, so that could distort our analysis of its margins. The music to the ears of Xinjiang Xinxin Mining Industry shareholders is that EBIT margins have grown from 23% to 33% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Xinjiang Xinxin Mining Industry Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Xinjiang Xinxin Mining Industry followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. With a whopping CN¥399m worth of shares as a group, insiders have plenty riding on the company's success. That holding amounts to 13% of the stock on issue, thus making insiders influential owners of the business and aligned with the interests of shareholders.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Well, based on the CEO pay, you'd argue that they are indeed. For companies with market capitalisations between CN¥1.4b and CN¥5.4b, like Xinjiang Xinxin Mining Industry, the median CEO pay is around CN¥2.6m.

The CEO of Xinjiang Xinxin Mining Industry only received CN¥630k in total compensation for the year ending December 2021. First impressions seem to indicate a compensation policy that is favourable to shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Xinjiang Xinxin Mining Industry Worth Keeping An Eye On?

Xinjiang Xinxin Mining Industry's earnings per share growth have been climbing higher at an appreciable rate. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The strong EPS improvement suggests the businesses is humming along. Big growth can make big winners, so the writing on the wall tells us that Xinjiang Xinxin Mining Industry is worth considering carefully. Of course, profit growth is one thing but it's even better if Xinjiang Xinxin Mining Industry is receiving high returns on equity, since that should imply it can keep growing without much need for capital. Click on this link to see how it is faring against the average in its industry.

Although Xinjiang Xinxin Mining Industry certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3833

Xinjiang Xinxin Mining Industry

Engages in mining, ore processing, smelting, refining, and selling of nickel, copper, and other nonferrous metals.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026