- Hong Kong

- /

- Metals and Mining

- /

- SEHK:358

Earnings Not Telling The Story For Jiangxi Copper Company Limited (HKG:358) After Shares Rise 27%

Jiangxi Copper Company Limited (HKG:358) shares have continued their recent momentum with a 27% gain in the last month alone. Looking further back, the 11% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

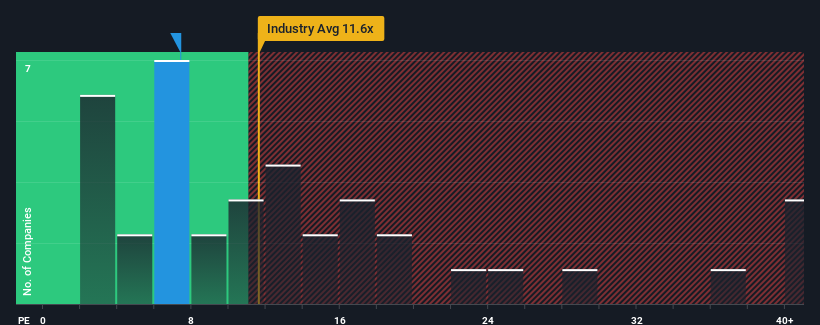

Although its price has surged higher, it's still not a stretch to say that Jiangxi Copper's price-to-earnings (or "P/E") ratio of 7.4x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings growth that's superior to most other companies of late, Jiangxi Copper has been doing relatively well. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Jiangxi Copper

What Are Growth Metrics Telling Us About The P/E?

In order to justify its P/E ratio, Jiangxi Copper would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a decent 8.5% gain to the company's bottom line. The latest three year period has also seen an excellent 181% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 4.0% per year as estimated by the seven analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 14% each year, which is noticeably more attractive.

With this information, we find it interesting that Jiangxi Copper is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Jiangxi Copper's P/E?

Its shares have lifted substantially and now Jiangxi Copper's P/E is also back up to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Jiangxi Copper's analyst forecasts revealed that its inferior earnings outlook isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 1 warning sign for Jiangxi Copper that you should be aware of.

If you're unsure about the strength of Jiangxi Copper's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you're looking to trade Jiangxi Copper, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:358

Jiangxi Copper

Engages in exploring, mining, ore dressing, smelting, refining, and processing of copper in Mainland China, Hong Kong, and internationally.

Undervalued with adequate balance sheet.