Sinopec Shanghai Petrochemical (SEHK:338) Forecasts 117.7% Earnings Growth, Challenging Value Narrative

Reviewed by Simply Wall St

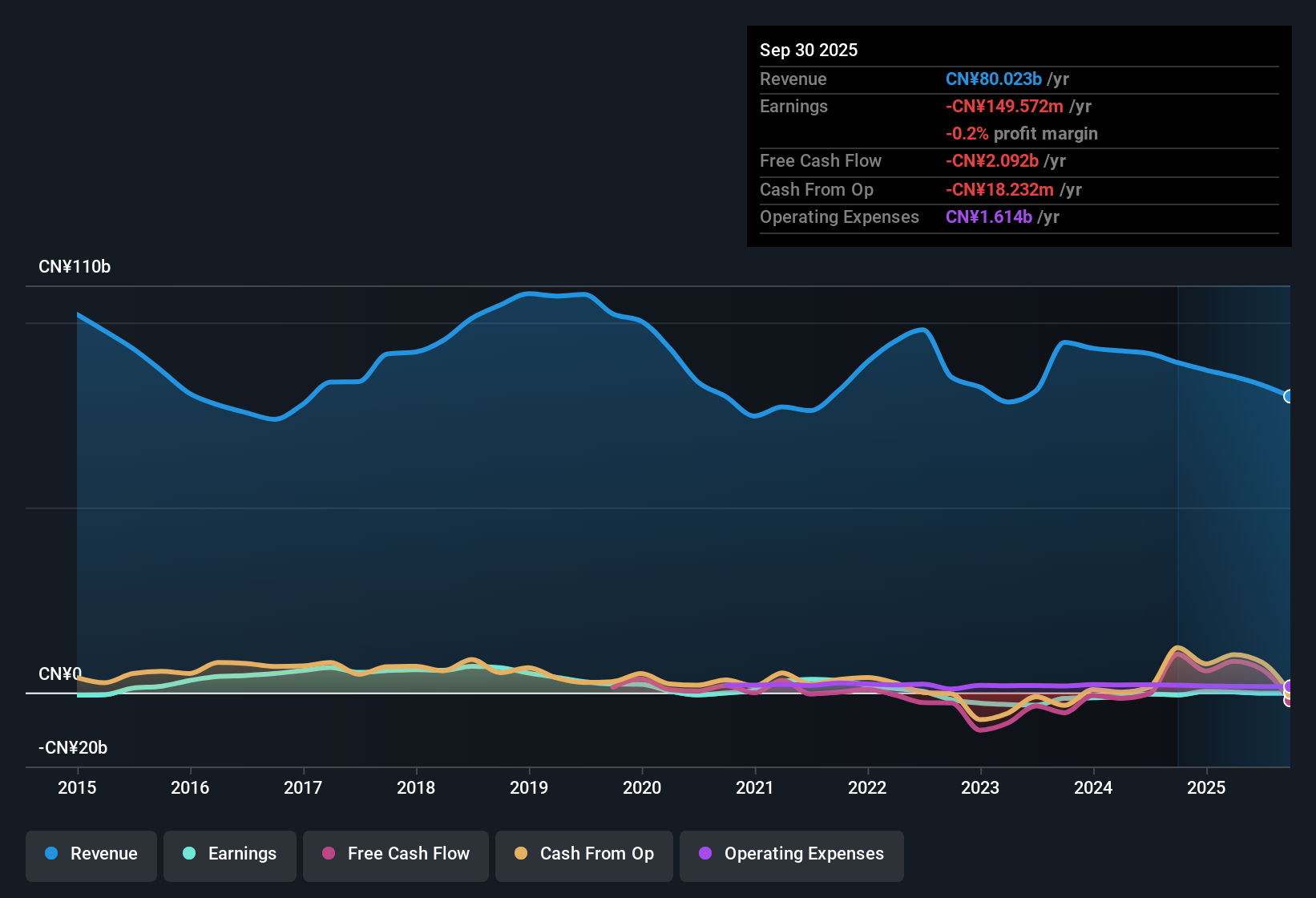

Sinopec Shanghai Petrochemical (SEHK:338) remains unprofitable, with annual losses worsening at a rate of 35.6% over the last five years. Looking ahead, forecasts call for a striking 117.7% annual increase in earnings and a return to profitability within three years. This would position the company well above the market average for growth. Investors will note the appeal of sharp anticipated earnings improvement alongside a muted revenue growth outlook of just 0.1% per year.

See our full analysis for Sinopec Shanghai Petrochemical.Now, let’s stack these numbers up against the most widely followed narratives to see which opinions hold up to scrutiny and which might warrant a second look.

Curious how numbers become stories that shape markets? Explore Community Narratives

Price-To-Sales Discounts Signal Value Play

- Sinopec Shanghai Petrochemical trades at a 0.2x Price-To-Sales ratio, far below the Hong Kong Chemicals industry average of 0.5x and the peer average of 0.6x. This stands out even among discounted sector valuations.

- Bulls argue that such a deeply discounted sales multiple, especially compared to sector benchmarks, strongly supports the case for state-backed stability and potential value re-rating if earnings momentum materializes.

- The current multiple is less than half that of industry and peers. This aligns directly with the bullish narrative that investors are seeking safety and upside in established, undervalued names.

- This valuation gap suggests that if profitability forecasts play out, the stock could see a sharper market response than more expensive sector peers.

DCF Fair Value Highlights Market Skepticism

- The HK$1.39 share price trades significantly higher than the DCF fair value estimate of HK$0.18, making the stock look expensive on a discounted cash flow basis despite attractive price-to-sales metrics.

- The prevailing narrative notes that while operational resilience draws attention, valuation discipline remains front of mind for investors. The sharp gap between current price and fair value reinforces the need for patience before any upside rerating.

- This tension, where investors pay a premium compared to the DCF calculation, reflects ongoing cautiousness about sector cyclicality and muted revenue prospects.

- Even with strong earnings growth forecasts, the disconnect challenges the view that discounted multiples alone can drive share price gains unless profitability arrives as projected.

No Material Risks Cited as Earnings Forecasts Jump

- No new risks have been flagged in company filings, which supports the near-term scenario where investors focus more on upside from the 117.7% annual earnings growth forecast than on downside protection.

- The prevailing market view emphasizes that the absence of newly disclosed risks, paired with headline-making earnings expectations, keeps interest firmly on the timeline to profitability rather than potential setbacks.

- The lack of recent risk warnings stands out in a sector typically defined by cost and regulatory volatility, lending credibility to cautious optimism for a turnaround.

- This backdrop may explain why shares are priced well above DCF value, as buyers appear less concerned about looming negatives in the current cycle.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Sinopec Shanghai Petrochemical's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite impressive earnings growth forecasts, Sinopec Shanghai Petrochemical’s shares trade well above intrinsic value. This underlines doubts about whether discounted multiples alone justify the current price.

Prefer better value for your money? Compare with these 871 undervalued stocks based on cash flows to spot companies where price and fundamentals are more closely aligned for immediate opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:338

Sinopec Shanghai Petrochemical

Manufactures and sells petroleum and chemical products in the People’s Republic of China.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives