- Hong Kong

- /

- Real Estate

- /

- SEHK:535

Exploring Three Top Undervalued Small Caps With Insider Buying

Reviewed by Simply Wall St

Global markets have been buoyed by robust stimulus measures from China and record highs in U.S. indices, including the Dow Jones Industrial Average and the S&P 500. Despite some mixed economic signals, such as a dip in consumer confidence and housing market fluctuations, optimism around AI-driven growth and benign inflation data has kept investor sentiment positive. In this environment, identifying undervalued small-cap stocks with insider buying can be particularly compelling. These stocks often present unique opportunities for growth due to their potential for significant appreciation when broader market conditions are favorable.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Trican Well Service | 7.7x | 0.9x | 13.52% | ★★★★★☆ |

| Columbus McKinnon | 22.6x | 1.0x | 39.15% | ★★★★★☆ |

| Thryv Holdings | NA | 0.7x | 26.22% | ★★★★★☆ |

| Bytes Technology Group | 26.5x | 6.0x | 5.49% | ★★★★☆☆ |

| MYR Group | 34.3x | 0.5x | 42.30% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.8x | 3.4x | 45.09% | ★★★★☆☆ |

| Franklin Financial Services | 9.7x | 1.9x | 39.61% | ★★★★☆☆ |

| Essentra | 732.1x | 1.4x | 37.04% | ★★★★☆☆ |

| Studsvik | 19.7x | 1.2x | 43.70% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

China Lesso Group Holdings (SEHK:2128)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: China Lesso Group Holdings is a leading manufacturer and distributor of plastic and rubber products, with operations generating significant revenue in the CN¥29.13 billion range.

Operations: The company generates revenue primarily from its Plastics & Rubber segment, with a recent revenue of CN¥29.13 billion. The net income margin has shown fluctuations, reaching 7.66% as of December 2023, while the gross profit margin was recorded at 26.04% for June 2024.

PE: 5.8x

China Lesso Group Holdings, a smaller company in the market, has caught attention for potentially being undervalued. Their recent earnings report for the half-year ending June 30, 2024, showed sales of ¥13.56 billion and net income of ¥1.04 billion, both down from last year. Insider confidence is evident as Luen Hei Wong purchased 4 million shares worth approximately ¥10 million between August and September 2024. Despite high debt levels and reliance on external borrowing, earnings are forecasted to grow by 10.65% annually.

Lee & Man Paper Manufacturing (SEHK:2314)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Lee & Man Paper Manufacturing is a company engaged in the production of pulp, tissue paper, and packaging paper with a market capitalization of HK$16.94 billion.

Operations: The company generates revenue primarily from packaging paper and tissue paper, with a smaller contribution from pulp. The gross profit margin has fluctuated significantly, reaching as high as 29.08% in December 2017 before declining to 10.03% in December 2023. Operating expenses have consistently impacted profitability, with general and administrative expenses being a notable component.

PE: 8.0x

Lee & Man Paper Manufacturing, a small cap stock, has shown insider confidence with Ho Chung Lee purchasing 483,000 shares worth HK$1.10 million between July and August 2024. The company reported strong financials for the first half of 2024 with sales reaching HK$12.51 billion and net income more than doubling to HK$805.69 million from the previous year. Additionally, an interim dividend of HKD 0.062 per share was declared for this period, reflecting solid performance and potential growth ahead.

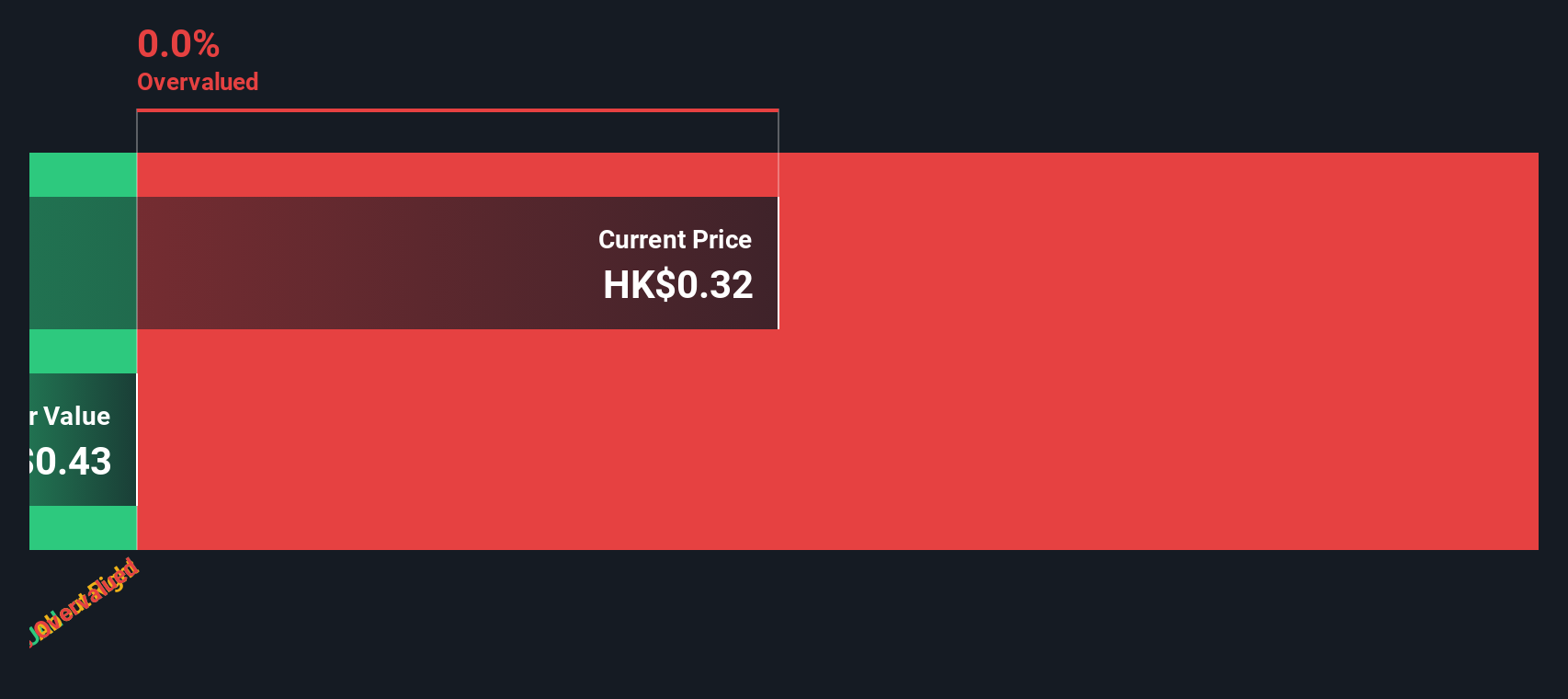

Gemdale Properties and Investment (SEHK:535)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Gemdale Properties and Investment focuses on property development, investment, and management with a market cap of CN¥7.95 billion.

Operations: The company generates revenue primarily from property development (CN¥17.26 billion) and property investment and management (CN¥1.23 billion). The net profit margin has varied significantly, reaching a high of 34.89% in Q4 2017 but declining to -13.03% in Q2 2024, indicating fluctuating profitability over recent periods.

PE: -2.1x

Gemdale Properties and Investment has shown recent insider confidence, with Non-Executive Director Lian Huat Loh purchasing 10 million shares valued at approximately HK$2.6 million, reflecting a significant 485% increase in their holdings. Despite a net loss of RMB 2.18 billion for the first half of 2024 and declining earnings over the past five years, the company achieved aggregate contracted sales of RMB 12.43 billion from January to August 2024, indicating strong operational performance amidst financial challenges.

- Delve into the full analysis valuation report here for a deeper understanding of Gemdale Properties and Investment.

Learn about Gemdale Properties and Investment's historical performance.

Where To Now?

- Reveal the 181 hidden gems among our Undervalued Small Caps With Insider Buying screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:535

Gemdale Properties and Investment

An investment holding company, engages in the property investment, development, and management activities in Mainland China.

Low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives