- Hong Kong

- /

- Metals and Mining

- /

- SEHK:2245

Lygend Resources & Technology Co., Ltd. (HKG:2245) Stock Catapults 27% Though Its Price And Business Still Lag The Market

Lygend Resources & Technology Co., Ltd. (HKG:2245) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 85% in the last year.

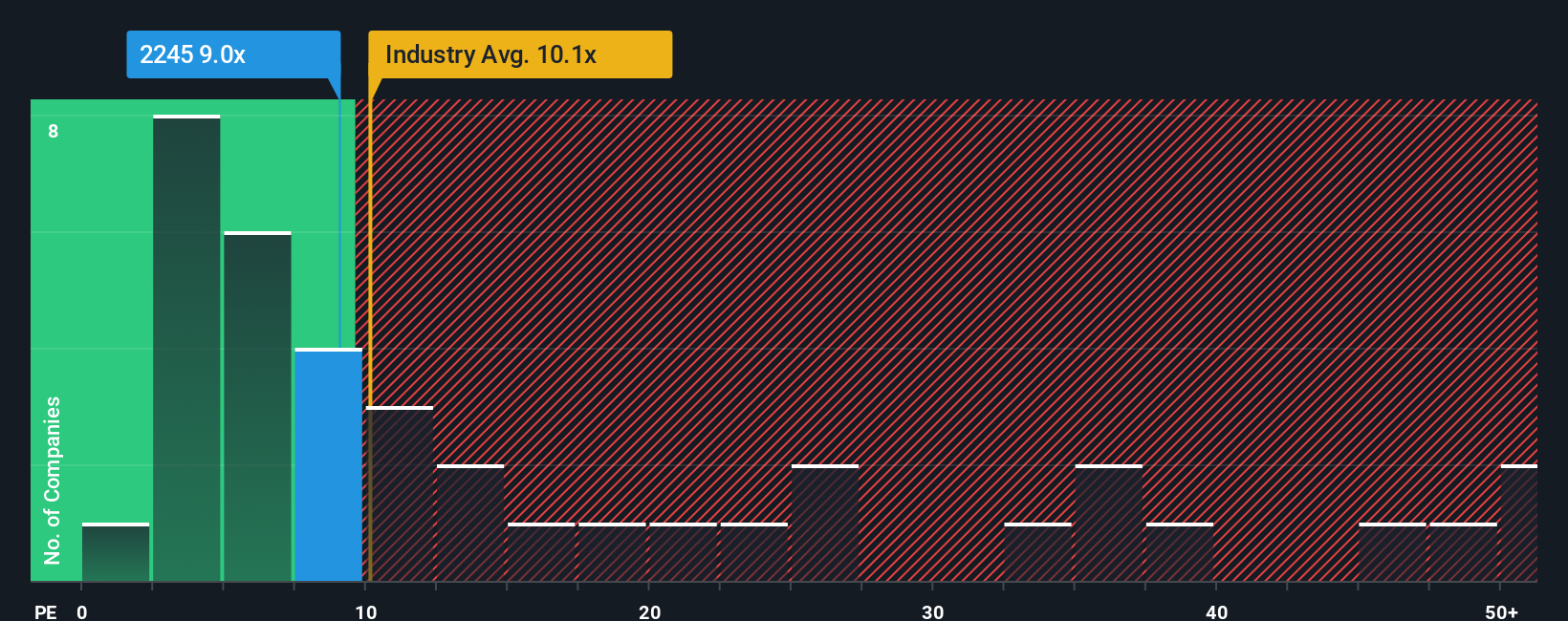

Even after such a large jump in price, Lygend Resources & Technology's price-to-earnings (or "P/E") ratio of 9x might still make it look like a buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 12x and even P/E's above 25x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's exceedingly strong of late, Lygend Resources & Technology has been doing very well. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Lygend Resources & Technology

How Is Lygend Resources & Technology's Growth Trending?

In order to justify its P/E ratio, Lygend Resources & Technology would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 69% gain to the company's bottom line. Still, incredibly EPS has fallen 33% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 19% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

In light of this, it's understandable that Lygend Resources & Technology's P/E would sit below the majority of other companies. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Lygend Resources & Technology's P/E?

The latest share price surge wasn't enough to lift Lygend Resources & Technology's P/E close to the market median. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Lygend Resources & Technology revealed its shrinking earnings over the medium-term are contributing to its low P/E, given the market is set to grow. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Lygend Resources & Technology that you need to take into consideration.

Of course, you might also be able to find a better stock than Lygend Resources & Technology. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2245

Lygend Resources & Technology

Engages in the production, smelting, and trading of nickel products in Mainland China and internationally.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.