China Sanjiang Fine Chemicals Company Limited (HKG:2198) Shares Fly 26% But Investors Aren't Buying For Growth

Despite an already strong run, China Sanjiang Fine Chemicals Company Limited (HKG:2198) shares have been powering on, with a gain of 26% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 84% in the last year.

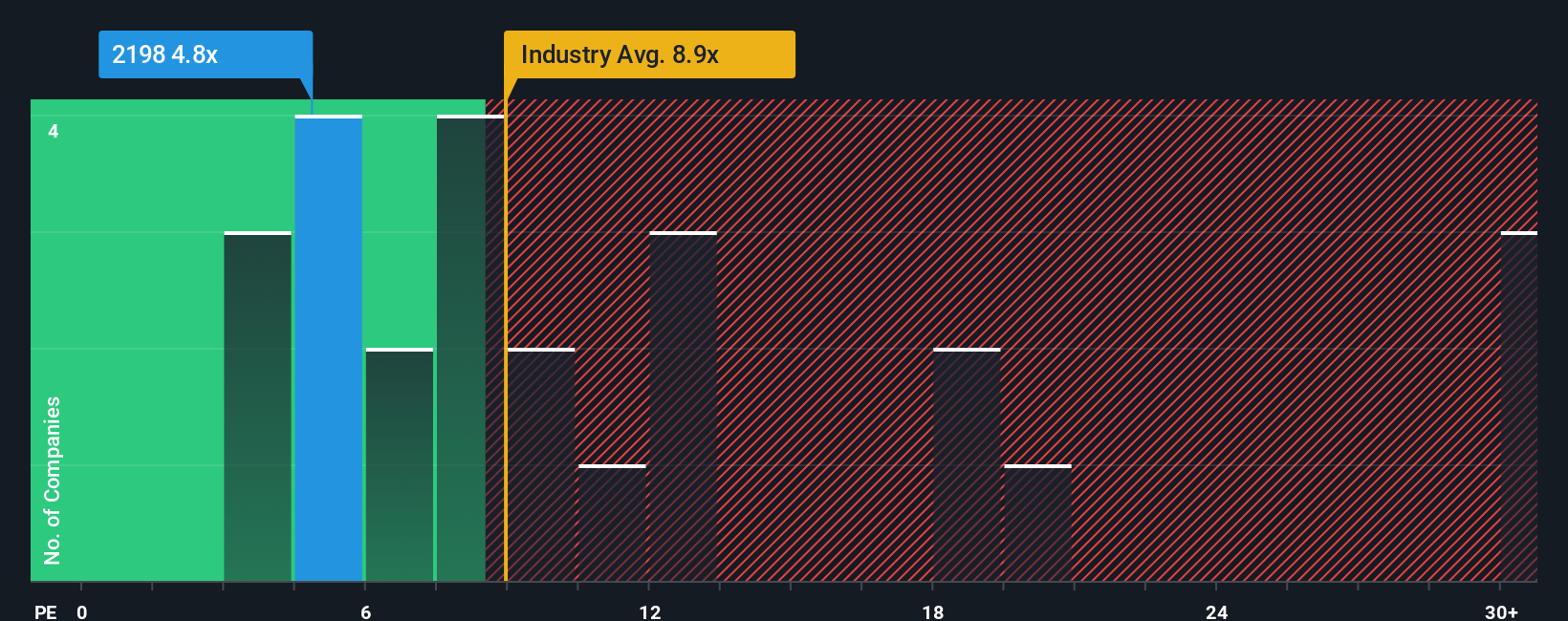

Although its price has surged higher, China Sanjiang Fine Chemicals' price-to-earnings (or "P/E") ratio of 4.8x might still make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 13x and even P/E's above 25x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

With earnings growth that's exceedingly strong of late, China Sanjiang Fine Chemicals has been doing very well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for China Sanjiang Fine Chemicals

How Is China Sanjiang Fine Chemicals' Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like China Sanjiang Fine Chemicals' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 210% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

This is in contrast to the rest of the market, which is expected to grow by 21% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that China Sanjiang Fine Chemicals' P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On China Sanjiang Fine Chemicals' P/E

China Sanjiang Fine Chemicals' recent share price jump still sees its P/E sitting firmly flat on the ground. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that China Sanjiang Fine Chemicals maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for China Sanjiang Fine Chemicals (2 are potentially serious!) that you should be aware of.

If you're unsure about the strength of China Sanjiang Fine Chemicals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2198

China Sanjiang Fine Chemicals

An investment holding company, manufactures and supplies ethylene oxide and glycol, propylene, polypropylene, methyl tert-butyl ether (MTBE), surfactants, and ethanolamine in Mainland China, Japan, and Singapore, and internationally.

Proven track record with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026