- Hong Kong

- /

- Basic Materials

- /

- SEHK:2009

Investors in BBMG (HKG:2009) from five years ago are still down 26%, even after 6.3% gain this past week

While not a mind-blowing move, it is good to see that the BBMG Corporation (HKG:2009) share price has gained 20% in the last three months. But over the last half decade, the stock has not performed well. You would have done a lot better buying an index fund, since the stock has dropped 48% in that half decade.

The recent uptick of 6.3% could be a positive sign of things to come, so let's take a look at historical fundamentals.

BBMG wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over five years, BBMG grew its revenue at 0.5% per year. That's not a very high growth rate considering it doesn't make profits. Given the weak growth, the share price fall of 8% isn't particularly surprising. The key question is whether the company can make it to profitability, and beyond, without trouble. Shareholders will want the company to approach profitability if it can't grow revenue any faster.

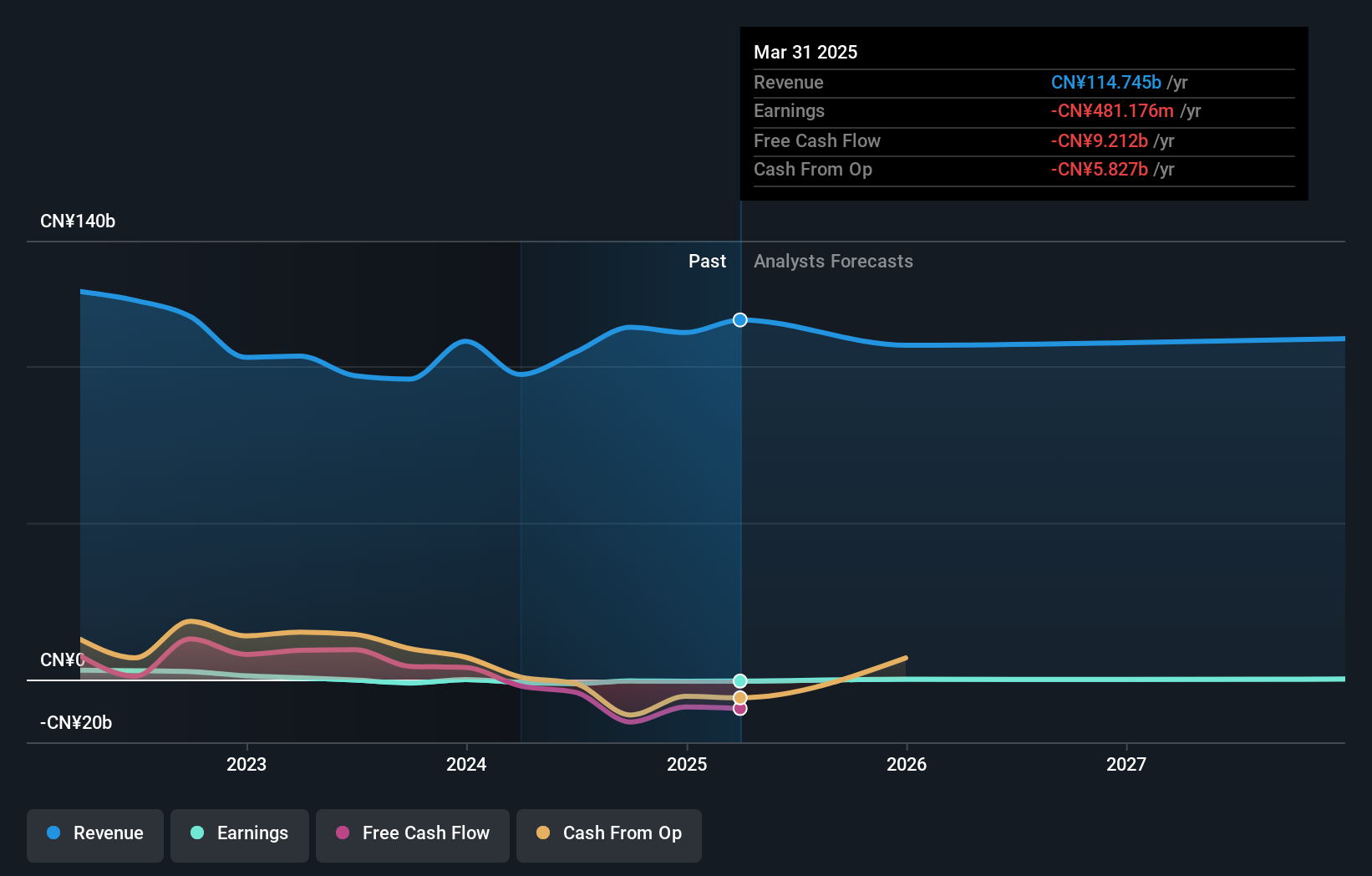

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. So we recommend checking out this free report showing consensus forecasts

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, BBMG's TSR for the last 5 years was -26%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that BBMG has rewarded shareholders with a total shareholder return of 57% in the last twelve months. That's including the dividend. There's no doubt those recent returns are much better than the TSR loss of 5% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with BBMG , and understanding them should be part of your investment process.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if BBMG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2009

BBMG

An investment holding company, engages in green building materials, and property development and operation businesses in Asia, Europe, Africa, and internationally.

Fair value with moderate growth potential.

Market Insights

Community Narratives