Asian Undervalued Small Caps With Insider Action To Watch In June 2025

Reviewed by Simply Wall St

As the Asian markets navigate a complex landscape of economic indicators and geopolitical tensions, small-cap stocks have emerged as a focal point for investors seeking opportunities in this dynamic region. With recent market movements and insider actions offering potential insights, identifying promising small-cap stocks requires careful consideration of factors such as resilience to trade fluctuations and adaptability to evolving economic conditions.

Top 10 Undervalued Small Caps With Insider Buying In Asia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Security Bank | 4.3x | 1.0x | 38.55% | ★★★★★★ |

| East West Banking | 3.0x | 0.7x | 35.68% | ★★★★★☆ |

| Lion Rock Group | 5.0x | 0.4x | 49.86% | ★★★★☆☆ |

| Dicker Data | 19.0x | 0.7x | -17.00% | ★★★★☆☆ |

| Atturra | 27.6x | 1.1x | 34.38% | ★★★★☆☆ |

| Eureka Group Holdings | 18.2x | 5.6x | 22.79% | ★★★★☆☆ |

| Sing Investments & Finance | 7.4x | 3.7x | 38.43% | ★★★★☆☆ |

| PWR Holdings | 33.7x | 4.7x | 25.56% | ★★★☆☆☆ |

| Charter Hall Long WALE REIT | NA | 12.5x | 20.03% | ★★★☆☆☆ |

| AInnovation Technology Group | NA | 2.4x | 46.86% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

China XLX Fertiliser (SEHK:1866)

Simply Wall St Value Rating: ★★★☆☆☆

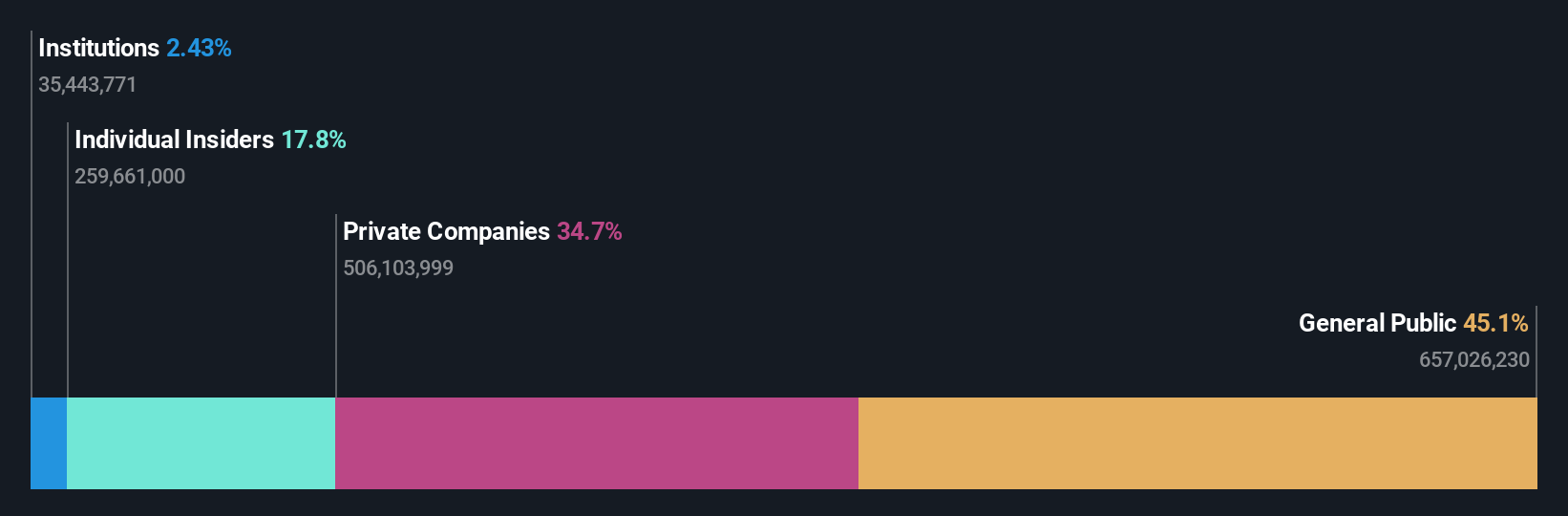

Overview: China XLX Fertiliser is a diversified chemical company engaged in the production and sale of various products such as urea, methanol, compound fertilisers, and others, with a market capitalisation of CN¥7.8 billion.

Operations: The primary revenue streams include Urea and Compound Fertiliser, contributing significantly to the company's total income. The gross profit margin has shown fluctuations, with a recent figure of 18.83%. Operating expenses are substantial, with General & Administrative and Sales & Marketing being key components.

PE: 5.3x

China XLX Fertiliser, a small company in Asia's agricultural sector, has caught attention due to its potential for growth. Recent insider confidence is evident with Qingjin Zhang acquiring 450,000 shares valued at approximately CNY 1.99 million in March 2025. The company's net income rose to CNY 1.46 billion in 2024 from CNY 1.19 billion the previous year, showcasing solid earnings quality despite high debt levels and reliance on external funding sources. Earnings are projected to grow nearly 20% annually, suggesting promising prospects amidst industry challenges.

- Unlock comprehensive insights into our analysis of China XLX Fertiliser stock in this valuation report.

Understand China XLX Fertiliser's track record by examining our Past report.

China Risun Group (SEHK:1907)

Simply Wall St Value Rating: ★★★★☆☆

Overview: China Risun Group operates in the manufacturing and trading of coke, coking chemicals, and refined chemicals, with a market presence in operation management and other related services.

Operations: The company's primary revenue streams are from Refined Chemicals Manufacturing and Coke and Coking Chemicals Manufacturing, contributing significantly to its total revenue. Trading and Operation Management also play a role in generating income. The gross profit margin has shown variability, with recent figures around 7.34%. Operating expenses include significant allocations to sales and marketing as well as general administrative costs.

PE: 504.8x

China Risun Group, a smaller player in Asia's market, recently launched a buyback program to repurchase up to 432.2 million shares, aiming to boost net asset value and earnings per share. Despite facing lower profit margins of 0.04% compared to last year's 1.9%, the company declared a special dividend of HK$0.024 per share for its shareholders on June 30, 2025. Earnings are anticipated to grow by over half annually, reflecting potential for future growth despite current challenges with high-risk external borrowing as their funding source.

- Click to explore a detailed breakdown of our findings in China Risun Group's valuation report.

Explore historical data to track China Risun Group's performance over time in our Past section.

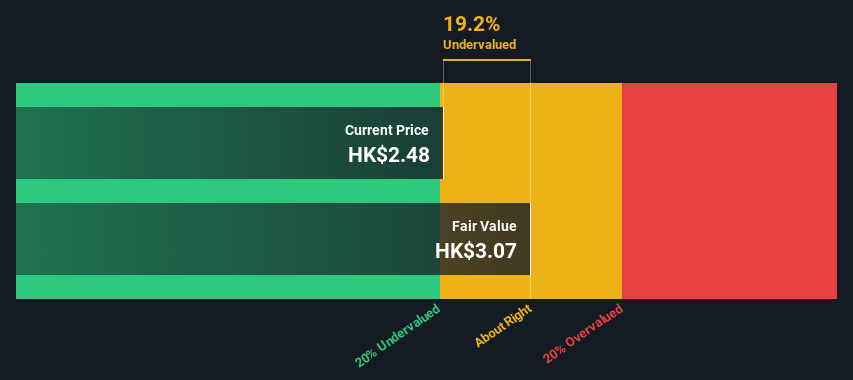

Sinofert Holdings (SEHK:297)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Sinofert Holdings is engaged in the production and distribution of fertilizers, with a market capitalization of CN¥5.66 billion.

Operations: The company generates revenue primarily from its Basic and Growth Business segments, with the latter contributing significantly to overall sales. Notably, the gross profit margin has shown an upward trend, reaching 11.76% by December 2024. Operating expenses have fluctuated but generally remain a substantial part of the cost structure. Despite variations in net income over time, recent periods indicate positive net income margins.

PE: 8.2x

Sinofert Holdings, a smaller player in the Asian market, has captured attention due to its potential for growth and value. The company reported a net income of CNY 1.06 billion for 2024, up from CNY 625 million the previous year, reflecting improved profitability. Insider confidence is evident with Tielin Wang purchasing 300,000 shares valued at approximately CNY 346,000 in March 2025. Despite relying solely on external borrowing for funding, earnings are projected to grow by over 15% annually. A final dividend increase was proposed at their recent AGM on June 10th.

- Delve into the full analysis valuation report here for a deeper understanding of Sinofert Holdings.

Gain insights into Sinofert Holdings' past trends and performance with our Past report.

Where To Now?

- Embark on your investment journey to our 59 Undervalued Asian Small Caps With Insider Buying selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1866

China XLX Fertiliser

An investment holding company, engages in the development, manufacture, and sale of urea primarily in Mainland China and internationally.

Reasonable growth potential with slight risk.

Market Insights

Community Narratives