As global markets navigate heightened geopolitical tensions and economic shifts, Hong Kong's Hang Seng Index has seen a notable climb, reflecting optimism around Beijing's supportive measures. In this environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

| Name | Insider Ownership | Earnings Growth |

| Laopu Gold (SEHK:6181) | 36.4% | 32.6% |

| Akeso (SEHK:9926) | 20.5% | 54.6% |

| Fenbi (SEHK:2469) | 33.1% | 22.4% |

| Xiamen Yan Palace Bird's Nest Industry (SEHK:1497) | 26.7% | 23.8% |

| Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.8% | 69.8% |

| Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

| DPC Dash (SEHK:1405) | 38.1% | 104.2% |

| Beijing Airdoc Technology (SEHK:2251) | 29.1% | 93.4% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 69.7% |

| Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

Below we spotlight a couple of our favorites from our exclusive screener.

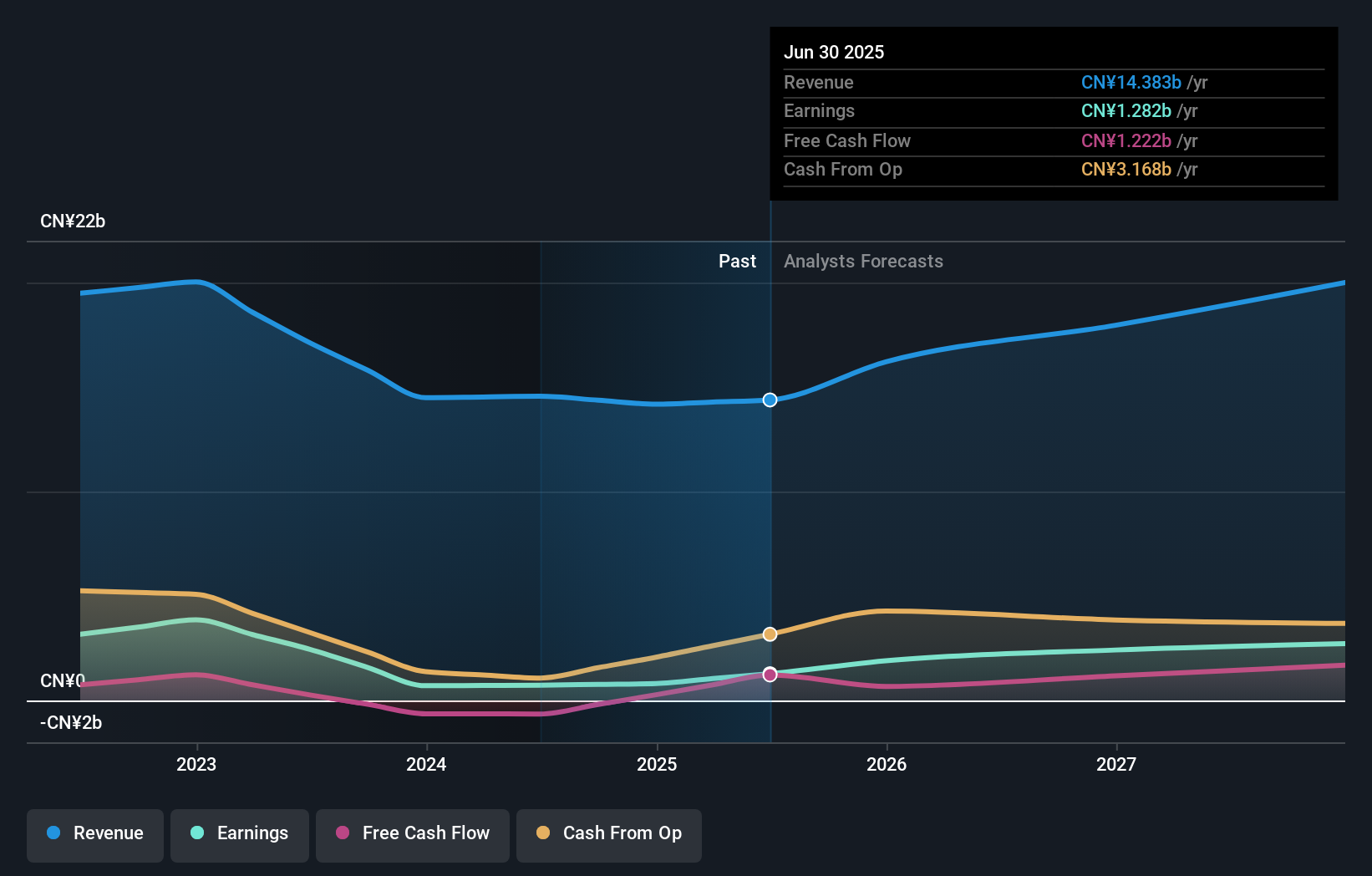

Dongyue Group (SEHK:189)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dongyue Group Limited is an investment holding company that manufactures, distributes, and sells polymers, organic silicone, refrigerants, dichloromethane, PVC, liquid alkali, and other products in China and internationally with a market cap of approximately HK$13.83 billion.

Operations: The company's revenue segments include CN¥4.31 billion from polymers, CN¥5.53 billion from refrigerants, CN¥5.12 billion from organic silicon, and CN¥1.12 billion from dichloromethane PVC and liquid alkali.

Insider Ownership: 15.4%

Earnings Growth Forecast: 43.7% p.a.

Dongyue Group's recent earnings report shows modest sales growth to CNY 7.26 billion and improved net income of CNY 307.65 million, reflecting a positive trajectory despite lower profit margins compared to last year. The company's earnings are projected to grow significantly over the next three years, outpacing the Hong Kong market average. Although there have been no substantial insider trades recently, the high insider ownership could align management's interests with shareholders'. The recent auditor change is not expected to impact financial reporting quality.

- Click here to discover the nuances of Dongyue Group with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Dongyue Group shares in the market.

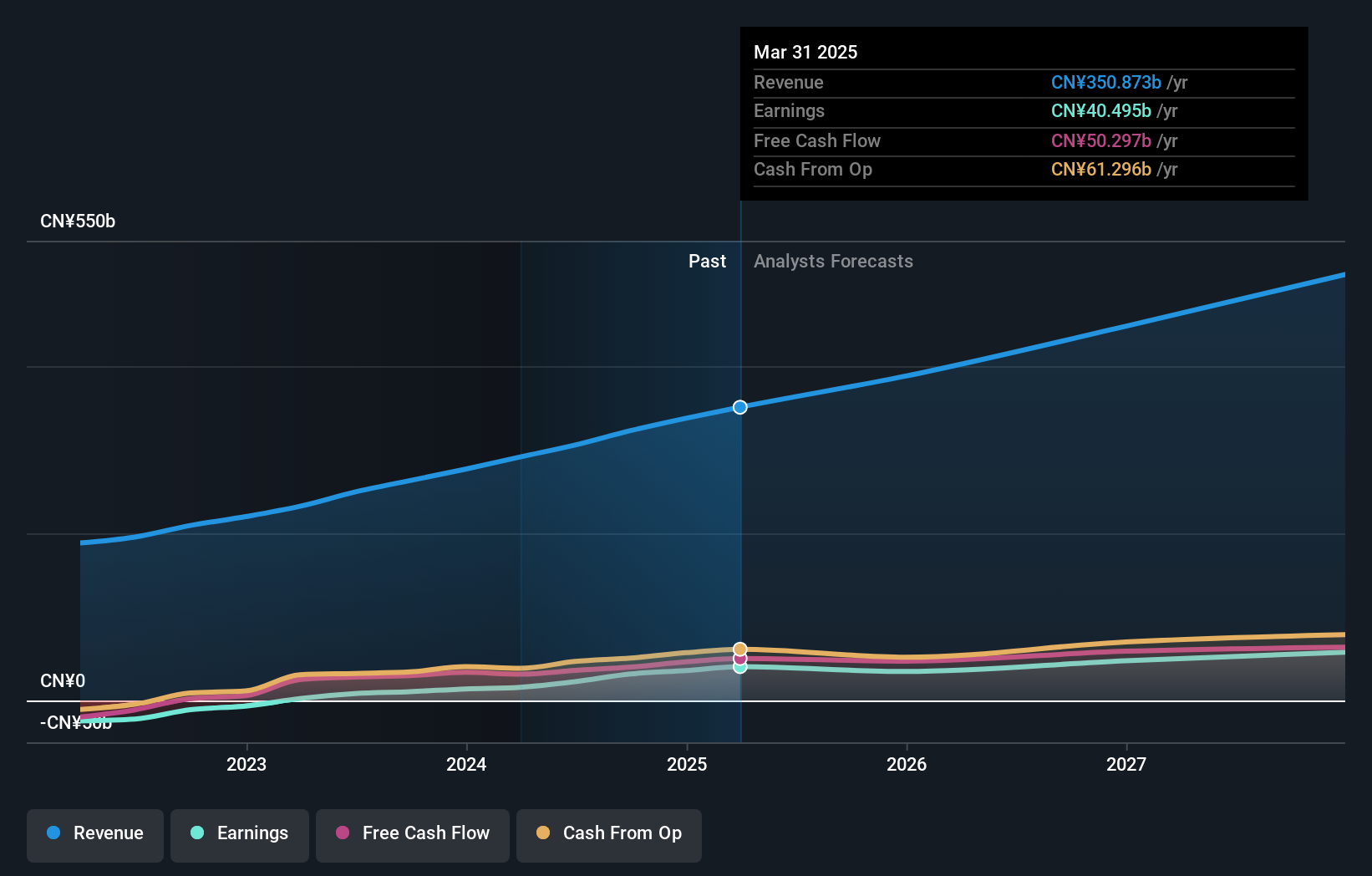

Meituan (SEHK:3690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Meituan is a technology retail company in the People’s Republic of China with a market cap of approximately HK$1.27 trillion.

Operations: The company's revenue segments consist of Core Local Commerce generating CN¥228.13 billion and New Initiatives contributing CN¥77.56 billion.

Insider Ownership: 11.8%

Earnings Growth Forecast: 26.1% p.a.

Meituan's recent financial performance highlights robust growth, with net income nearly doubling to CNY 16.72 billion for the first half of 2024. The company has been actively repurchasing shares, completing buybacks totaling over HKD 7.17 billion this year, indicating confidence in its valuation. Despite significant insider selling recently, Meituan's earnings are forecast to grow at a strong rate of 26.1% annually, surpassing the Hong Kong market average and suggesting potential alignment with shareholder interests through high insider ownership.

- Take a closer look at Meituan's potential here in our earnings growth report.

- The analysis detailed in our Meituan valuation report hints at an inflated share price compared to its estimated value.

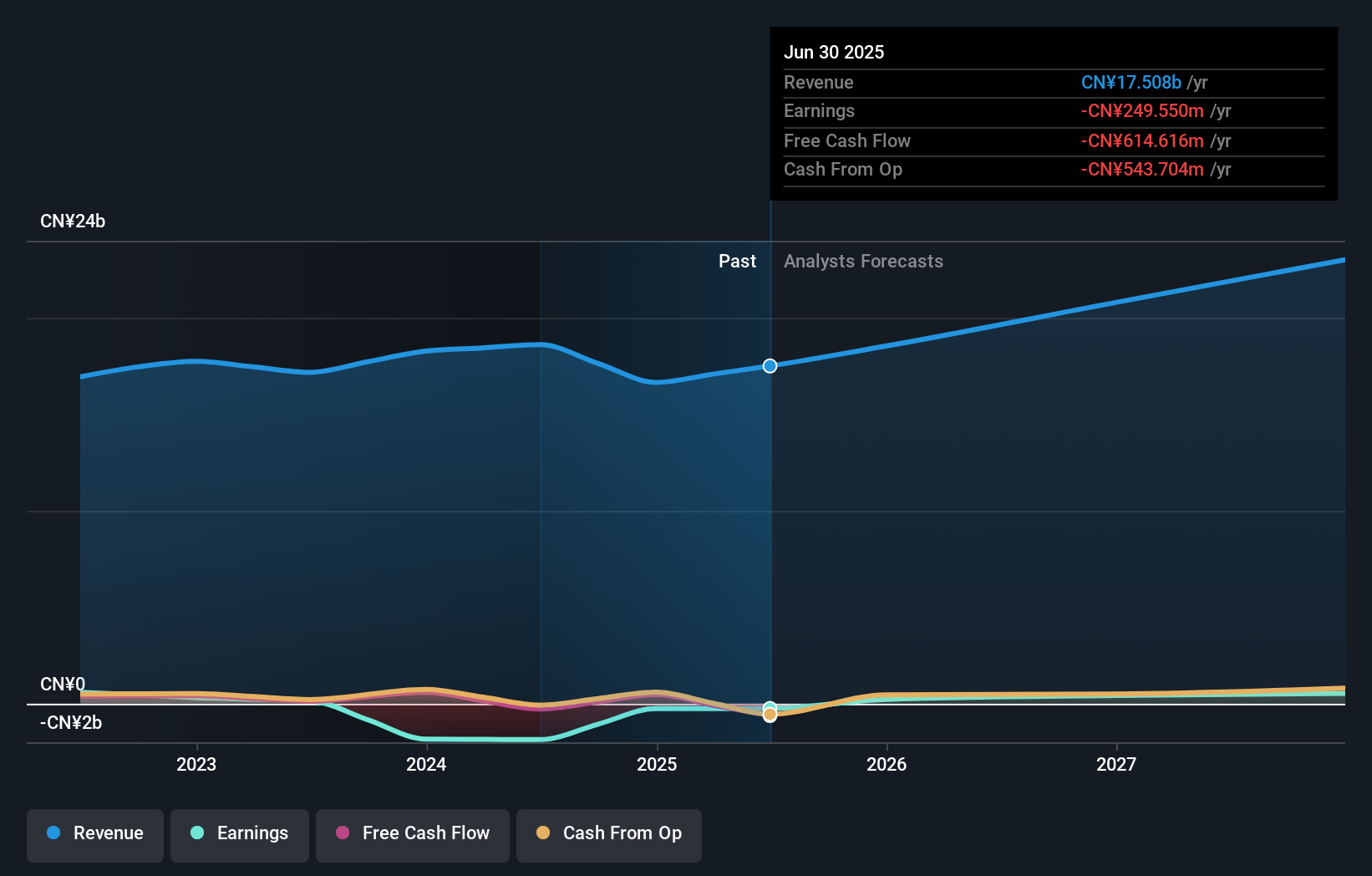

Digital China Holdings (SEHK:861)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Digital China Holdings Limited is an investment holding company that offers big data products and solutions to government and enterprise clients mainly in Mainland China, with a market cap of HK$5.04 billion.

Operations: The company's revenue segments include CN¥3.39 billion from Big Data Products and Solutions, CN¥5.31 billion from Software and Operating Services, and CN¥10.03 billion from Traditional and Localization Services.

Insider Ownership: 23.5%

Earnings Growth Forecast: 61.8% p.a.

Digital China Holdings is trading at a substantial discount to its estimated fair value, suggesting potential upside. Despite recent profit declines due to competition and increased expenses, earnings are forecasted to grow significantly by 61.82% annually, with the company expected to become profitable within three years. Revenue growth is projected at 9.8% per year, outpacing the Hong Kong market average. Recent board changes aim to strengthen governance and strategic direction amidst these challenges.

- Get an in-depth perspective on Digital China Holdings' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Digital China Holdings' share price might be too pessimistic.

Seize The Opportunity

- Embark on your investment journey to our 47 Fast Growing SEHK Companies With High Insider Ownership selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:861

Digital China Holdings

An investment holding company, provides big data products and solutions for government and enterprise customers in Mainland China.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives