A Piece Of The Puzzle Missing From China XLX Fertiliser Ltd.'s (HKG:1866) 26% Share Price Climb

China XLX Fertiliser Ltd. (HKG:1866) shares have had a really impressive month, gaining 26% after a shaky period beforehand. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 5.0% over the last year.

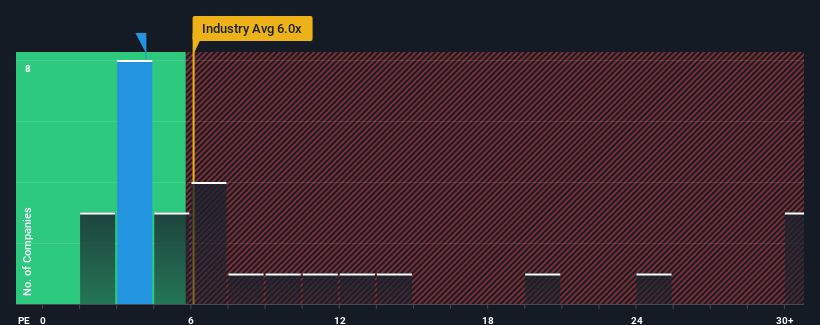

In spite of the firm bounce in price, China XLX Fertiliser's price-to-earnings (or "P/E") ratio of 4.1x might still make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 9x and even P/E's above 18x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Recent times haven't been advantageous for China XLX Fertiliser as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for China XLX Fertiliser

Does Growth Match The Low P/E?

China XLX Fertiliser's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's bottom line. Even so, admirably EPS has lifted 187% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 22% over the next year. With the market predicted to deliver 23% growth , the company is positioned for a comparable earnings result.

With this information, we find it odd that China XLX Fertiliser is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

What We Can Learn From China XLX Fertiliser's P/E?

Shares in China XLX Fertiliser are going to need a lot more upward momentum to get the company's P/E out of its slump. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that China XLX Fertiliser currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

And what about other risks? Every company has them, and we've spotted 2 warning signs for China XLX Fertiliser you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1866

China XLX Fertiliser

An investment holding company, engages in the development, manufacture, and sale of urea primarily in Mainland China and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.