- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1818

Zhaojin Mining Industry (HKG:1818) Takes On Some Risk With Its Use Of Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Zhaojin Mining Industry Company Limited (HKG:1818) does carry debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Zhaojin Mining Industry

How Much Debt Does Zhaojin Mining Industry Carry?

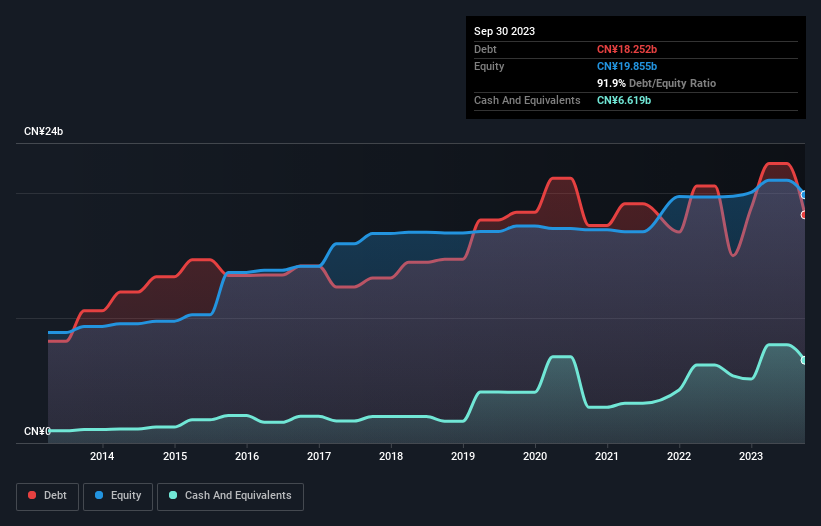

You can click the graphic below for the historical numbers, but it shows that as of September 2023 Zhaojin Mining Industry had CN¥18.3b of debt, an increase on CN¥15.0b, over one year. However, because it has a cash reserve of CN¥6.62b, its net debt is less, at about CN¥11.6b.

How Healthy Is Zhaojin Mining Industry's Balance Sheet?

The latest balance sheet data shows that Zhaojin Mining Industry had liabilities of CN¥17.6b due within a year, and liabilities of CN¥11.3b falling due after that. On the other hand, it had cash of CN¥6.62b and CN¥1.31b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥21.0b.

This is a mountain of leverage relative to its market capitalization of CN¥26.7b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Weak interest cover of 2.5 times and a disturbingly high net debt to EBITDA ratio of 5.1 hit our confidence in Zhaojin Mining Industry like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. On the other hand, Zhaojin Mining Industry grew its EBIT by 27% in the last year. If it can maintain that kind of improvement, its debt load will begin to melt away like glaciers in a warming world. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Zhaojin Mining Industry's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. Over the last three years, Zhaojin Mining Industry saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

To be frank both Zhaojin Mining Industry's net debt to EBITDA and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. But at least it's pretty decent at growing its EBIT; that's encouraging. Looking at the bigger picture, it seems clear to us that Zhaojin Mining Industry's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 1 warning sign for Zhaojin Mining Industry you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Zhaojin Mining Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1818

Zhaojin Mining Industry

An investment holding company, engages in exploration, mining, processing, smelting, and sale of gold and silver products in the People’s Republic of China.

High growth potential with excellent balance sheet.