- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1818

Zhaojin Mining Industry Company Limited's (HKG:1818) Stock Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong?

Zhaojin Mining Industry (HKG:1818) has had a rough week with its share price down 4.5%. But if you pay close attention, you might find that its key financial indicators look quite decent, which could mean that the stock could potentially rise in the long-term given how markets usually reward more resilient long-term fundamentals. In this article, we decided to focus on Zhaojin Mining Industry's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

View our latest analysis for Zhaojin Mining Industry

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Zhaojin Mining Industry is:

6.2% = CN¥1.5b ÷ CN¥24b (Based on the trailing twelve months to September 2024).

The 'return' is the profit over the last twelve months. So, this means that for every HK$1 of its shareholder's investments, the company generates a profit of HK$0.06.

What Is The Relationship Between ROE And Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Zhaojin Mining Industry's Earnings Growth And 6.2% ROE

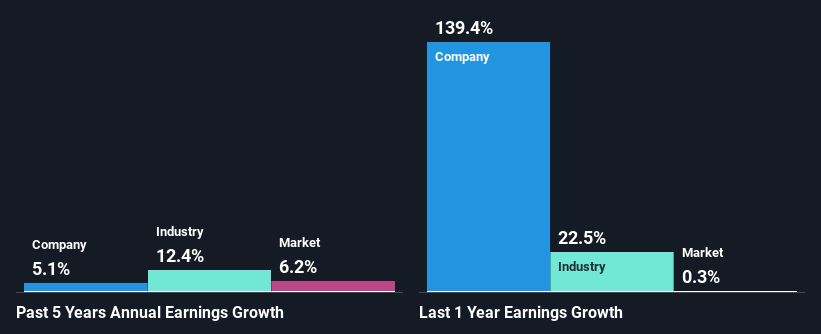

On the face of it, Zhaojin Mining Industry's ROE is not much to talk about. Next, when compared to the average industry ROE of 11%, the company's ROE leaves us feeling even less enthusiastic. However, the moderate 5.1% net income growth seen by Zhaojin Mining Industry over the past five years is definitely a positive. We reckon that there could be other factors at play here. Such as - high earnings retention or an efficient management in place.

We then compared Zhaojin Mining Industry's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 12% in the same 5-year period, which is a bit concerning.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Has the market priced in the future outlook for 1818? You can find out in our latest intrinsic value infographic research report.

Is Zhaojin Mining Industry Making Efficient Use Of Its Profits?

With a three-year median payout ratio of 26% (implying that the company retains 74% of its profits), it seems that Zhaojin Mining Industry is reinvesting efficiently in a way that it sees respectable amount growth in its earnings and pays a dividend that's well covered.

Additionally, Zhaojin Mining Industry has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders. Existing analyst estimates suggest that the company's future payout ratio is expected to drop to 20% over the next three years. As a result, the expected drop in Zhaojin Mining Industry's payout ratio explains the anticipated rise in the company's future ROE to 12%, over the same period.

Conclusion

Overall, we feel that Zhaojin Mining Industry certainly does have some positive factors to consider. Namely, its respectable earnings growth, which it achieved due to it retaining most of its profits. However, given the low ROE, investors may not be benefitting from all that reinvestment after all. With that said, the latest industry analyst forecasts reveal that the company's earnings are expected to accelerate. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Valuation is complex, but we're here to simplify it.

Discover if Zhaojin Mining Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1818

Zhaojin Mining Industry

An investment holding company, engages in exploration, mining, processing, smelting, and sale of gold and other metallic products in the People’s Republic of China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026