- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1818

Here's Why Zhaojin Mining Industry Company Limited's (HKG:1818) CEO Compensation Is The Least Of Shareholders' Concerns

CEO Xin Dong has done a decent job of delivering relatively good performance at Zhaojin Mining Industry Company Limited (HKG:1818) recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 07 June 2021. Based on our analysis of the data below, we think CEO compensation seems reasonable for now.

Check out our latest analysis for Zhaojin Mining Industry

How Does Total Compensation For Xin Dong Compare With Other Companies In The Industry?

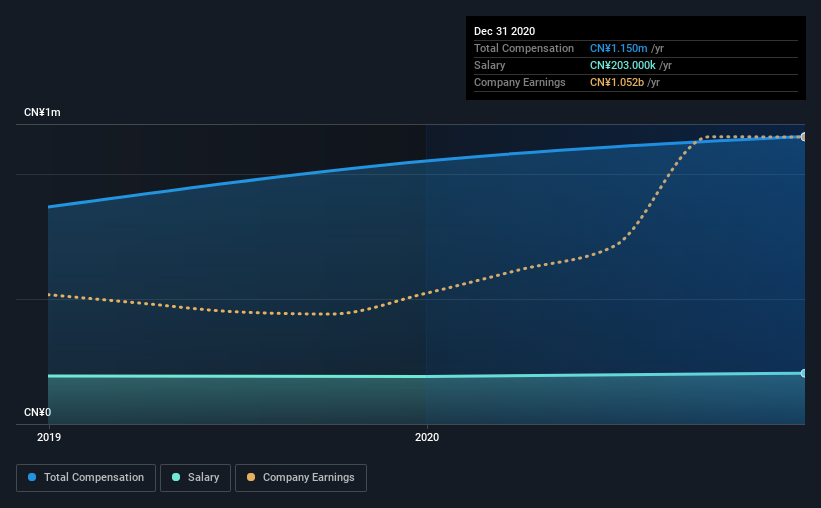

According to our data, Zhaojin Mining Industry Company Limited has a market capitalization of HK$27b, and paid its CEO total annual compensation worth CN¥1.2m over the year to December 2020. Notably, that's an increase of 9.3% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CN¥203k.

On comparing similar companies from the same industry with market caps ranging from HK$16b to HK$50b, we found that the median CEO total compensation was CN¥905k. This suggests that Zhaojin Mining Industry remunerates its CEO largely in line with the industry average. Furthermore, Xin Dong directly owns HK$2.5m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CN¥203k | CN¥190k | 18% |

| Other | CN¥947k | CN¥862k | 82% |

| Total Compensation | CN¥1.2m | CN¥1.1m | 100% |

On an industry level, roughly 84% of total compensation represents salary and 16% is other remuneration. It's interesting to note that Zhaojin Mining Industry allocates a smaller portion of compensation to salary in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Zhaojin Mining Industry Company Limited's Growth

Zhaojin Mining Industry Company Limited has seen its earnings per share (EPS) increase by 16% a year over the past three years. Its revenue is up 21% over the last year.

This demonstrates that the company has been improving recently and is good news for the shareholders. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Zhaojin Mining Industry Company Limited Been A Good Investment?

Zhaojin Mining Industry Company Limited has served shareholders reasonably well, with a total return of 30% over three years. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 2 warning signs for Zhaojin Mining Industry that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zhaojin Mining Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1818

Zhaojin Mining Industry

An investment holding company, engages in exploration, mining, processing, smelting, and sale of gold and other metallic products in the People’s Republic of China and internationally.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives