- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1378

Market Participants Recognise China Hongqiao Group Limited's (HKG:1378) Earnings Pushing Shares 26% Higher

Despite an already strong run, China Hongqiao Group Limited (HKG:1378) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days bring the annual gain to a very sharp 91%.

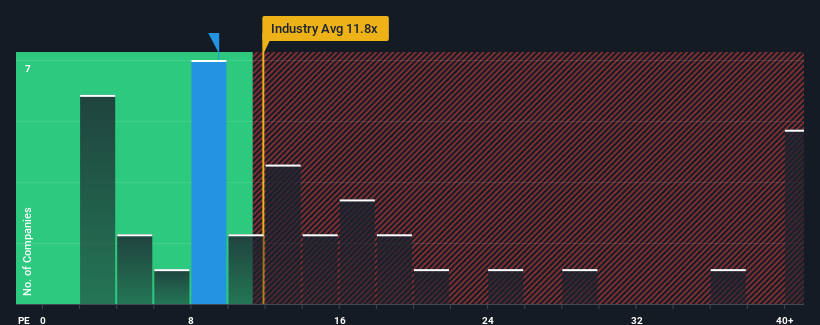

Even after such a large jump in price, it's still not a stretch to say that China Hongqiao Group's price-to-earnings (or "P/E") ratio of 9.4x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 10x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

China Hongqiao Group certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for China Hongqiao Group

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like China Hongqiao Group's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 29% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 17% per annum over the next three years. With the market predicted to deliver 16% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's understandable that China Hongqiao Group's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

China Hongqiao Group's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of China Hongqiao Group's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with China Hongqiao Group, and understanding should be part of your investment process.

You might be able to find a better investment than China Hongqiao Group. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1378

China Hongqiao Group

An investment holding company, manufactures and sells aluminum products.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives