- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1378

February 2025's Leading Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rising inflation and shifting trade policies, U.S. stock indexes are climbing toward record highs, with growth stocks leading the charge. In this environment of economic uncertainty and elevated interest rates, dividend stocks can offer investors a measure of stability and income potential, making them an attractive option for those seeking to balance growth with consistent returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 5.89% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.58% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.02% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.90% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.40% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.21% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.89% | ★★★★★★ |

Click here to see the full list of 1990 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

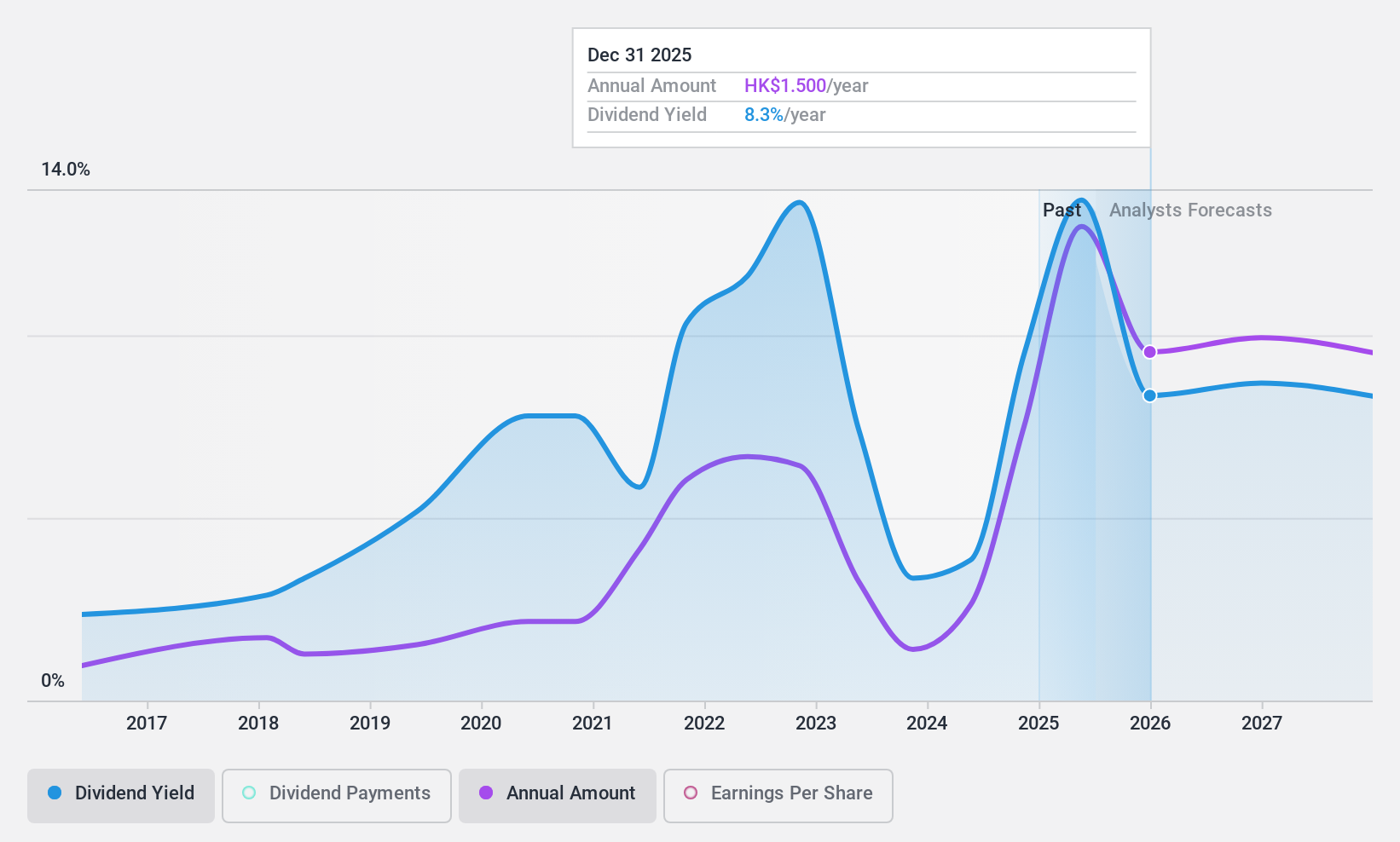

China Hongqiao Group (SEHK:1378)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Hongqiao Group Limited is an investment holding company that manufactures and sells aluminum products in the People's Republic of China and Indonesia, with a market cap of approximately HK$120.39 billion.

Operations: The primary revenue segment for China Hongqiao Group Limited is the manufacture and sales of aluminum products, generating CN¥141.48 billion.

Dividend Yield: 8.9%

China Hongqiao Group's dividend is well-covered by both earnings and cash flow, with payout ratios of 42.3% and 48.5%, respectively. Despite an attractive dividend yield in the top quartile of the Hong Kong market, the company has a volatile dividend history over the past decade. Recent share buyback initiatives aim to enhance shareholder value, while new debt issuance may impact future cash flows available for dividends.

- Click to explore a detailed breakdown of our findings in China Hongqiao Group's dividend report.

- According our valuation report, there's an indication that China Hongqiao Group's share price might be on the cheaper side.

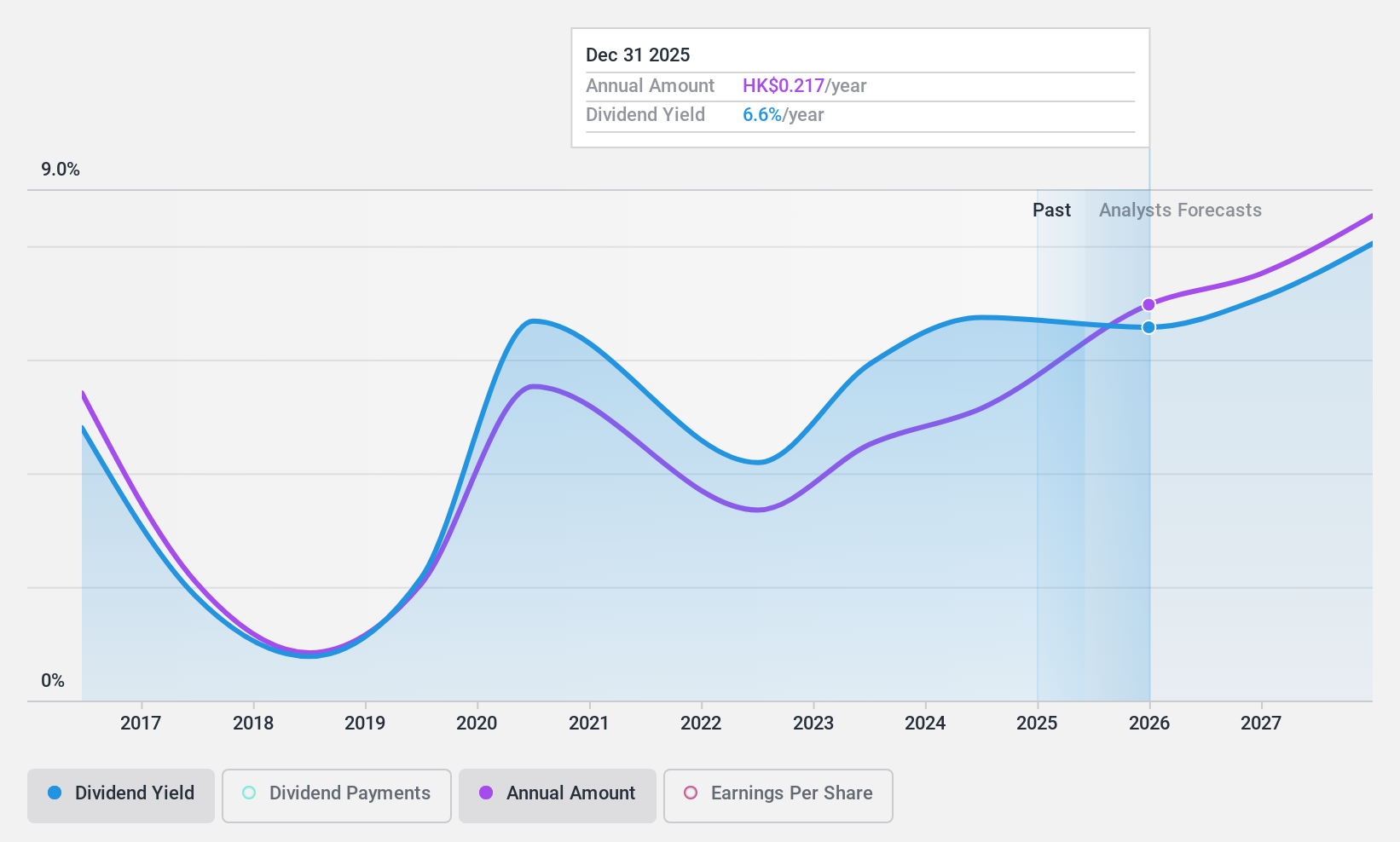

Huishang Bank (SEHK:3698)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Huishang Bank Corporation Limited, along with its subsidiaries, offers a range of commercial banking products and services in the People’s Republic of China and has a market cap of HK$35.56 billion.

Operations: Huishang Bank Corporation Limited generates its revenue from various segments, including corporate banking at CN¥12.75 billion, retail banking at CN¥8.32 billion, and treasury operations at CN¥5.47 billion in the People’s Republic of China.

Dividend Yield: 5.9%

Huishang Bank's dividends are thoroughly covered by earnings, with a low payout ratio of 14%, yet the dividend yield of 5.87% falls short compared to top Hong Kong payers. Despite an increase in dividends over the past decade, payments have been volatile and unreliable. Recent board and auditor changes are routine, with no disputes reported. The stock trades at a significant discount to estimated fair value and is well-valued relative to peers.

- Get an in-depth perspective on Huishang Bank's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Huishang Bank is trading behind its estimated value.

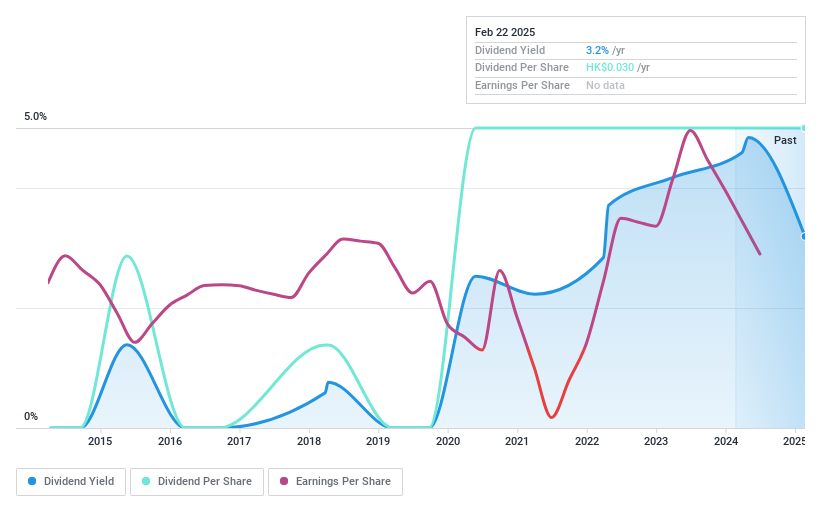

Automated Systems Holdings (SEHK:771)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Automated Systems Holdings Limited is an investment holding company that provides IT services to corporate customers across several regions, including Hong Kong, the United States, and Mainland China, with a market cap of HK$800.35 million.

Operations: Automated Systems Holdings Limited generates revenue from two main segments: IT Products, contributing HK$1.13 billion, and IT Services, contributing HK$1.24 billion.

Dividend Yield: 3.2%

Automated Systems Holdings' dividends are well-covered by earnings and cash flows, with a payout ratio of 31.9% and a cash payout ratio of 23.3%. However, the dividend yield of 3.19% is lower than top Hong Kong payers, and payments have been volatile over the past decade. The recent supply agreement with Beijing Teamsun Technology Co., Ltd., effective until December 2027, may influence future performance but doesn't directly impact dividend stability or growth prospects.

- Take a closer look at Automated Systems Holdings' potential here in our dividend report.

- Upon reviewing our latest valuation report, Automated Systems Holdings' share price might be too pessimistic.

Taking Advantage

- Click through to start exploring the rest of the 1987 Top Dividend Stocks now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1378

China Hongqiao Group

An investment holding company, manufactures and sells aluminum products.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives