- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1303

Recent 14% pullback isn't enough to hurt long-term Huili Resources (Group) (HKG:1303) shareholders, they're still up 91% over 1 year

The Huili Resources (Group) Limited (HKG:1303) share price has had a bad week, falling 14%. But that doesn't change the fact that the returns over the last year have been pleasing. To wit, it had solidly beat the market, up 91%.

In light of the stock dropping 14% in the past week, we want to investigate the longer term story, and see if fundamentals have been the driver of the company's positive one-year return.

Check out our latest analysis for Huili Resources (Group)

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Huili Resources (Group) went from making a loss to reporting a profit, in the last year.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

We think that the revenue growth of 208% could have some investors interested. We do see some companies suppress earnings in order to accelerate revenue growth.

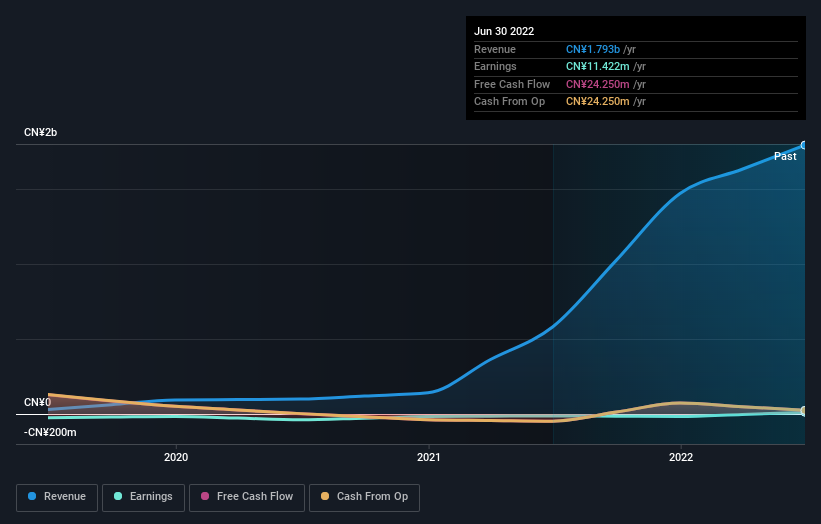

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

If you are thinking of buying or selling Huili Resources (Group) stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that Huili Resources (Group) has rewarded shareholders with a total shareholder return of 91% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 8% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Huili Resources (Group) better, we need to consider many other factors. To that end, you should learn about the 3 warning signs we've spotted with Huili Resources (Group) (including 1 which can't be ignored) .

We will like Huili Resources (Group) better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Huili Resources (Group) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1303

Huili Resources (Group)

An investment holding, engages in mining, processing, and selling mineral ores in the People’s Republic of China.

Excellent balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success