- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1203

GDH Guangnan (Holdings) (HKG:1203) Is Due To Pay A Dividend Of HK$0.02

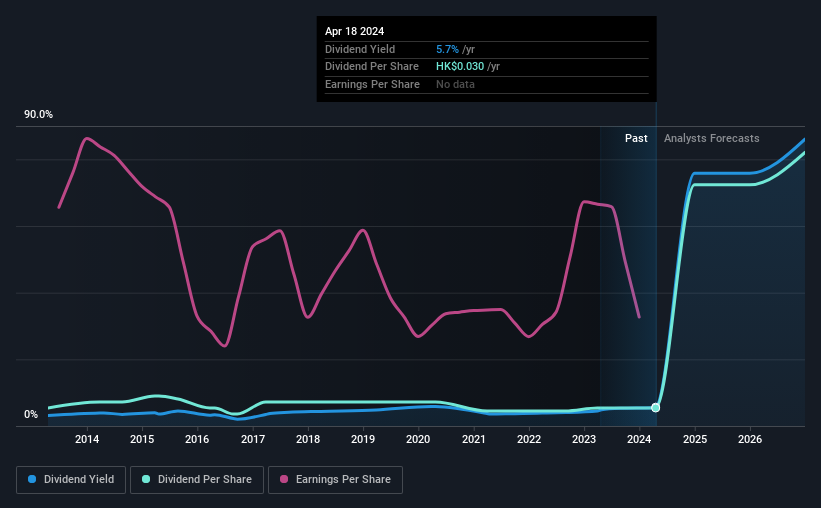

The board of GDH Guangnan (Holdings) Limited (HKG:1203) has announced that it will pay a dividend of HK$0.02 per share on the 19th of July. This means the annual payment is 5.7% of the current stock price, which is above the average for the industry.

Check out our latest analysis for GDH Guangnan (Holdings)

GDH Guangnan (Holdings)'s Earnings Easily Cover The Distributions

If the payments aren't sustainable, a high yield for a few years won't matter that much. The last dividend was quite easily covered by GDH Guangnan (Holdings)'s earnings. This indicates that quite a large proportion of earnings is being invested back into the business.

According to analysts, EPS should be several times higher next year. If the dividend extends its recent trend, estimates say the dividend could reach 2.2%, which we would be comfortable to see continuing.

Dividend Volatility

The company has a long dividend track record, but it doesn't look great with cuts in the past. There hasn't been much of a change in the dividend over the last 10 years. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

The Dividend Has Limited Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. GDH Guangnan (Holdings)'s EPS has fallen by approximately 11% per year during the past five years. A sharp decline in earnings per share is not great from from a dividend perspective. Even conservative payout ratios can come under pressure if earnings fall far enough. Over the next year, however, earnings are actually predicted to rise, but we would still be cautious until a track record of earnings growth can be built.

In Summary

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about GDH Guangnan (Holdings)'s payments, as there could be some issues with sustaining them into the future. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Taking the debate a bit further, we've identified 3 warning signs for GDH Guangnan (Holdings) that investors need to be conscious of moving forward. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1203

GDH Guangnan (Holdings)

An investment holding company, engages in the distribution and trading of fresh and live foodstuffs in Hong Kong, Mainland China, Asian countries, and internationally.

Solid track record with adequate balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026