- Hong Kong

- /

- Metals and Mining

- /

- SEHK:1053

Further weakness as Chongqing Iron & Steel (HKG:1053) drops 8.0% this week, taking three-year losses to 27%

Chongqing Iron & Steel Company Limited (HKG:1053) shareholders will doubtless be very grateful to see the share price up 51% in the last quarter. But that cannot eclipse the less-than-impressive returns over the last three years. After all, the share price is down 27% in the last three years, significantly under-performing the market.

Since Chongqing Iron & Steel has shed HK$708m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Chongqing Iron & Steel

Given that Chongqing Iron & Steel didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Chongqing Iron & Steel's revenue dropped 3.6% per year. That's not what investors generally want to see. The annual decline of 8% per year in that period has clearly disappointed holders. And with no profits, and weak revenue, are you surprised? However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

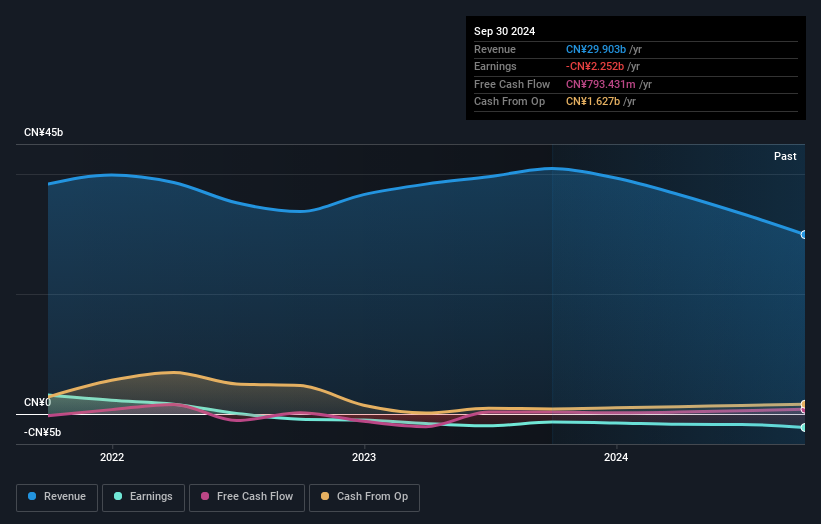

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Chongqing Iron & Steel's earnings, revenue and cash flow.

A Different Perspective

It's nice to see that Chongqing Iron & Steel shareholders have received a total shareholder return of 24% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 1.8% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Chongqing Iron & Steel better, we need to consider many other factors. For instance, we've identified 2 warning signs for Chongqing Iron & Steel that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1053

Chongqing Iron & Steel

Engages in the production and sale of steel plates in the People’s Republic of China.

Good value with adequate balance sheet.

Market Insights

Community Narratives