ZhongAn Online P & C Insurance Co., Ltd. (HKG:6060) Stock's 25% Dive Might Signal An Opportunity But It Requires Some Scrutiny

ZhongAn Online P & C Insurance Co., Ltd. (HKG:6060) shares have retraced a considerable 25% in the last month, reversing a fair amount of their solid recent performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 37% in that time.

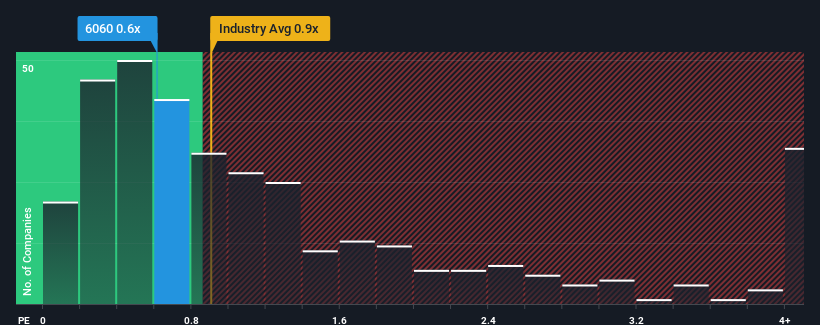

Even after such a large drop in price, you could still be forgiven for feeling indifferent about ZhongAn Online P & C Insurance's P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Insurance industry in Hong Kong is about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for ZhongAn Online P & C Insurance

What Does ZhongAn Online P & C Insurance's Recent Performance Look Like?

Recent times haven't been great for ZhongAn Online P & C Insurance as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ZhongAn Online P & C Insurance.How Is ZhongAn Online P & C Insurance's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like ZhongAn Online P & C Insurance's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. The latest three year period has also seen an excellent 60% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 10.0% per annum as estimated by the twelve analysts watching the company. With the industry only predicted to deliver 1.3% each year, the company is positioned for a stronger revenue result.

In light of this, it's curious that ZhongAn Online P & C Insurance's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From ZhongAn Online P & C Insurance's P/S?

ZhongAn Online P & C Insurance's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, ZhongAn Online P & C Insurance's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

We don't want to rain on the parade too much, but we did also find 4 warning signs for ZhongAn Online P & C Insurance (2 don't sit too well with us!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if ZhongAn Online P & C Insurance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6060

ZhongAn Online P & C Insurance

An Internet-based Insurtech company, provides internet insurance and insurance information technology services in the People’s Republic of China.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives