Market Cool On ZhongAn Online P & C Insurance Co., Ltd.'s (HKG:6060) Revenues Pushing Shares 25% Lower

ZhongAn Online P & C Insurance Co., Ltd. (HKG:6060) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 60% loss during that time.

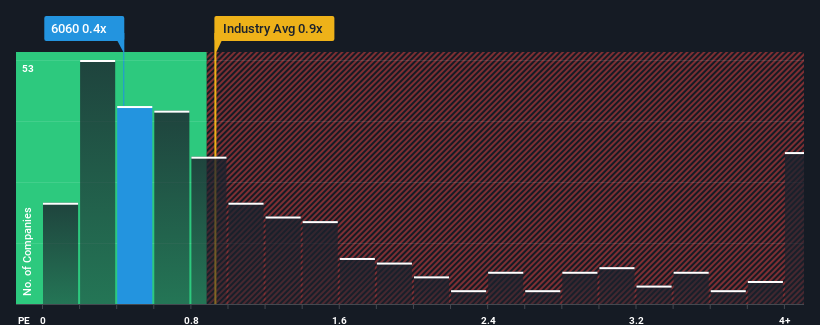

Although its price has dipped substantially, there still wouldn't be many who think ZhongAn Online P & C Insurance's price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S in Hong Kong's Insurance industry is similar at about 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for ZhongAn Online P & C Insurance

What Does ZhongAn Online P & C Insurance's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, ZhongAn Online P & C Insurance has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on ZhongAn Online P & C Insurance will help you uncover what's on the horizon.How Is ZhongAn Online P & C Insurance's Revenue Growth Trending?

ZhongAn Online P & C Insurance's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 22% gain to the company's top line. The latest three year period has also seen an excellent 60% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 10.0% per year during the coming three years according to the twelve analysts following the company. That's shaping up to be materially higher than the 4.4% per year growth forecast for the broader industry.

In light of this, it's curious that ZhongAn Online P & C Insurance's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From ZhongAn Online P & C Insurance's P/S?

ZhongAn Online P & C Insurance's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite enticing revenue growth figures that outpace the industry, ZhongAn Online P & C Insurance's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 3 warning signs for ZhongAn Online P & C Insurance (2 shouldn't be ignored!) that you need to take into consideration.

If these risks are making you reconsider your opinion on ZhongAn Online P & C Insurance, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade ZhongAn Online P & C Insurance, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ZhongAn Online P & C Insurance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6060

ZhongAn Online P & C Insurance

An Internet-based Insurtech company, provides internet insurance and insurance information technology services in the People’s Republic of China.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives