How Much Did ZhongAn Online P & C Insurance's(HKG:6060) Shareholders Earn From Share Price Movements Over The Last Three Years?

As an investor its worth striving to ensure your overall portfolio beats the market average. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term ZhongAn Online P & C Insurance Co., Ltd. (HKG:6060) shareholders have had that experience, with the share price dropping 46% in three years, versus a market decline of about 0.1%. Furthermore, it's down 21% in about a quarter. That's not much fun for holders.

See our latest analysis for ZhongAn Online P & C Insurance

Given that ZhongAn Online P & C Insurance didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over three years, ZhongAn Online P & C Insurance grew revenue at 43% per year. That is faster than most pre-profit companies. While its revenue increased, the share price dropped at a rate of 13% per year. That seems like an unlucky result for holders. It seems likely that actual growth fell short of shareholders' expectations. Still, with high hopes now tempered, now might prove to be an opportunity to buy.

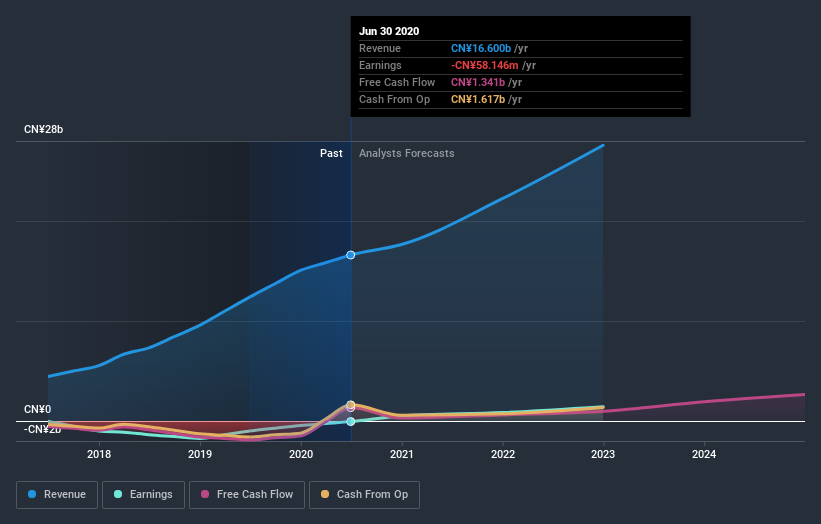

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free report showing analyst forecasts should help you form a view on ZhongAn Online P & C Insurance

A Different Perspective

We're pleased to report that ZhongAn Online P & C Insurance rewarded shareholders with a total shareholder return of 21% over the last year. That certainly beats the loss of about 13% per year over three years. It could well be that the business has turned around -- or else regained the confidence of investors. It's always interesting to track share price performance over the longer term. But to understand ZhongAn Online P & C Insurance better, we need to consider many other factors. Even so, be aware that ZhongAn Online P & C Insurance is showing 1 warning sign in our investment analysis , you should know about...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade ZhongAn Online P & C Insurance, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if ZhongAn Online P & C Insurance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:6060

ZhongAn Online P & C Insurance

An Internet-based Insurtech company, provides internet insurance and insurance information technology services in the People’s Republic of China.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives