China Life Insurance (SEHK:2628) Reports RMB 626.9B Premiums, Eyes Geographic Expansion and AI Investments

Reviewed by Simply Wall St

Click to explore a detailed breakdown of our findings on China Life Insurance.

Key Assets Propelling China Life Insurance Forward

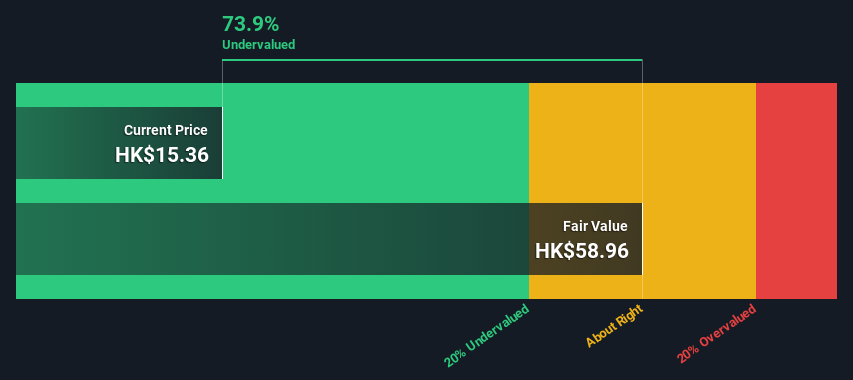

China Life Insurance has demonstrated remarkable earnings growth, with a 123% increase over the past year, underscoring its strong market position. This growth is further supported by the company's strategic product innovations, as highlighted by the successful launch of new product lines which exceeded sales forecasts. Additionally, the company is trading at a significant discount of 73.9% to its estimated fair value, suggesting it may be undervalued in the market. This valuation, combined with a Price-To-Earnings Ratio of 4.6x, positions China Life favorably compared to peers.

Challenges Constraining China Life Insurance's Potential

However, the company faces challenges, including forecasted earnings declines averaging 14.5% annually over the next three years. This is compounded by a history of volatile dividend payments, which may affect investor confidence. The current net profit margin of 10.8% is also lower than the previous year's 14.5%, indicating pressure on profitability. These factors highlight the need for improved operational efficiency and cost management to maintain competitiveness.

Future Prospects for China Life Insurance in the Market

Opportunities abound for China Life Insurance, particularly through geographic expansion and technological investments. The company is exploring new markets, which could diversify revenue streams and reduce reliance on existing ones. Investments in AI and automation are expected to enhance operational efficiency, potentially lowering costs. Furthermore, the company's low dividend payout ratio of 20.3% indicates room for sustainable dividend growth, appealing to income-focused investors.

External Factors Threatening China Life Insurance

Despite these opportunities, the company must navigate several external threats. Economic uncertainties could impact consumer spending, posing a risk to revenue growth. Additionally, regulatory changes may affect operational frameworks and cost structures, necessitating adaptability. Supply chain disruptions, as noted by Hou Grace, Head of Development, could lead to increased costs and delays, underscoring the importance of resilience in maintaining customer satisfaction.

Conclusion

China Life Insurance's impressive 123% earnings growth and successful product innovations underscore its strong market position, while trading at a 73.9% discount to its estimated fair value suggests significant potential for market correction. However, the forecasted 14.5% annual earnings decline and volatile dividends highlight the need for improved cost management and operational efficiency to sustain investor confidence. The company's strategic focus on geographic expansion and technological investments, coupled with a low dividend payout ratio of 20.3%, presents opportunities for diversified revenue streams and sustainable dividend growth. Yet, external threats such as economic uncertainties and regulatory changes necessitate resilience and adaptability to maintain competitiveness and capitalize on its current undervaluation.

Where To Now?

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About SEHK:2628

China Life Insurance

Operates as a life insurance company in the People’s Republic of China.

Outstanding track record, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives