As global markets grapple with the steepest stock declines in years due to unexpected tariff announcements and escalating trade tensions, investors are increasingly focused on strategies that offer stability amid uncertainty. In such volatile conditions, dividend stocks present an attractive option for those seeking regular income and potential resilience against market fluctuations.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Totech (TSE:9960) | 4.56% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.06% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 5.06% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.78% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 4.20% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.56% | ★★★★★★ |

| ENEOS Holdings (TSE:5020) | 4.25% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.48% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.33% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.48% | ★★★★★★ |

Click here to see the full list of 1640 stocks from our Top Global Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

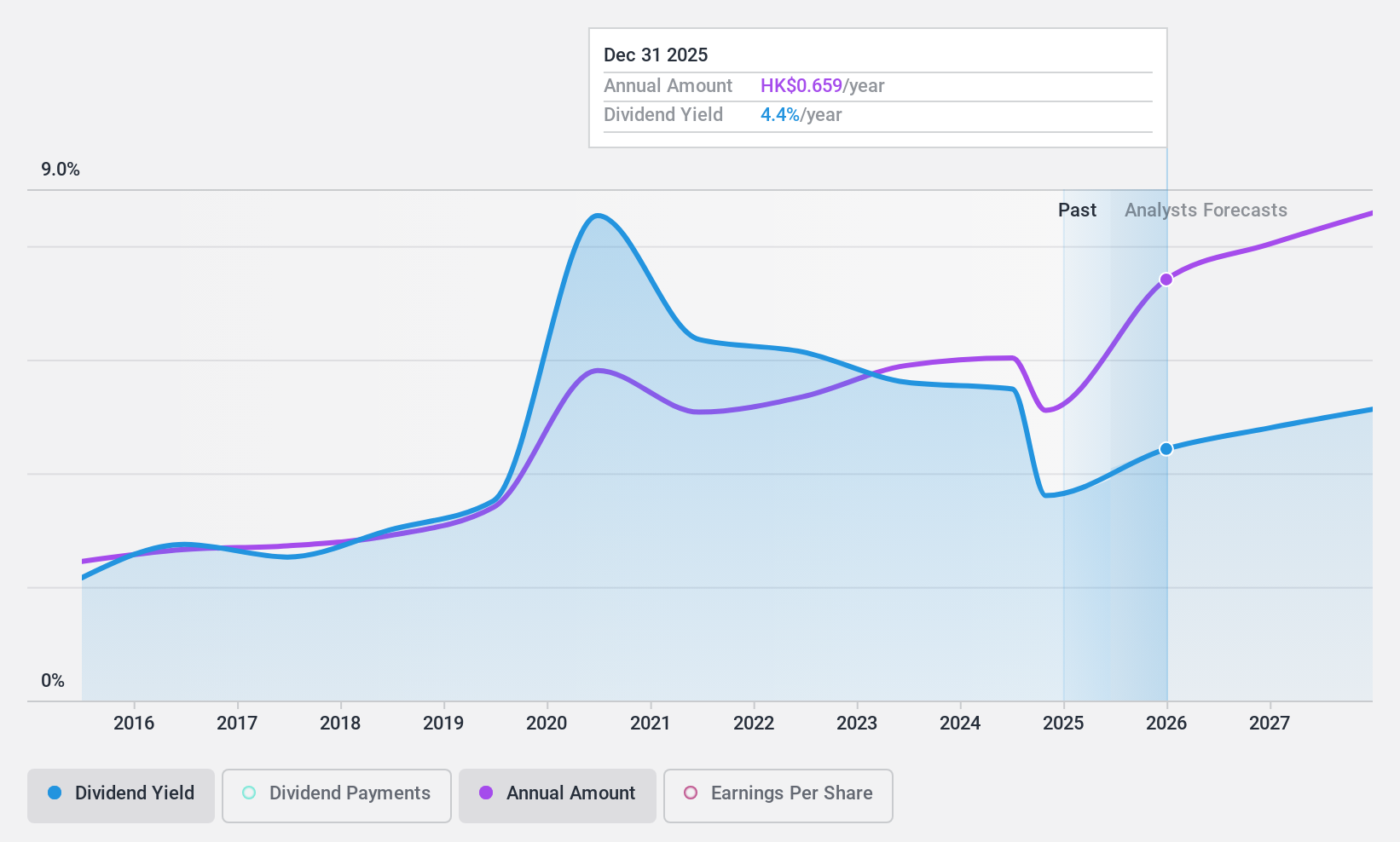

PICC Property and Casualty (SEHK:2328)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PICC Property and Casualty Company Limited, along with its subsidiaries, operates in the property and casualty insurance sector in the People's Republic of China, with a market cap of HK$335.87 billion.

Operations: PICC Property and Casualty Company Limited generates revenue primarily from its insurance segments, including Motor Vehicle (CN¥294.67 billion), Agriculture (CN¥55.30 billion), Accidental Injury and Health (CN¥48.92 billion), Liability (CN¥37.15 billion), Commercial Property (CN¥16.95 billion), and Others (CN¥30.57 billion).

Dividend Yield: 4.7%

PICC Property and Casualty's dividend is well-covered by earnings and cash flows, with payout ratios of 37.3% and 44.4%, respectively. Despite a recent decrease to RMB 0.332 per share, dividends have grown over the past decade but remain volatile, affecting reliability. The company's net income rose significantly to CNY 32.17 billion in 2024, yet its dividend yield of 4.67% lags behind top Hong Kong payers at 7.63%.

- Unlock comprehensive insights into our analysis of PICC Property and Casualty stock in this dividend report.

- Our comprehensive valuation report raises the possibility that PICC Property and Casualty is priced lower than what may be justified by its financials.

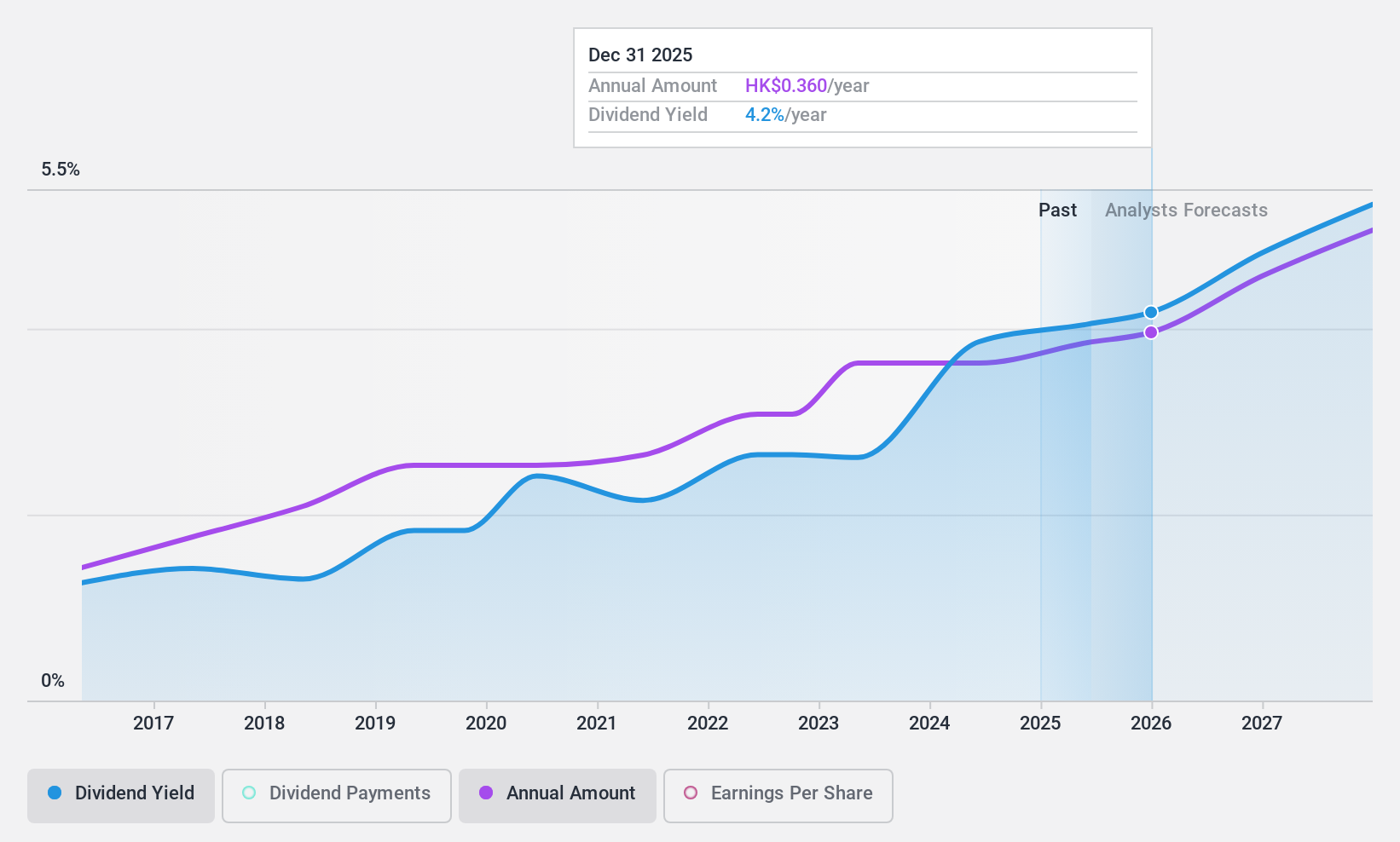

Beijing Tong Ren Tang Chinese Medicine (SEHK:3613)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Beijing Tong Ren Tang Chinese Medicine Company Limited, with a market cap of HK$7.44 billion, is involved in the manufacture, retail, and wholesale of healthcare products and Chinese medicine to both wholesalers and individuals.

Operations: Beijing Tong Ren Tang Chinese Medicine Company Limited generates its revenue from three main segments: Overseas (HK$402.62 million), Hong Kong (HK$1.27 billion), and Mainland China (HK$248.76 million).

Dividend Yield: 3.9%

Beijing Tong Ren Tang Chinese Medicine offers a stable dividend history with a payout ratio of 58.6%, indicating coverage by earnings. The annual dividend of HK$0.35 per share is reliable, though its yield of 3.94% is below the top Hong Kong payers at 7.63%. Recent earnings showed a slight decline in net income to HK$500.28 million, yet sales increased to HK$1.61 billion, supporting its dividend sustainability despite limited cash flow data for further analysis.

- Click here and access our complete dividend analysis report to understand the dynamics of Beijing Tong Ren Tang Chinese Medicine.

- According our valuation report, there's an indication that Beijing Tong Ren Tang Chinese Medicine's share price might be on the expensive side.

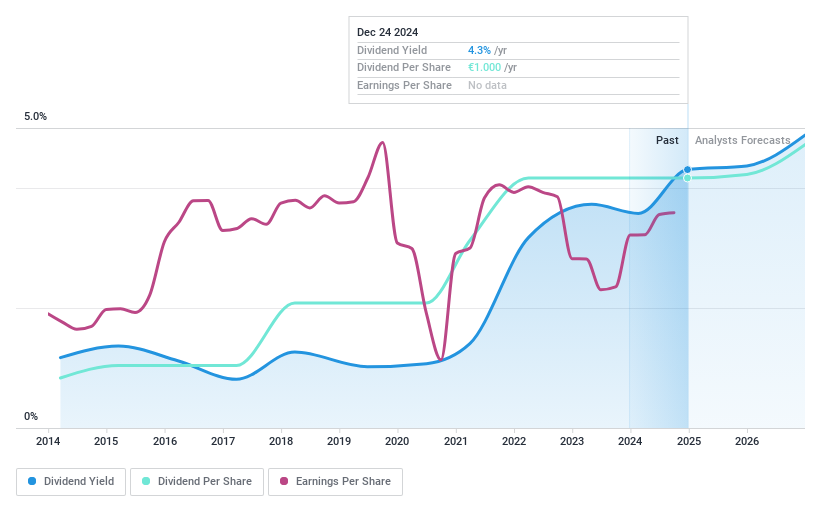

Cancom (XTRA:COK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Cancom SE, along with its subsidiaries, offers information technology services both in Germany and internationally, with a market cap of approximately €759.52 million.

Operations: Cancom SE generates revenue from its Wholesale - Computer Peripherals segment, totaling €1.74 billion.

Dividend Yield: 4.1%

Cancom's dividend reliability is underscored by stable and growing payments over the past decade, despite a high payout ratio of 100.8% indicating limited earnings coverage. However, the cash payout ratio of 18.5% suggests dividends are well covered by cash flows. The recent announcement confirmed an annual dividend of €1 per share for June 2025, amidst revenue growth to €1.75 billion in 2024, though net income slightly declined to €33.45 million from the previous year.

- Click here to discover the nuances of Cancom with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Cancom's current price could be quite moderate.

Summing It All Up

- Click through to start exploring the rest of the 1637 Top Global Dividend Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:COK

Cancom

Provides information technology services in Germany and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives