Assessing FWD Group Holdings (SEHK:1828) Valuation After Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

If you have been watching FWD Group Holdings (SEHK:1828) lately, you might have noticed some interesting movement in its share price. Without a particular news event driving the change, the recent uptick in the stock could be catching the attention of both long-term holders and new investors. Sometimes, these shifts invite us to step back and ask whether the market is sensing something ahead or simply re-rating the company’s outlook compared to peers.

Over the past month, FWD Group Holdings has climbed by 26% after a steadier pace earlier this year, suggesting renewed momentum behind the stock. The year-to-date gain stands at 25%, painting a picture of a company moving out of a quieter stretch. While there has not been a headline event to explain the shift, the surge itself may be raising questions about changing risk sentiment or expectations for the company’s growth, especially following its recent annual revenue increase of 23%.

With this kind of price action, the key question is whether there is still upside ahead or if the market has already factored in future growth potential. Could there be value left on the table?

Price-to-Earnings of 85.6x: Is it justified?

FWD Group Holdings is currently trading at a Price-to-Earnings (P/E) ratio of 85.6 times, which positions it significantly above both the Asian insurance industry average of 11.4x and the peer average of 12.5x. This suggests that the market is placing a considerable premium on its shares compared to other companies in its sector.

The P/E ratio indicates how much investors are willing to pay for each dollar of the company’s earnings. A higher P/E can signal expectations of strong future growth or the presence of unique qualities that set the company apart from its peers. In the case of FWD Group Holdings, this elevated multiple could reflect confidence in its revenue expansion, its newly achieved profitability, or positive sentiment regarding its future prospects. However, it also points to a risk that the share price may be running ahead of fundamentals if growth does not materialize as strongly as anticipated.

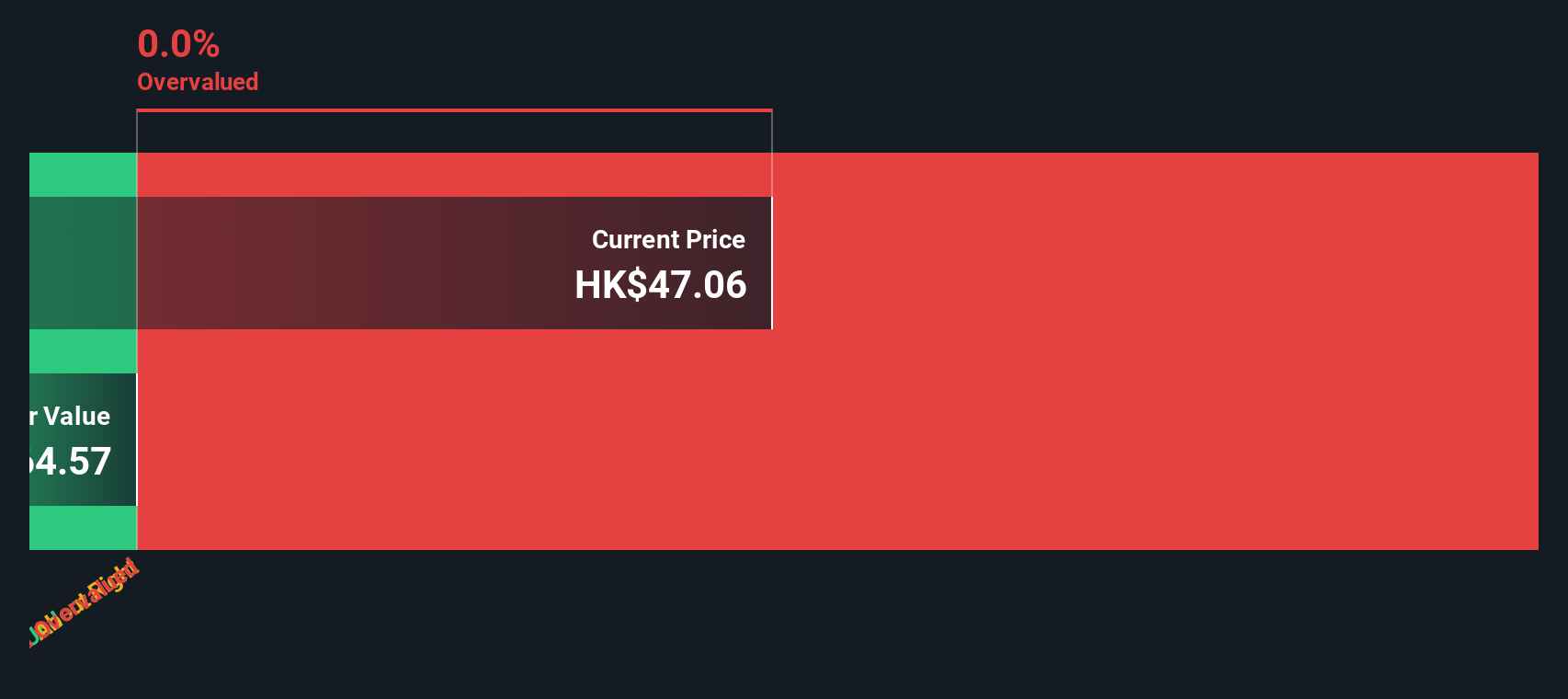

Result: Fair Value of $47.05 (OVERVALUED)

See our latest analysis for FWD Group Holdings.However, factors such as slowing revenue growth or changes in market risk appetite could quickly challenge the outlook and lead to greater price volatility.

Find out about the key risks to this FWD Group Holdings narrative.Another View: Looking Beyond the Surface

While the current valuation paints FWD Group Holdings as expensive compared to the industry, a glance at our DCF model tells a similar story. It also comes up with an overvalued result, reinforcing questions about what is driving investor optimism. Could the future prove these signals wrong, or is the risk already flashing in the numbers?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own FWD Group Holdings Narrative

If you see things differently or want to dig into the numbers yourself, you have the tools to make your own assessment in just a few minutes, so why not Do it your way?

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding FWD Group Holdings.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Use Simply Wall Street’s powerful screener to uncover companies with strong growth potential, attractive value, or innovation at their core. Find the stocks that suit your goals and stay ahead of the crowd.

- Tap into next-generation technology by tracking companies at the forefront of quantum breakthroughs through our quantum computing stocks.

- Unlock value plays with robust fundamentals and see which stocks could be trading below their true worth with our undervalued stocks based on cash flows.

- Spot the future of healthcare transformation with AI-driven medical innovators using our healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1828

FWD Group Holdings

Through its subsidiaries, underwrites insurance products in Hong Kong and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives