Even With A 25% Surge, Cautious Investors Are Not Rewarding China Reinsurance (Group) Corporation's (HKG:1508) Performance Completely

Despite an already strong run, China Reinsurance (Group) Corporation (HKG:1508) shares have been powering on, with a gain of 25% in the last thirty days. The annual gain comes to 122% following the latest surge, making investors sit up and take notice.

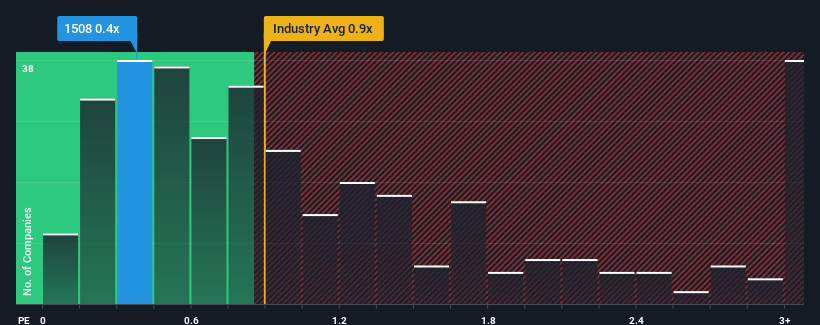

Even after such a large jump in price, you could still be forgiven for feeling indifferent about China Reinsurance (Group)'s P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Insurance industry in Hong Kong is also close to 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for China Reinsurance (Group)

How Has China Reinsurance (Group) Performed Recently?

With revenue growth that's inferior to most other companies of late, China Reinsurance (Group) has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on China Reinsurance (Group).Is There Some Revenue Growth Forecasted For China Reinsurance (Group)?

In order to justify its P/S ratio, China Reinsurance (Group) would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 15% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 32% drop in revenue in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 26% during the coming year according to the three analysts following the company. Meanwhile, the broader industry is forecast to contract by 3.6%, which would indicate the company is doing very well.

In light of this, it's peculiar that China Reinsurance (Group)'s P/S sits in-line with the majority of other companies. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

What We Can Learn From China Reinsurance (Group)'s P/S?

China Reinsurance (Group) appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that China Reinsurance (Group) currently trades on a lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You need to take note of risks, for example - China Reinsurance (Group) has 3 warning signs (and 2 which are a bit unpleasant) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1508

China Reinsurance (Group)

Operates as a reinsurance company in the People's Republic of China and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives