China Reinsurance (SEHK:1508) Earnings Growth Beats 5-Year Trend But Guidance Trails Market Narrative

Reviewed by Simply Wall St

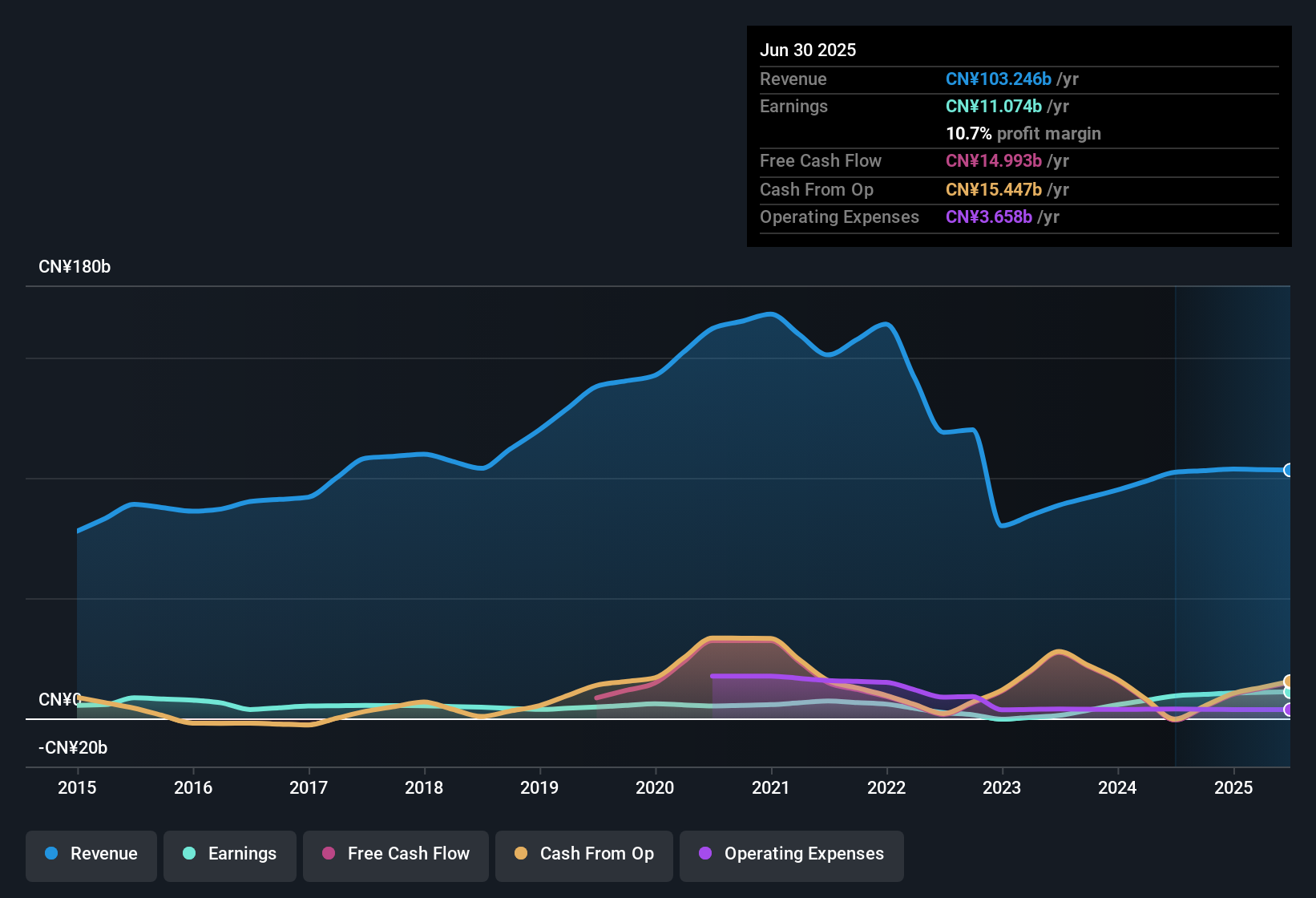

China Reinsurance (Group) (SEHK:1508) reported earnings growth of 18.2% over the past year, outpacing its five-year average of 16.3% per year. Looking ahead, the company forecasts annual earnings growth of 5.3% and revenue growth of 6.4%. Both figures are set to trail the Hong Kong market averages, which stand at 12.5% for earnings and 8.6% for revenue.

See our full analysis for China Reinsurance (Group).The next section examines how these headline results compare with broader market narratives, highlighting areas where consensus is reinforced and where the latest numbers may challenge expectations.

See what the community is saying about China Reinsurance (Group)

Profit Margins Hold Steady Amid Modest Growth Outlook

- Profit margins are projected to rise slightly from 10.2% to 10.3% over the next three years, even as annual revenue growth is forecast at just 3.4%, which is below sector averages.

- Analysts' consensus view points to digital transformation and new product innovations such as climate change and EV insurance as supporting margin resilience and potential operational efficiencies.

- The consensus sees further efficiency gains as China Reinsurance leans on technology and global expansion to offset slower revenue growth.

- Innovation in insurance products, especially in response to emerging risks, is singled out as a catalyst for bolstering margins where topline growth is muted.

Analysts see these margin trends as reinforcing the balanced outlook, where operational improvements could preserve profitability even if revenue lags the wider market. 📈 Read the full China Reinsurance (Group) Consensus Narrative. 📊 Read the full China Reinsurance (Group) Consensus Narrative.

Investment Returns Pressured by Falling Interest Rates

- The declining domestic interest rate environment in China puts pressure on China Reinsurance's ability to deliver attractive investment returns, directly affecting net margins and long-term earnings potential.

- Analysts' consensus view flags that, despite strategic investments in high-dividend sectors like technology and AI, there is increased strain on overall returns as investment yields fall.

- Lower interest rates may diminish the upside from China Reinsurance's traditionally stable investment portfolio, making emerging sector bets more critical for growth.

- While the company is focused on value-based, stable investments, the competitive reinsurance landscape may require further diversification to defend profitability in this environment.

Shares Trade at Deep Discount Versus Peers and Fair Value

- China Reinsurance is priced at a 5.1x P/E ratio, which is less than half the Asian insurance industry average of 11.6x and less than one-sixth the peer group average of 30.3x. The current share price (HK$1.45) also sits below both the DCF fair value of HK$1.57 and the analyst consensus price target of HK$1.69.

- Analysts' consensus view highlights that this valuation gap could attract value-oriented investors, with the caveat that the modest earnings growth outlook is the main counterbalance.

- The consensus contends the steep discount is justified only if low growth persists, but any upside surprise in profitability or global expansion could catalyze a rerating.

- With few major risks flagged, barring some uncertainty over dividend sustainability, the undervaluation appears driven largely by tempered growth rather than acute structural concerns.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for China Reinsurance (Group) on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.Have your own take on these results? Shape your analysis in under three minutes and bring your perspective to life. Do it your way

A great starting point for your China Reinsurance (Group) research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While China Reinsurance's modest revenue growth and pressured investment returns suggest challenges in sustaining performance, the outlook lags behind sector leaders with stronger momentum.

If you want to focus on companies delivering consistent earnings and revenue expansion, use our stable growth stocks screener to discover steady performers built to shine in any market climate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1508

China Reinsurance (Group)

Operates as a reinsurance company in the People's Republic of China and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives