As global markets navigate a landscape marked by cautious monetary policies and fluctuating economic indicators, Asian equities have shown resilience, with some regions experiencing gains despite broader uncertainties. In this climate, dividend stocks in Asia stand out as attractive options for investors seeking stable returns; these stocks often provide a buffer against volatility while offering the potential for regular income streams.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.22% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.72% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.22% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 3.83% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 3.90% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| Daicel (TSE:4202) | 4.45% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.59% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.40% | ★★★★★★ |

Click here to see the full list of 1049 stocks from our Top Asian Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

China Reinsurance (Group) (SEHK:1508)

Simply Wall St Dividend Rating: ★★★★☆☆

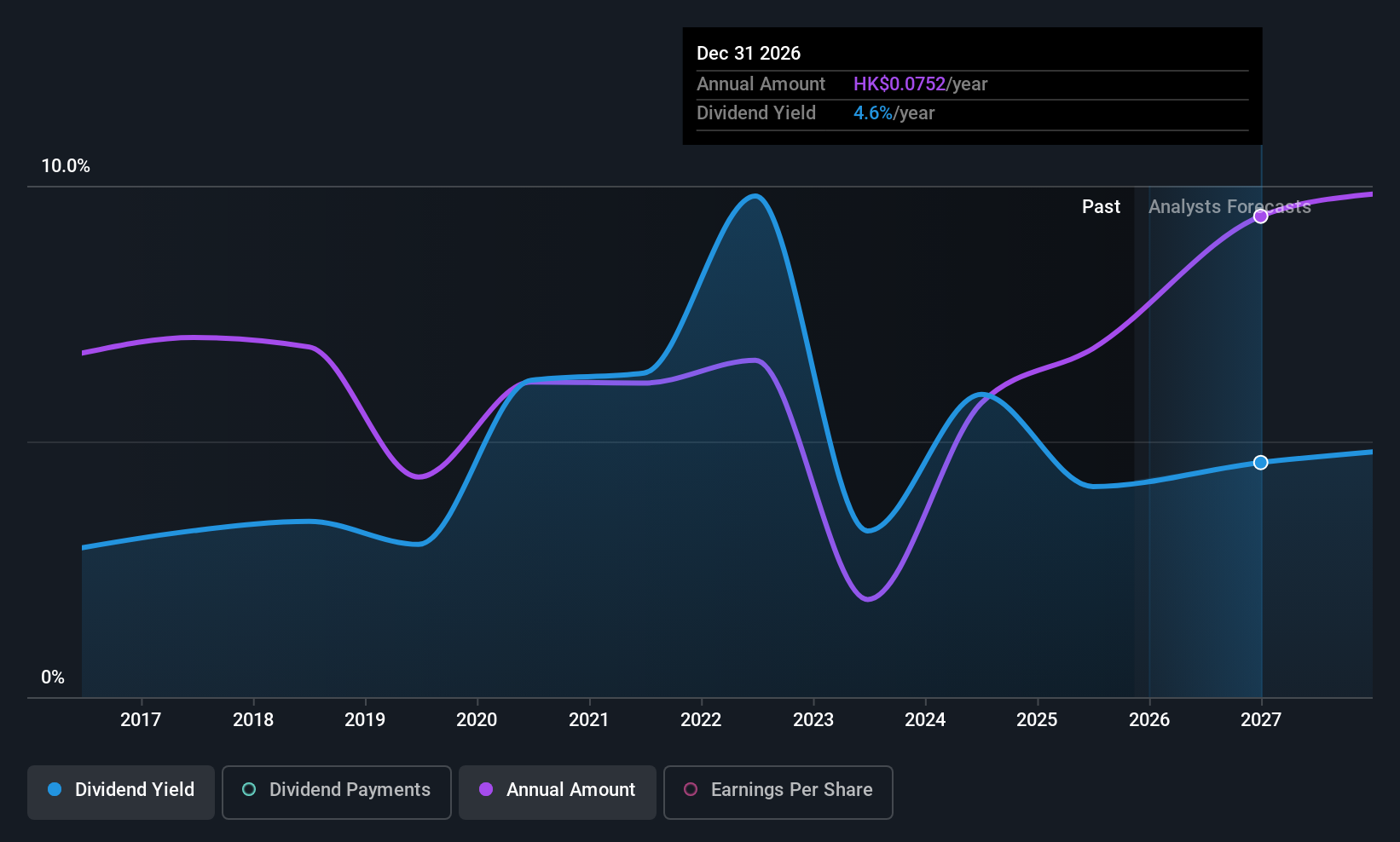

Overview: China Reinsurance (Group) Corporation, along with its subsidiaries, operates as a reinsurance company both within the People's Republic of China and internationally, with a market cap of HK$65.84 billion.

Operations: China Reinsurance (Group) Corporation generates its revenue through various reinsurance operations both domestically and internationally.

Dividend Yield: 3.5%

China Reinsurance (Group) offers a mixed picture for dividend investors. While its dividends are well-covered by earnings and cash flows, with a low payout ratio of 19.2% and cash payout ratio of 14.2%, the dividend yield is relatively low at 3.53% compared to top payers in Hong Kong. Recent earnings growth, with net income rising to CNY 6.24 billion, suggests potential stability; however, past dividend payments have been volatile and unreliable over the last decade.

- Dive into the specifics of China Reinsurance (Group) here with our thorough dividend report.

- Our valuation report unveils the possibility China Reinsurance (Group)'s shares may be trading at a discount.

Yunnan Yuntianhua (SHSE:600096)

Simply Wall St Dividend Rating: ★★★★☆☆

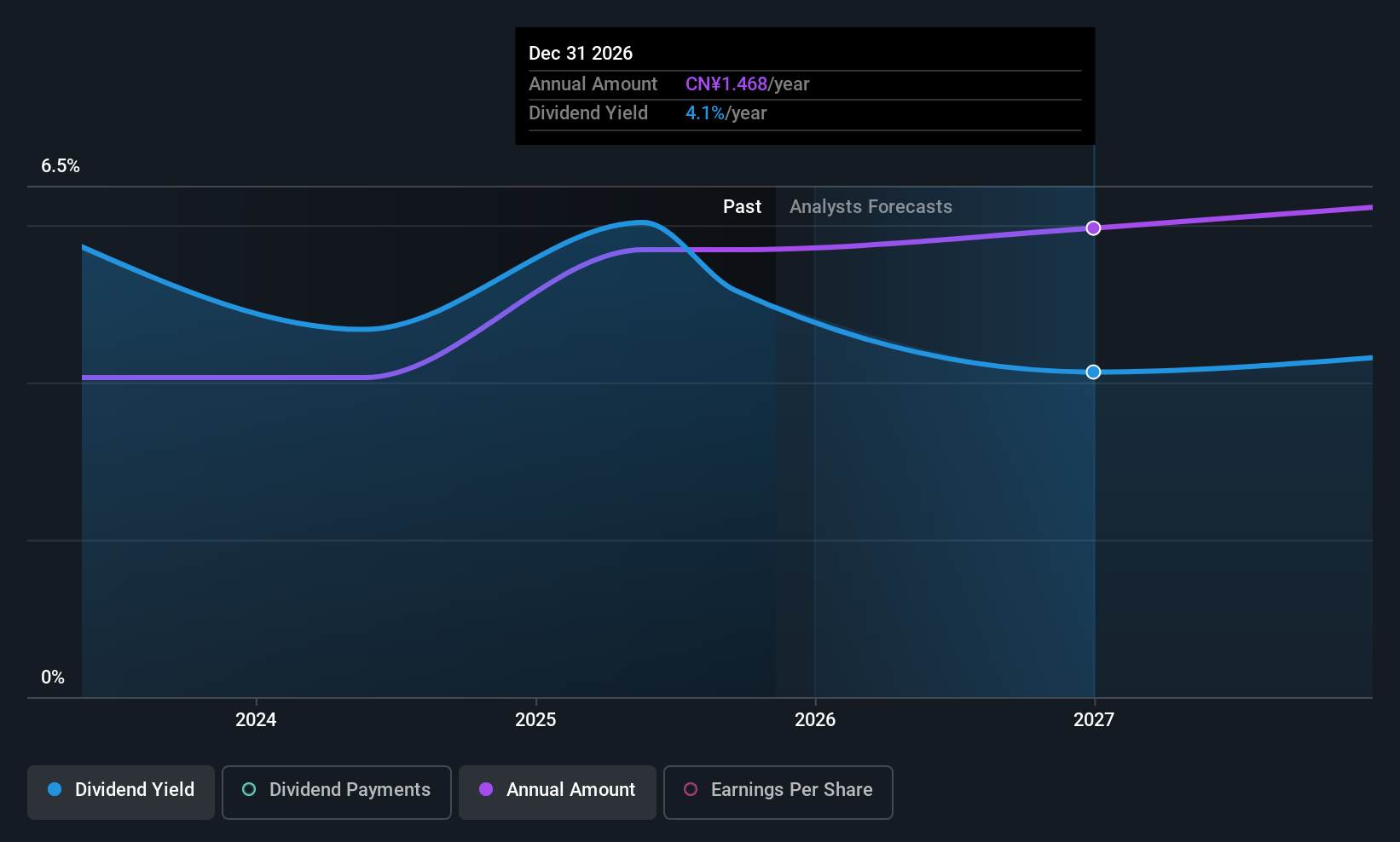

Overview: Yunnan Yuntianhua Co., Ltd. is a Chinese company that manufactures and sells phosphate and nitrogen fertilizers as well as formaldehyde copolymers, with a market capitalization of CN¥48.86 billion.

Operations: Yunnan Yuntianhua Co., Ltd.'s revenue is primarily derived from its Fertilizer Related Industry (Excl. Phosphorus Chemical Industry) at CN¥25.31 billion, followed by the Commercial Logistics Industry at CN¥20.17 billion, Phosphorus Chemical Industry at CN¥2.93 billion, Engineering Materials at CN¥1.43 billion, New Energy Materials Industry at CN¥1.14 billion, and Phosphate Mining at CN¥657 million.

Dividend Yield: 5.2%

Yunnan Yuntianhua's dividend yield of 5.22% places it among the top quartile of Chinese dividend payers, supported by a sustainable payout ratio of 55.9% and a cash payout ratio of 31.8%. Despite only two years of consistent dividend payments, they have shown growth with minimal volatility. Recent earnings reveal net income at CNY 2.76 billion for H1 2025, slightly down from last year, but dividends remain well-covered by both earnings and cash flows.

- Click to explore a detailed breakdown of our findings in Yunnan Yuntianhua's dividend report.

- In light of our recent valuation report, it seems possible that Yunnan Yuntianhua is trading behind its estimated value.

ShenZhen YUTO Packaging Technology (SZSE:002831)

Simply Wall St Dividend Rating: ★★★★☆☆

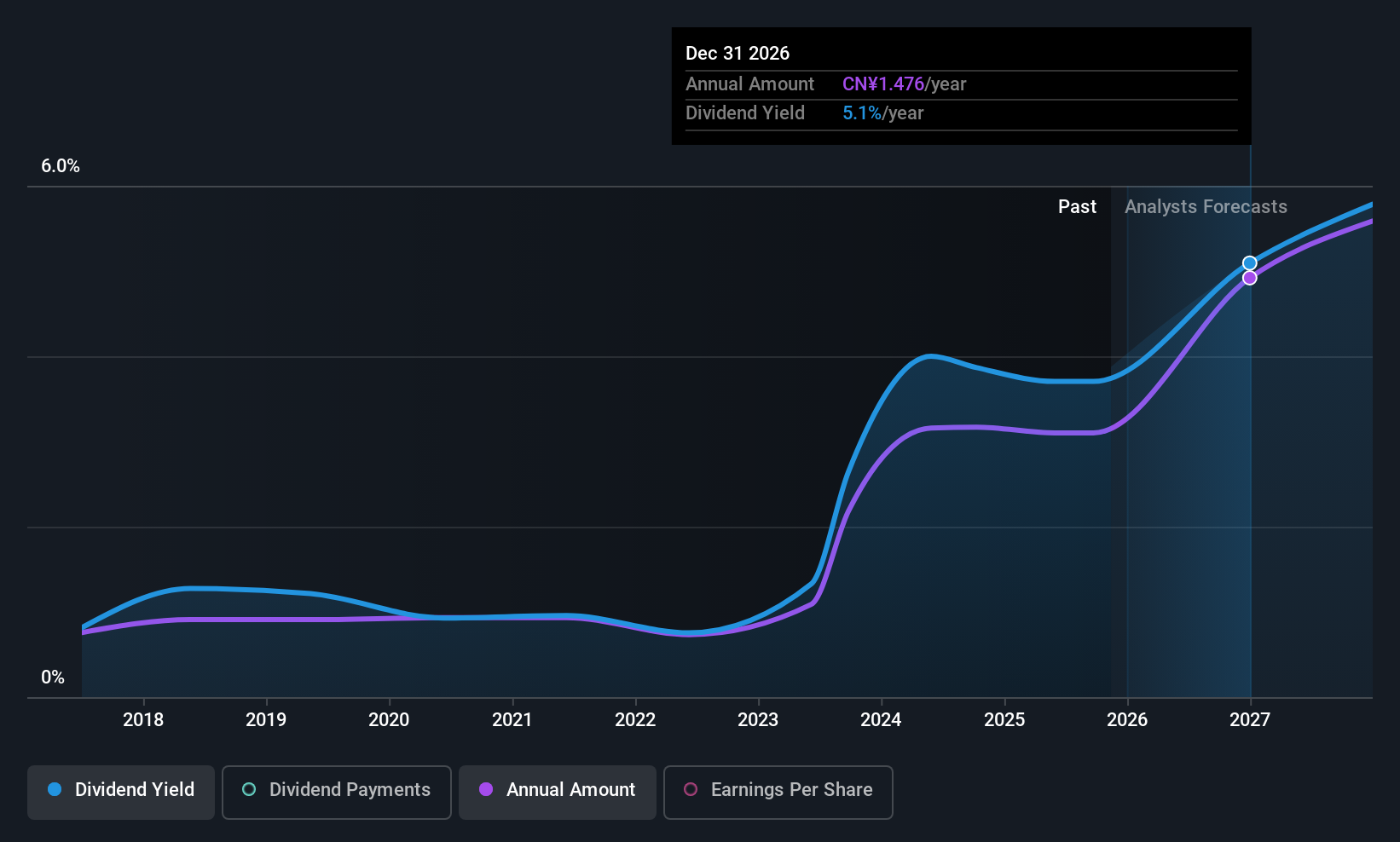

Overview: ShenZhen YUTO Packaging Technology Co., Ltd. operates in the packaging industry, focusing on providing comprehensive packaging solutions, with a market cap of approximately CN¥24.76 billion.

Operations: ShenZhen YUTO Packaging Technology Co., Ltd. generates revenue primarily from its Paper Packaging segment, amounting to CN¥16.38 billion.

Dividend Yield: 3.4%

ShenZhen YUTO Packaging Technology's dividend yield of 3.4% ranks it in the top 25% of Chinese dividend payers, with a payout ratio of 63.9% and a cash payout ratio of 65.3%, indicating dividends are well-covered by earnings and cash flows. Despite an unstable eight-year dividend history marked by volatility, recent approvals for increased interim dividends suggest potential growth, supported by improved earnings for H1 2025 with net income rising to CNY 553.84 million.

- Navigate through the intricacies of ShenZhen YUTO Packaging Technology with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, ShenZhen YUTO Packaging Technology's share price might be too pessimistic.

Next Steps

- Click here to access our complete index of 1049 Top Asian Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1508

China Reinsurance (Group)

Operates as a reinsurance company in the People's Republic of China and internationally.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives