Revenues Not Telling The Story For AIA Group Limited (HKG:1299)

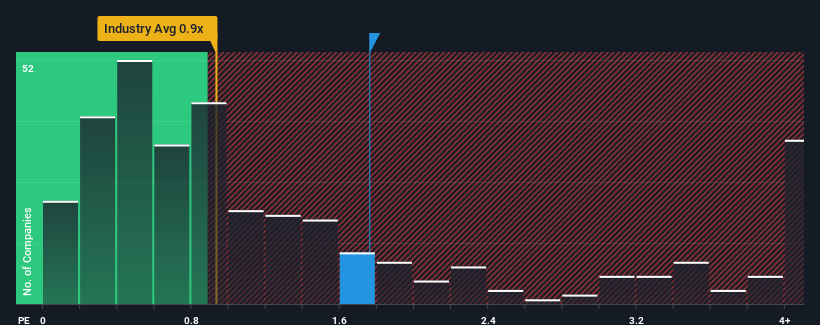

When close to half the companies in the Insurance industry in Hong Kong have price-to-sales ratios (or "P/S") below 0.4x, you may consider AIA Group Limited (HKG:1299) as a stock to potentially avoid with its 1.8x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for AIA Group

How Has AIA Group Performed Recently?

AIA Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think AIA Group's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

AIA Group's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The latest three year period has also seen a 29% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth, although potentially wondering why there's so much variation in revenue growth.

Shifting to the future, estimates from the analysts covering the company are not good at all, suggesting revenue should decline by 7.6% per annum over the next three years. Meanwhile, the broader industry is forecast to moderate by 1.4% per year, which indicates the company should perform poorly indeed.

With this information, it's strange that AIA Group is trading at a higher P/S in comparison. When revenue shrink rapidly often the P/S premium shrinks too, which could set up shareholders for future disappointment. Maintaining these prices will be extremely difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at AIA Group's analyst forecasts determined that its even shakier outlook against the industry isn't impacting its high P/S anywhere near as much as we would have predicted. Revenue outlooks like this don't typically support a company trading at such an elevated P/S, and if it did, it doesn't usually do it for long. We're also cautious about the company's ability to resist even greater pain to its business from the broader industry turmoil. Unless there's a material improvement in the forecast revenue growth for the company, it's hard to justify the share price at current levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for AIA Group that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade AIA Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1299

Established dividend payer with proven track record.

Market Insights

Community Narratives