Insider Action Backs These 3 Undervalued Small Caps In Hong Kong

Reviewed by Simply Wall St

As global markets experience shifts with central banks in Europe cutting rates and U.S. small-cap indices like the Russell 2000 outperforming, attention turns to Hong Kong's market dynamics where the Hang Seng Index has seen a decline. In this context, identifying promising small-cap stocks involves examining factors such as insider activity and valuation metrics, which can provide insights into potential opportunities amidst broader economic fluctuations.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ferretti | 11.2x | 0.7x | 45.72% | ★★★★★☆ |

| Edianyun | NA | 0.6x | 39.05% | ★★★★★☆ |

| Vesync | 7.2x | 1.1x | -3.69% | ★★★★☆☆ |

| Lion Rock Group | 5.4x | 0.4x | 49.92% | ★★★★☆☆ |

| Cheerwin Group | 11.2x | 1.4x | 47.07% | ★★★★☆☆ |

| Gemdale Properties and Investment | NA | 0.2x | 44.97% | ★★★★☆☆ |

| China Lesso Group Holdings | 5.8x | 0.4x | -502.68% | ★★★☆☆☆ |

| Skyworth Group | 5.6x | 0.1x | -296.42% | ★★★☆☆☆ |

| Lee & Man Paper Manufacturing | 7.1x | 0.4x | -45.15% | ★★★☆☆☆ |

| Emperor International Holdings | NA | 0.9x | 25.53% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

Vesync (SEHK:2148)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vesync is a company that specializes in the development and sale of appliances and tools, with a market capitalization of approximately HK$2.36 billion.

Operations: The company generates revenue primarily from the Appliance & Tool segment, with recent figures reaching $604.75 million. Its gross profit margin has shown an upward trend, recently recorded at 48.46%. Operating expenses are significant, with sales and marketing being a major component.

PE: 7.2x

Vesync, a company recently added to the S&P Global BMI Index, showcases potential for growth with its diverse market reach and innovative products. The company's sales for the first half of 2024 reached US$296 million, up from US$277 million in 2023. Insider confidence is evident as Zhaojun Chen purchased 200,000 shares valued at approximately HK$829K. Despite reliance on higher-risk external borrowing for funding, Vesync's strategic focus on non-Amazon channels and operational efficiency improvements bolster its prospects.

- Click here to discover the nuances of Vesync with our detailed analytical valuation report.

Gain insights into Vesync's historical performance by reviewing our past performance report.

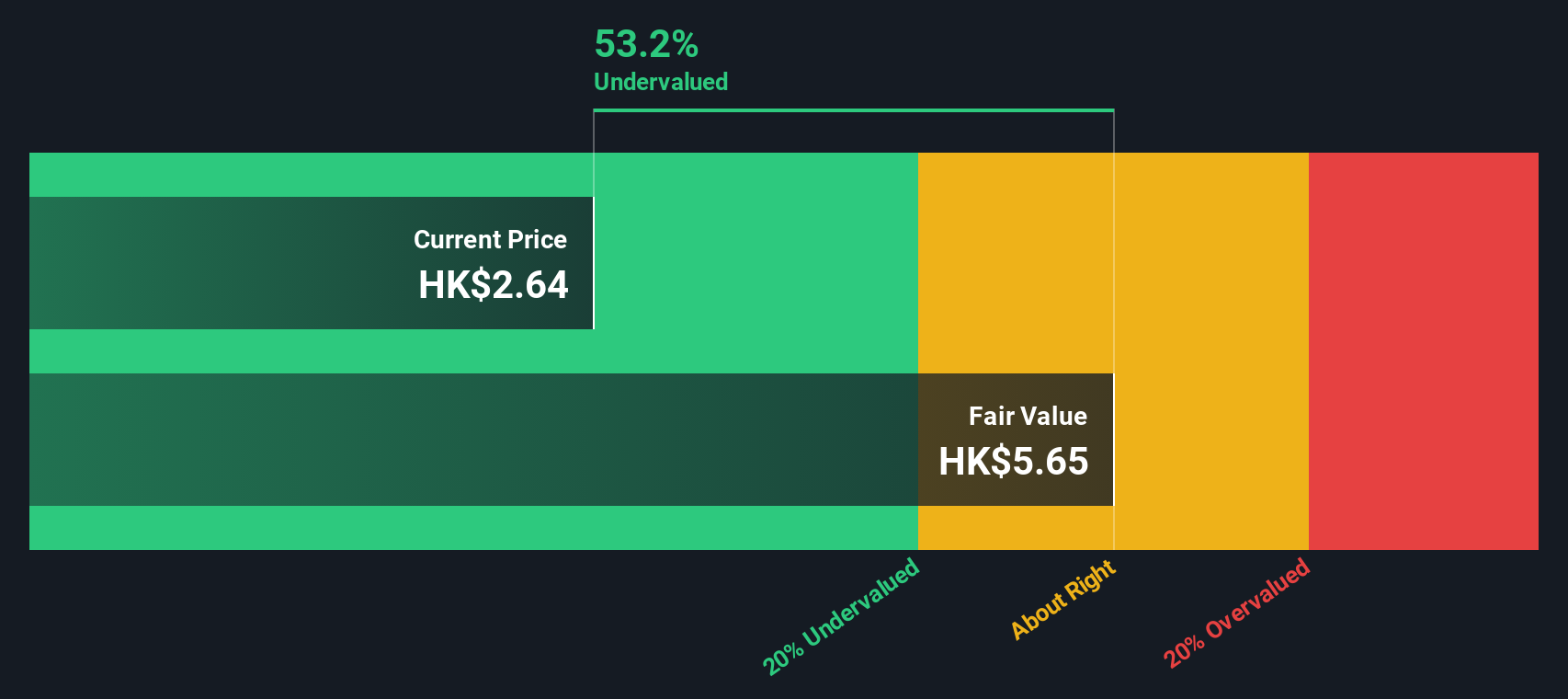

Cheerwin Group (SEHK:6601)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cheerwin Group is a company engaged in the production and distribution of household care, personal care, and pet products, with a focus on consumer goods.

Operations: The company generates revenue primarily from Household Care, with significant contributions from Pets and Pet Products. Over recent periods, the gross profit margin has shown an upward trend, reaching 47.89% as of October 2024. Operating expenses are largely driven by Sales & Marketing and General & Administrative costs.

PE: 11.2x

Cheerwin Group, a smaller player in Hong Kong's market, has shown positive financial momentum with sales rising to CNY 1.25 billion and net income reaching CNY 179 million for the first half of 2024. Insider confidence is evident as Danxia Chen recently purchased 300,000 shares valued at approximately HK$405,059. The company announced an interim dividend of RMB 0.0538 per share, reflecting its commitment to shareholder returns despite relying solely on external borrowing for funding.

- Click here and access our complete valuation analysis report to understand the dynamics of Cheerwin Group.

Review our historical performance report to gain insights into Cheerwin Group's's past performance.

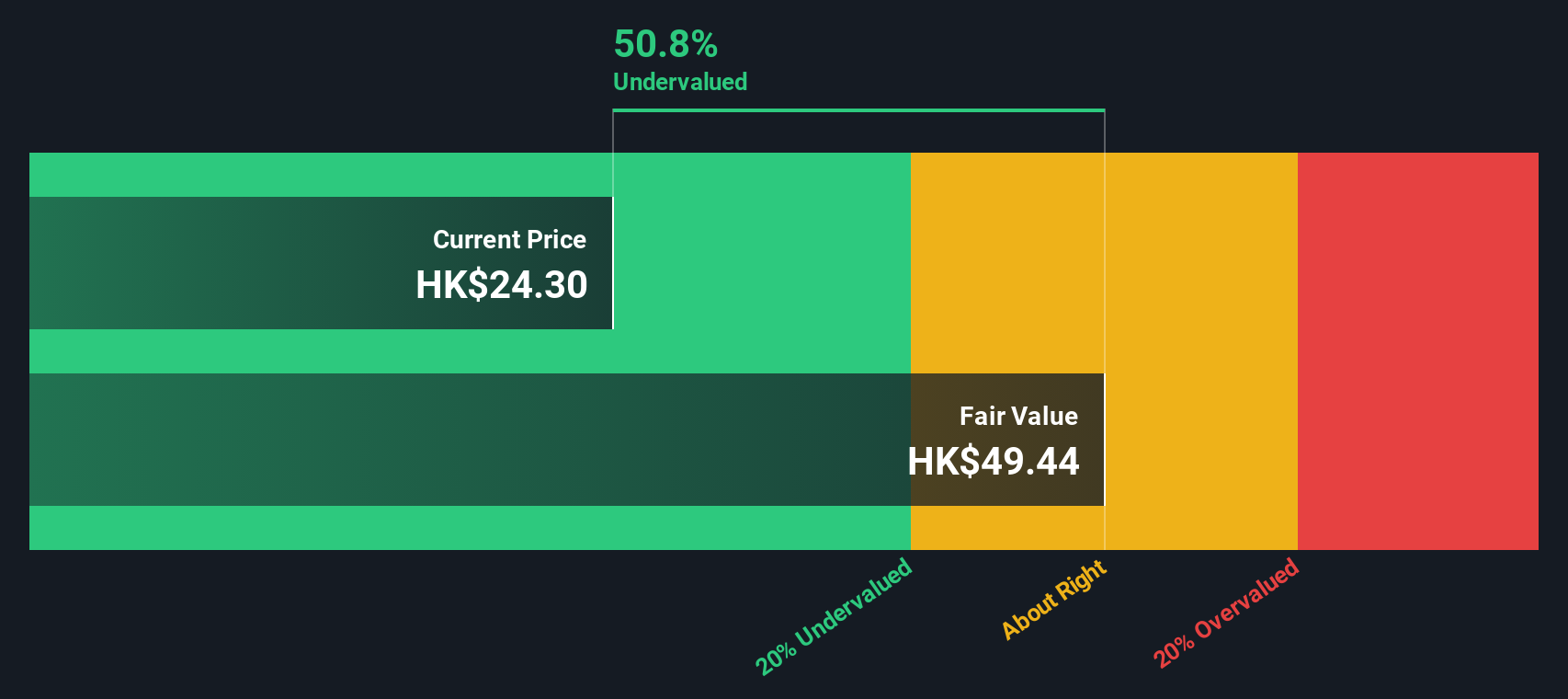

Ferretti (SEHK:9638)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ferretti is involved in the design, construction, and marketing of yachts and recreational boats with a market cap of approximately HK$12.34 billion.

Operations: The primary revenue stream is from the design, construction, and marketing of yachts and recreational boats. The cost of goods sold (COGS) for this segment is €828.93 million, leading to a gross profit margin of 36.04%. Operating expenses amount to €360.28 million, impacting the net income margin which stands at 6.67%.

PE: 11.2x

Ferretti, a yacht manufacturer in Hong Kong's smaller stock segment, has seen dynamic shifts recently. Despite being dropped from the S&P Global BMI Index on September 10, 2024, the company reported increased sales of €695.1 million for H1 2024 compared to €628.18 million the previous year. Earnings per share rose slightly to €0.13 from €0.12, indicating steady financial performance amidst executive changes and reliance on external borrowing for funding needs. Notably, insider confidence remains high with recent share purchases signaling potential growth prospects despite market challenges.

- Dive into the specifics of Ferretti here with our thorough valuation report.

Assess Ferretti's past performance with our detailed historical performance reports.

Where To Now?

- Click here to access our complete index of 10 Undervalued SEHK Small Caps With Insider Buying.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9638

Ferretti

Designs, constructs, markets, and sells yachts and vessels under the Riva, Wally, Ferretti Yachts, Pershing, Itama, Easy Boat, CRN, and Custom Line brand names.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives