Ming Fai International Holdings And 2 Other Promising Penny Stocks To Consider

Reviewed by Simply Wall St

Global markets have recently experienced a rally, driven by optimism surrounding potential economic growth and tax reforms following significant political changes in the U.S. As investors navigate these evolving conditions, attention is turning towards lesser-known opportunities that may offer unique advantages. Penny stocks, often representing smaller or newer companies, continue to be a relevant investment area due to their affordability and potential for growth when supported by strong financials.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.22 | MYR343.4M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.785 | MYR135.97M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.87 | HK$545.92M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.475 | MYR2.36B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.865 | MYR287.13M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.25 | £847.72M | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.6075 | A$71.21M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB2.04 | THB1.67B | ★★★★★★ |

Click here to see the full list of 5,755 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Ming Fai International Holdings (SEHK:3828)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ming Fai International Holdings Limited is an investment holding company involved in the manufacture and trading of hospitality supplies and operating supplies and equipment across various international markets, with a market cap of HK$594.75 million.

Operations: The company's revenue is primarily derived from its Hospitality Supplies Business, with HK$549.02 million from The People's Republic of China, HK$379.50 million from Other Asia Pacific Regions, HK$305.16 million from North America, HK$267.19 million from Europe, and additional contributions from Australia and Hong Kong; alongside this, the Health Care and Hygienic Products Business generates significant revenue in North America at HK$145.35 million and smaller amounts in other regions; while the Operating Supplies and Equipment (OS&E) Business contributes notably within The PRC at HK$154.24 million.

Market Cap: HK$594.75M

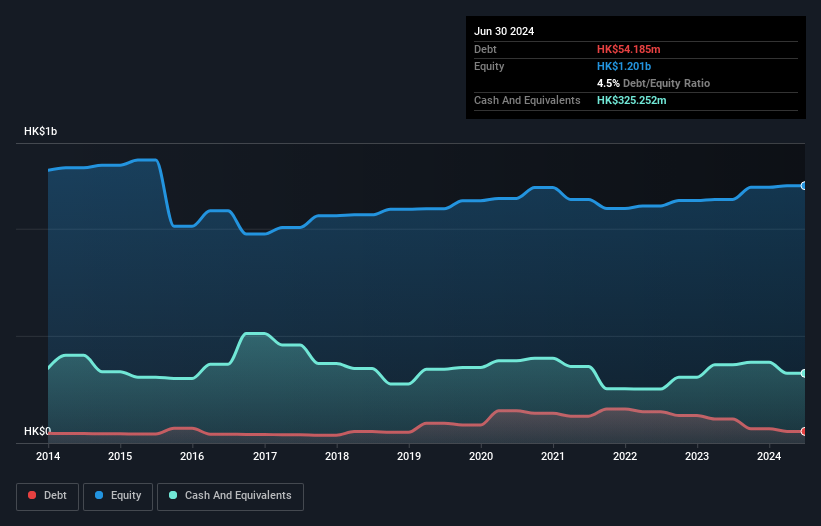

Ming Fai International Holdings has shown a solid financial position with short-term assets of HK$1.3 billion exceeding both its short and long-term liabilities, indicating strong liquidity. The company reported earnings growth of 38.4% over the past year, outpacing its five-year average growth rate of 1.3%. Despite a low return on equity at 9.6%, Ming Fai's debt is well-managed with more cash than total debt and interest payments comfortably covered by profits. Recent earnings results showed an increase in net income to HK$53.27 million, supporting the interim dividend announcement of HKD 0.03 per share for shareholders.

- Dive into the specifics of Ming Fai International Holdings here with our thorough balance sheet health report.

- Gain insights into Ming Fai International Holdings' past trends and performance with our report on the company's historical track record.

Communication & System Solution (SET:CSS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Communication & System Solution Public Company Limited, along with its subsidiaries, operates in Thailand by distributing and installing passive fire protection materials and equipment for buildings and factories, with a market cap of THB1.14 billion.

Operations: There are no reported revenue segments for Communication & System Solution Public Company Limited.

Market Cap: THB1.14B

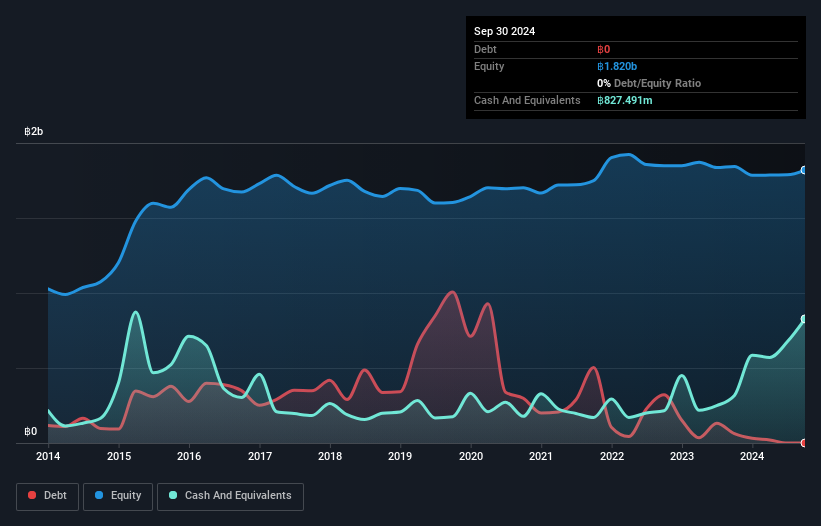

Communication & System Solution Public Company Limited has demonstrated financial stability with no debt and short-term assets of THB 2.5 billion exceeding both its short and long-term liabilities, ensuring liquidity. The management team is experienced, averaging 11.8 years in tenure, which supports operational continuity. Despite a recent improvement in net income to THB 61.78 million for Q3 2024, the company's earnings have declined by an average of 11.4% annually over five years, with current net profit margins at a lower rate than last year (1.4% vs 1.8%). The stock trades significantly below estimated fair value but exhibits stable volatility levels.

- Unlock comprehensive insights into our analysis of Communication & System Solution stock in this financial health report.

- Explore historical data to track Communication & System Solution's performance over time in our past results report.

Valuetronics Holdings (SGX:BN2)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Valuetronics Holdings Limited is an investment holding company that offers integrated electronics manufacturing services (EMS), with a market capitalization of SGD260.26 million.

Operations: The company's revenue is derived from Consumer Electronics, contributing HK$417.9 million, and Industrial and Commercial Electronics, which accounts for HK$1.25 billion.

Market Cap: SGD260.26M

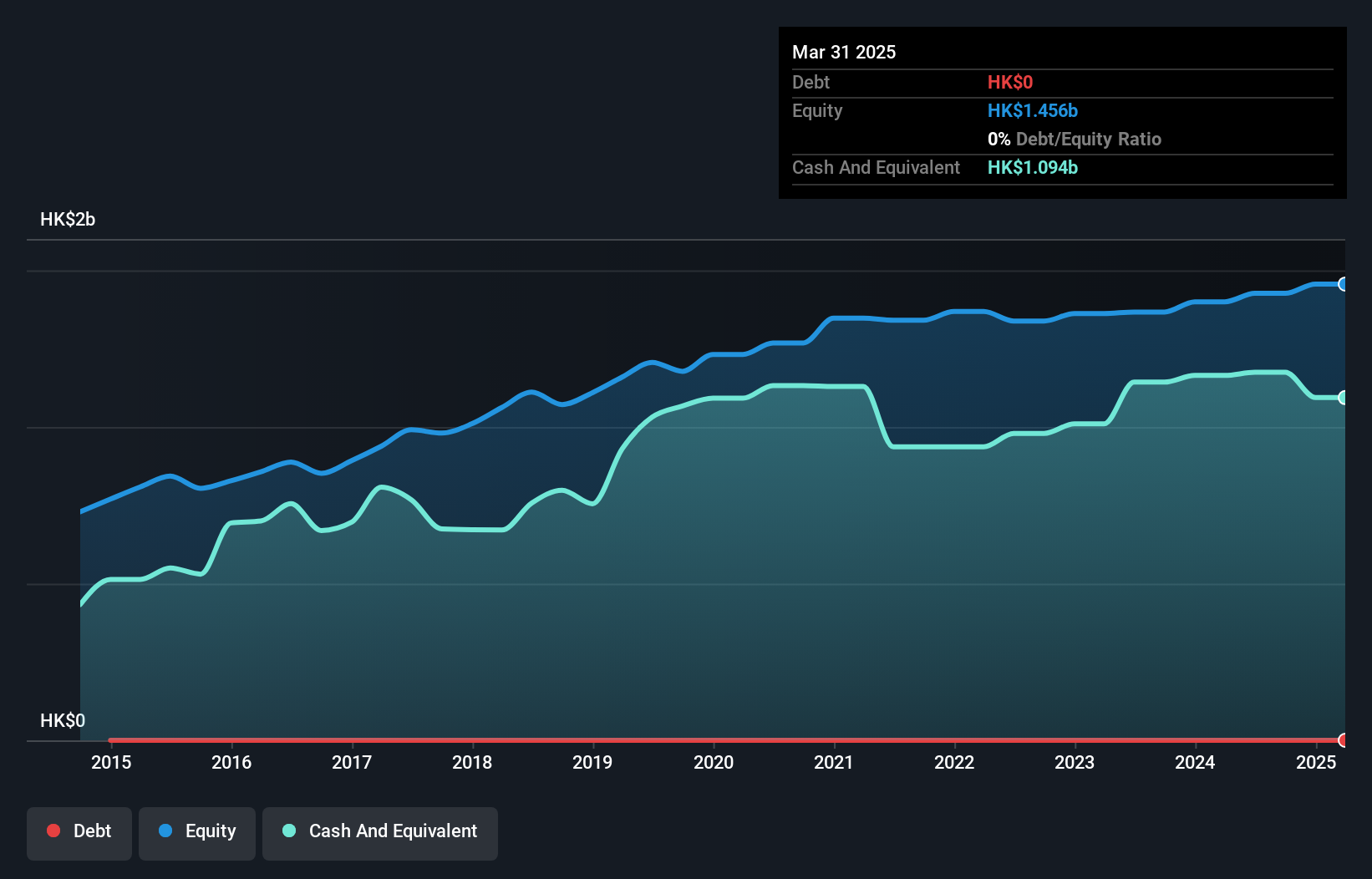

Valuetronics Holdings Limited, with a market cap of S$260.26 million, has shown resilience despite challenges in the electronics manufacturing sector. Recent earnings for the half-year ended September 2024 revealed sales of HK$862.13 million and net income growth to HK$90.53 million, indicating profitability improvements from last year. The company is debt-free and maintains strong liquidity, with short-term assets significantly exceeding liabilities. Strategic investments in AI computing infrastructure through its joint venture aim to capture emerging revenue streams in high-performance computing services, potentially enhancing future growth prospects despite an unstable dividend track record and low return on equity at 11.4%.

- Jump into the full analysis health report here for a deeper understanding of Valuetronics Holdings.

- Evaluate Valuetronics Holdings' prospects by accessing our earnings growth report.

Next Steps

- Take a closer look at our Penny Stocks list of 5,755 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Valuetronics Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:BN2

Valuetronics Holdings

An investment holding company, provides integrated electronics manufacturing services (EMS).

Flawless balance sheet average dividend payer.