Storytel Among 3 Companies Estimated To Be Trading Below Intrinsic Value

Reviewed by Simply Wall St

In recent weeks, global markets have experienced fluctuations driven by tariff uncertainties and mixed economic data, with U.S. stocks ending lower despite strong earnings reports from a majority of S&P 500 companies. As investors navigate these volatile conditions, identifying undervalued stocks trading below their intrinsic value can offer potential opportunities for those looking to capitalize on market inefficiencies and long-term growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$18.71 | US$37.36 | 49.9% |

| KG Mobilians (KOSDAQ:A046440) | ₩4445.00 | ₩8850.75 | 49.8% |

| Alarum Technologies (TASE:ALAR) | ₪3.356 | ₪6.68 | 49.7% |

| Celsius Holdings (NasdaqCM:CELH) | US$21.28 | US$42.43 | 49.8% |

| Aoshikang Technology (SZSE:002913) | CN¥29.12 | CN¥57.92 | 49.7% |

| S&U (LSE:SUS) | £16.25 | £32.33 | 49.7% |

| Similarweb (NYSE:SMWB) | US$11.87 | US$23.62 | 49.7% |

| Neosperience (BIT:NSP) | €0.53 | €1.06 | 49.9% |

| Medy-Tox (KOSDAQ:A086900) | ₩119200.00 | ₩235487.26 | 49.4% |

| Kyndryl Holdings (NYSE:KD) | US$41.15 | US$81.37 | 49.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Storytel (OM:STORY B)

Overview: Storytel AB (publ) offers streaming services for audiobooks and e-books, with a market cap of SEK7.16 billion.

Operations: The company's revenue segments include SEK859.34 million from books and a segment adjustment of SEK3.51 billion.

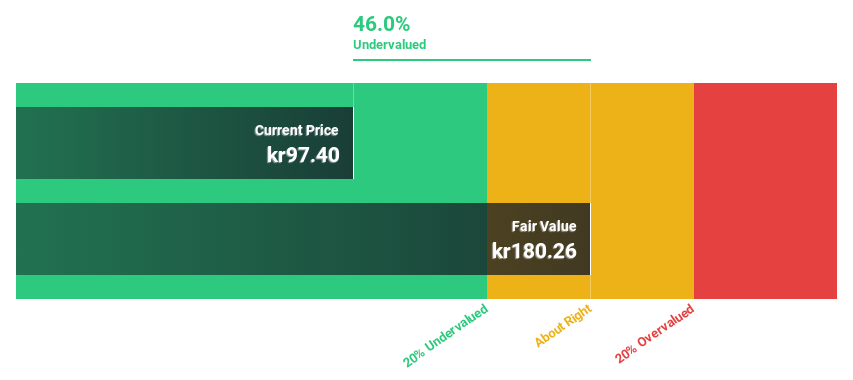

Estimated Discount To Fair Value: 47.4%

Storytel is trading at SEK92.75, significantly below its estimated fair value of SEK176.17, indicating potential undervaluation based on cash flows. The company is expected to achieve profitability within the next three years, with earnings forecasted to grow 80.72% annually, outpacing market averages. Recent collaboration with Vodafone Turkey expands Storytel's reach to over 20 million subscribers, potentially boosting revenue growth projected at 10% per year, well above the Swedish market rate of 1.1%.

- Upon reviewing our latest growth report, Storytel's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Storytel with our detailed financial health report.

Giant Biogene Holding (SEHK:2367)

Overview: Giant Biogene Holding Co., Ltd. is an investment holding company that focuses on the research, development, manufacture, and sale of bioactive material-based beauty and health products in China, with a market cap of HK$59.79 billion.

Operations: The company's revenue primarily comes from its biotechnology segment, which generated CN¥4.46 billion.

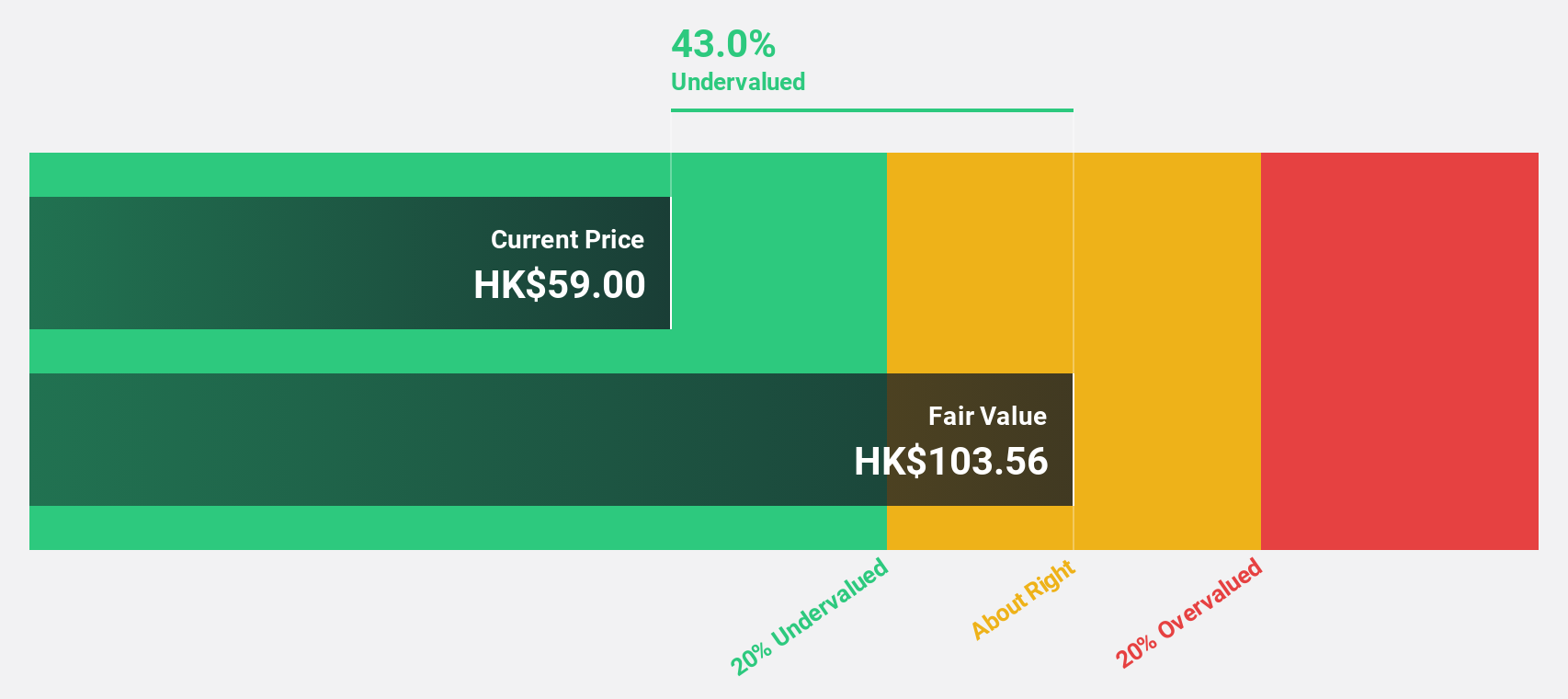

Estimated Discount To Fair Value: 40.6%

Giant Biogene Holding is trading at HK$58.8, significantly below its estimated fair value of HK$99.02, highlighting potential undervaluation based on cash flows. The company's earnings are forecast to grow 23.66% annually over the next three years, surpassing the Hong Kong market's growth rate of 11.5%. Additionally, Giant Biogene has demonstrated strong profitability with a 68.1% earnings increase last year and a high projected return on equity of 34.4%.

- Our growth report here indicates Giant Biogene Holding may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Giant Biogene Holding's balance sheet health report.

Bangkok Life Assurance (SET:BLA)

Overview: Bangkok Life Assurance Public Company Limited, with a market cap of THB33.13 billion, offers life insurance services to individuals and corporates in Thailand through its subsidiaries.

Operations: The company generates revenue of THB45.65 billion from its life insurance business segment.

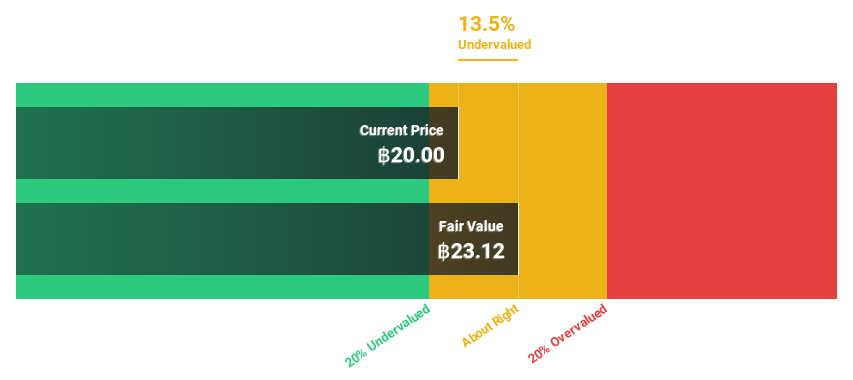

Estimated Discount To Fair Value: 16.1%

Bangkok Life Assurance is trading at THB19.4, slightly below its estimated fair value of THB23.12, suggesting potential undervaluation based on cash flows. The company's earnings are expected to grow significantly at 20.5% annually over the next three years, outpacing the Thai market's growth rate of 16.6%. Despite a lower projected return on equity of 8.7%, recent earnings have shown strong growth with a 22.6% increase last year.

- Our expertly prepared growth report on Bangkok Life Assurance implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of Bangkok Life Assurance here with our thorough financial health report.

Key Takeaways

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 916 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bangkok Life Assurance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SET:BLA

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion