- Hong Kong

- /

- Household Products

- /

- SEHK:2023

China Ludao Technology (HKG:2023) Shareholders Will Want The ROCE Trajectory To Continue

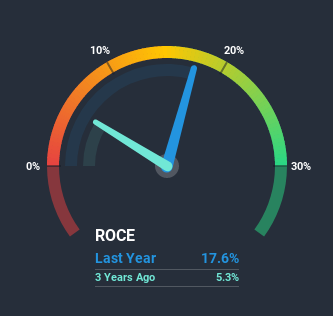

If you're not sure where to start when looking for the next multi-bagger, there are a few key trends you should keep an eye out for. Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Put simply, these types of businesses are compounding machines, meaning they are continually reinvesting their earnings at ever-higher rates of return. So on that note, China Ludao Technology (HKG:2023) looks quite promising in regards to its trends of return on capital.

Return On Capital Employed (ROCE): What is it?

For those who don't know, ROCE is a measure of a company's yearly pre-tax profit (its return), relative to the capital employed in the business. The formula for this calculation on China Ludao Technology is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.18 = CN¥62m ÷ (CN¥792m - CN¥436m) (Based on the trailing twelve months to June 2020).

Therefore, China Ludao Technology has an ROCE of 18%. In isolation, that's a pretty standard return but against the Household Products industry average of 47%, it's not as good.

See our latest analysis for China Ludao Technology

Historical performance is a great place to start when researching a stock so above you can see the gauge for China Ludao Technology's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of China Ludao Technology, check out these free graphs here.

What Does the ROCE Trend For China Ludao Technology Tell Us?

China Ludao Technology is showing promise given that its ROCE is trending up and to the right. The figures show that over the last five years, ROCE has grown 87% whilst employing roughly the same amount of capital. So it's likely that the business is now reaping the full benefits of its past investments, since the capital employed hasn't changed considerably. On that front, things are looking good so it's worth exploring what management has said about growth plans going forward.

For the record though, there was a noticeable increase in the company's current liabilities over the period, so we would attribute some of the ROCE growth to that. The current liabilities has increased to 55% of total assets, so the business is now more funded by the likes of its suppliers or short-term creditors. And with current liabilities at those levels, that's pretty high.

The Bottom Line

To sum it up, China Ludao Technology is collecting higher returns from the same amount of capital, and that's impressive. Given the stock has declined 38% in the last five years, this could be a good investment if the valuation and other metrics are also appealing. So researching this company further and determining whether or not these trends will continue seems justified.

One more thing to note, we've identified 2 warning signs with China Ludao Technology and understanding these should be part of your investment process.

While China Ludao Technology isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

If you decide to trade China Ludao Technology, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:2023

China Ludao Technology

An investment holding company, researches and develops, manufactures, and sells aerosol, chemical, and related products in Mainland China, the United States, Japan, Chile, and internationally.

Proven track record and fair value.

Market Insights

Community Narratives