- Hong Kong

- /

- Personal Products

- /

- SEHK:1044

We Think Hengan International Group (HKG:1044) Can Stay On Top Of Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Hengan International Group Company Limited (HKG:1044) does carry debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Hengan International Group

What Is Hengan International Group's Net Debt?

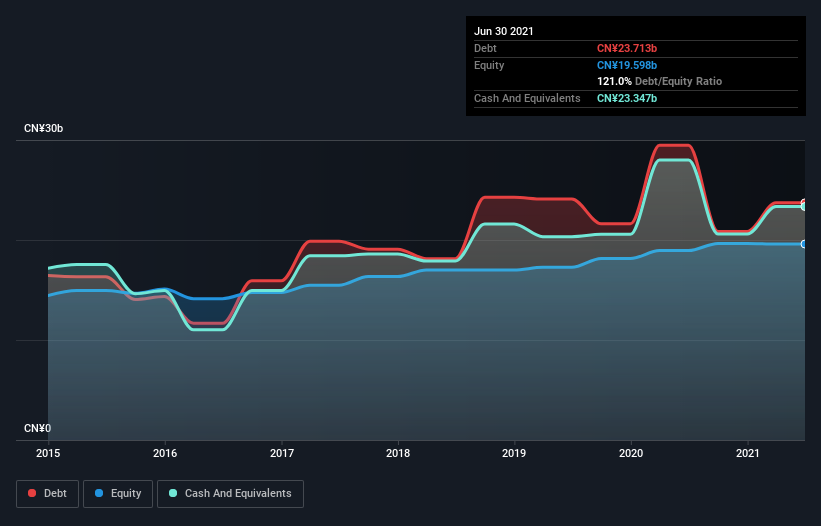

As you can see below, Hengan International Group had CN¥23.7b of debt at June 2021, down from CN¥29.5b a year prior. However, it also had CN¥23.3b in cash, and so its net debt is CN¥366.0m.

How Healthy Is Hengan International Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Hengan International Group had liabilities of CN¥25.3b due within 12 months and liabilities of CN¥1.99b due beyond that. Offsetting these obligations, it had cash of CN¥23.3b as well as receivables valued at CN¥4.46b due within 12 months. So it actually has CN¥561.4m more liquid assets than total liabilities.

Having regard to Hengan International Group's size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the CN¥38.0b company is short on cash, but still worth keeping an eye on the balance sheet. Carrying virtually no net debt, Hengan International Group has a very light debt load indeed.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Hengan International Group has barely any net debt, as demonstrated by its net debt to EBITDA ratio of only 0.068. Happily, it actually managed to receive more interest than it paid, over the last year. So there's no doubt this company can take on debt as easily as enthusiastic spray-tanners take on an orange hue. On the other hand, Hengan International Group's EBIT dived 17%, over the last year. If that rate of decline in earnings continues, the company could find itself in a tight spot. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Hengan International Group's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the most recent three years, Hengan International Group recorded free cash flow worth 72% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Hengan International Group's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But the stark truth is that we are concerned by its EBIT growth rate. Taking all this data into account, it seems to us that Hengan International Group takes a pretty sensible approach to debt. While that brings some risk, it can also enhance returns for shareholders. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for Hengan International Group you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Hengan International Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1044

Hengan International Group

An investment holding company, manufactures, distributes, and sells personal hygiene products in the People’s Republic of China and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives