- Hong Kong

- /

- Medical Equipment

- /

- SEHK:9997

Does Kangji Medical Holdings Limited (HKG:9997) Create Value For Shareholders?

While some investors are already well versed in financial metrics (hat tip), this article is for those who would like to learn about Return On Equity (ROE) and why it is important. To keep the lesson grounded in practicality, we'll use ROE to better understand Kangji Medical Holdings Limited (HKG:9997).

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

View our latest analysis for Kangji Medical Holdings

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Kangji Medical Holdings is:

9.6% = CN¥286m ÷ CN¥3.0b (Based on the trailing twelve months to June 2020).

The 'return' is the income the business earned over the last year. Another way to think of that is that for every HK$1 worth of equity, the company was able to earn HK$0.10 in profit.

Does Kangji Medical Holdings Have A Good Return On Equity?

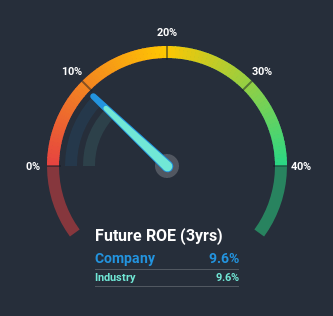

Arguably the easiest way to assess company's ROE is to compare it with the average in its industry. However, this method is only useful as a rough check, because companies do differ quite a bit within the same industry classification. If you look at the image below, you can see Kangji Medical Holdings has a similar ROE to the average in the Medical Equipment industry classification (9.6%).

That isn't amazing, but it is respectable. Although the ROE is similar to the industry, we should still perform further checks to see if the company's ROE is being boosted by high debt levels. If a company takes on too much debt, it is at higher risk of defaulting on interest payments.

Why You Should Consider Debt When Looking At ROE

Virtually all companies need money to invest in the business, to grow profits. That cash can come from issuing shares, retained earnings, or debt. In the first two cases, the ROE will capture this use of capital to grow. In the latter case, the use of debt will improve the returns, but will not change the equity. That will make the ROE look better than if no debt was used.

Kangji Medical Holdings' Debt And Its 9.6% ROE

One positive for shareholders is that Kangji Medical Holdings does not have any net debt! Its ROE already suggests it is a good business, but the fact it has achieved this -- and doesn't borrowings -- makes it worthy of further consideration, in our view. At the end of the day, when a company has zero debt, it is in a better position to take future growth opportunities.

Summary

Return on equity is useful for comparing the quality of different businesses. Companies that can achieve high returns on equity without too much debt are generally of good quality. All else being equal, a higher ROE is better.

But when a business is high quality, the market often bids it up to a price that reflects this. It is important to consider other factors, such as future profit growth -- and how much investment is required going forward. So I think it may be worth checking this free report on analyst forecasts for the company.

But note: Kangji Medical Holdings may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

When trading Kangji Medical Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Kangji Medical Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kangji Medical Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:9997

Kangji Medical Holdings

An investment holding company, engages in the design, development, manufacture, and sale of minimally invasive surgical instruments and accessories in Mainland China and internationally.

Flawless balance sheet and fair value.