- Hong Kong

- /

- Healthcare Services

- /

- SEHK:9955

Take Care Before Jumping Onto ClouDr Group Limited (HKG:9955) Even Though It's 27% Cheaper

To the annoyance of some shareholders, ClouDr Group Limited (HKG:9955) shares are down a considerable 27% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 70% loss during that time.

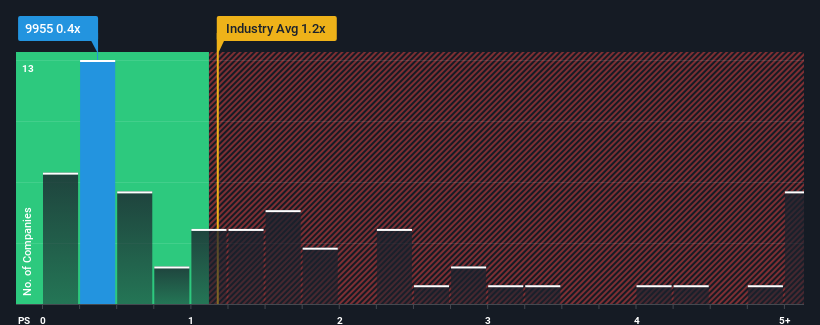

After such a large drop in price, considering around half the companies operating in Hong Kong's Healthcare industry have price-to-sales ratios (or "P/S") above 1.2x, you may consider ClouDr Group as an solid investment opportunity with its 0.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for ClouDr Group

How ClouDr Group Has Been Performing

Recent times have been advantageous for ClouDr Group as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think ClouDr Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For ClouDr Group?

There's an inherent assumption that a company should underperform the industry for P/S ratios like ClouDr Group's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 22% per year as estimated by the four analysts watching the company. That's shaping up to be materially higher than the 16% per annum growth forecast for the broader industry.

In light of this, it's peculiar that ClouDr Group's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

ClouDr Group's P/S has taken a dip along with its share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems ClouDr Group currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for ClouDr Group with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9955

ClouDr Group

Provides supplies and software as a service (SaaS) installation to hospitals and pharmacies, digital marketing services to pharmaceutical companies, and online consultation and prescriptions for patients with chronic condition management.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives