- Singapore

- /

- Medical Equipment

- /

- SGX:AP4

Top Undervalued Small Caps With Insider Buying In Global August 2025

Reviewed by Simply Wall St

In August 2025, global markets have been buoyed by optimism surrounding potential U.S. interest rate cuts, with small-cap stocks experiencing notable gains as the Russell 2000 Index outperformed larger indices. Amidst this backdrop of economic data and rate cut speculation, identifying promising small-cap stocks often involves looking for those with strong fundamentals and insider buying activity, which can signal confidence in their growth potential despite broader market uncertainties.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Bytes Technology Group | 17.6x | 4.4x | 11.61% | ★★★★☆☆ |

| Hemisphere Energy | 5.8x | 2.3x | 10.22% | ★★★★☆☆ |

| East West Banking | 3.3x | 0.8x | 17.62% | ★★★★☆☆ |

| BWP Trust | 9.8x | 12.8x | 16.76% | ★★★★☆☆ |

| Sagicor Financial | 7.1x | 0.4x | -71.96% | ★★★★☆☆ |

| Daiwa House Logistics Trust | 12.9x | 6.7x | 15.49% | ★★★★☆☆ |

| CVS Group | 46.9x | 1.4x | 35.63% | ★★★★☆☆ |

| A.G. BARR | 19.3x | 1.8x | 46.55% | ★★★☆☆☆ |

| Dicker Data | 20.3x | 0.7x | -19.85% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.9x | 1.8x | 19.08% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

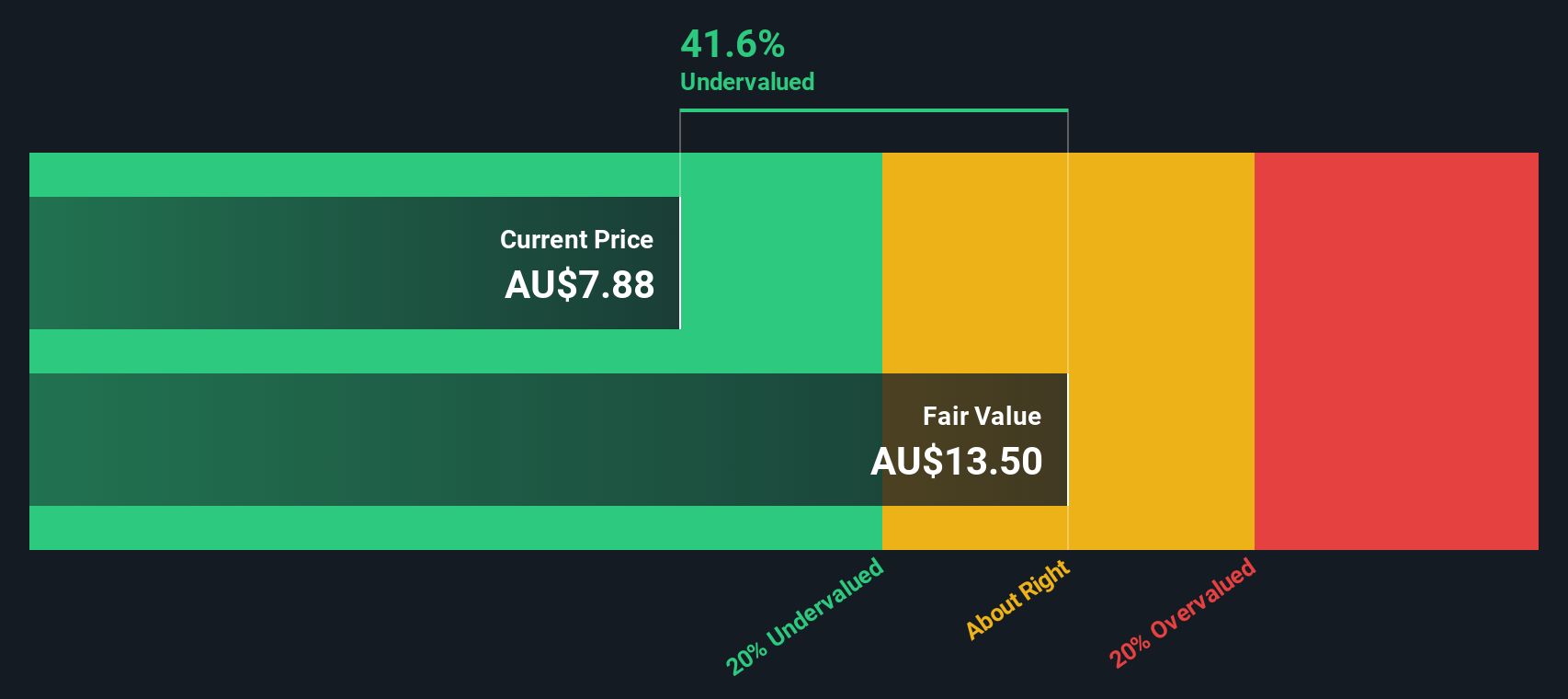

Amotiv (ASX:AOV)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Amotiv is a company specializing in powertrain and undercar systems, lighting power and electrical solutions, as well as 4WD accessories and trailering products, with a market capitalization of A$1.25 billion.

Operations: Amotiv generates revenue primarily from three segments: Powertrain & Undercar, Lighting Power & Electrical, and 4wd Accessories & Trailering. The company experienced fluctuations in its gross profit margin, peaking at 57.13% in December 2016 and decreasing to around 43.75% by June 2025. Operating expenses are a significant part of the cost structure, with Sales & Marketing being a major component alongside General & Administrative and R&D expenses.

PE: -12.2x

Amotiv, a smaller company in its sector, faces challenges with high debt levels and reliance on external borrowing. Despite this, insider confidence is evident with recent share purchases in July 2025. The company reported sales of A$997.4 million for the year ending June 30, 2025, but faced a net loss of A$106.3 million compared to last year's profit. Earnings are projected to grow significantly by nearly 50% annually, suggesting potential future growth despite current setbacks.

- Get an in-depth perspective on Amotiv's performance by reading our valuation report here.

Explore historical data to track Amotiv's performance over time in our Past section.

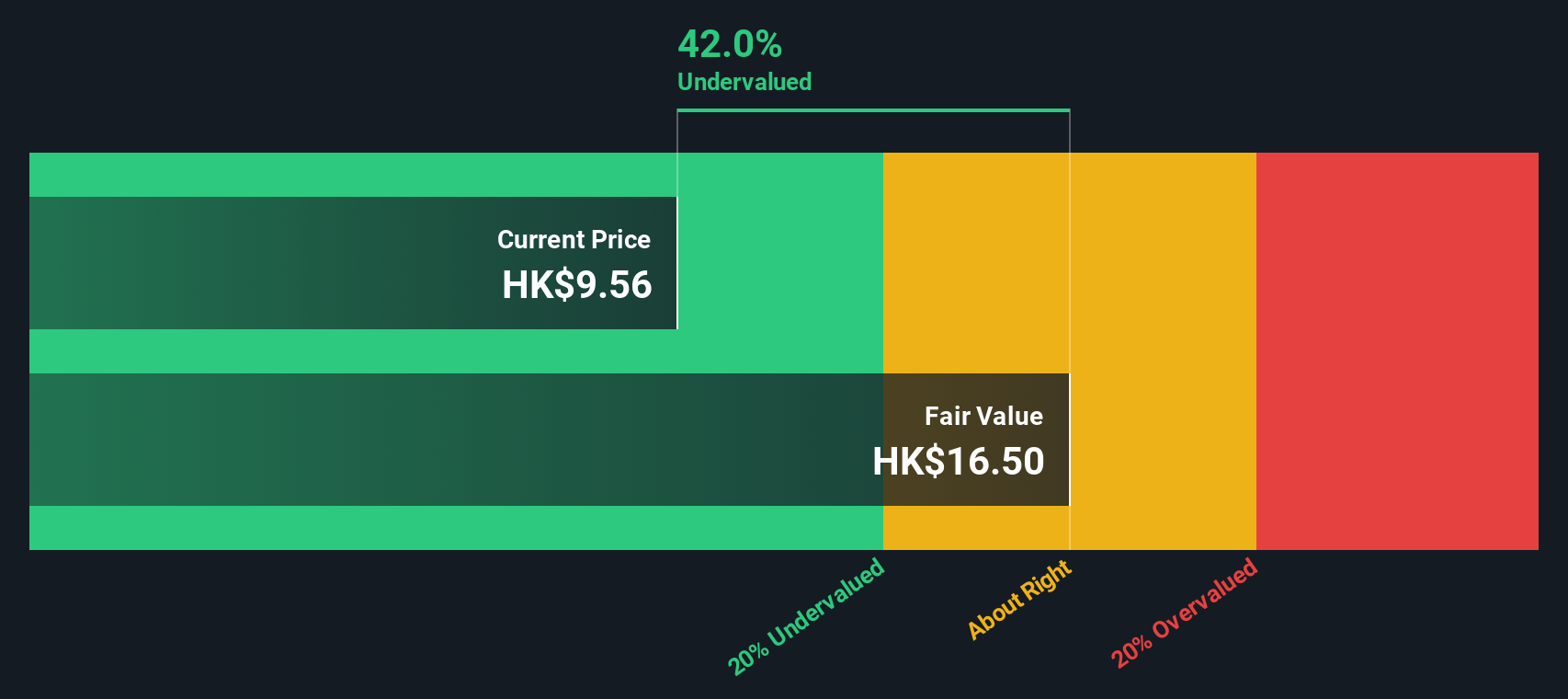

YSB (SEHK:9885)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: YSB is a company that specializes in providing logistics and supply chain solutions, with a market capitalization of approximately CN¥5.23 billion.

Operations: YSB generates revenue primarily through its sales operations, with a notable increase in revenue from CN¥6.06 billion in 2020 to CN¥18.93 billion by mid-2025. The company's cost of goods sold (COGS) has also risen, reaching CN¥16.90 billion as of June 2025, impacting its profitability metrics over time. Notably, the gross profit margin has shown fluctuations but reached 10.76% by mid-2025, indicating some level of improvement in managing production costs relative to sales growth during this period.

PE: 74.7x

YSB Inc., a company with a focus on innovative technology, recently reported significant growth in its financial performance. For the half-year ending June 30, 2025, sales increased to CNY 9.84 billion from CNY 8.81 billion last year, while net income soared to CNY 78 million from CNY 21.82 million. This impressive growth is supported by strong demand for their high-margin products and enhanced digital capabilities driving operational efficiency. Insider confidence is evident as an insider purchased 300,000 shares worth approximately CNY 1.91 million between August and September this year, reflecting belief in YSB's potential amidst external borrowing risks due to low customer deposits.

- Click here and access our complete valuation analysis report to understand the dynamics of YSB.

Review our historical performance report to gain insights into YSB's's past performance.

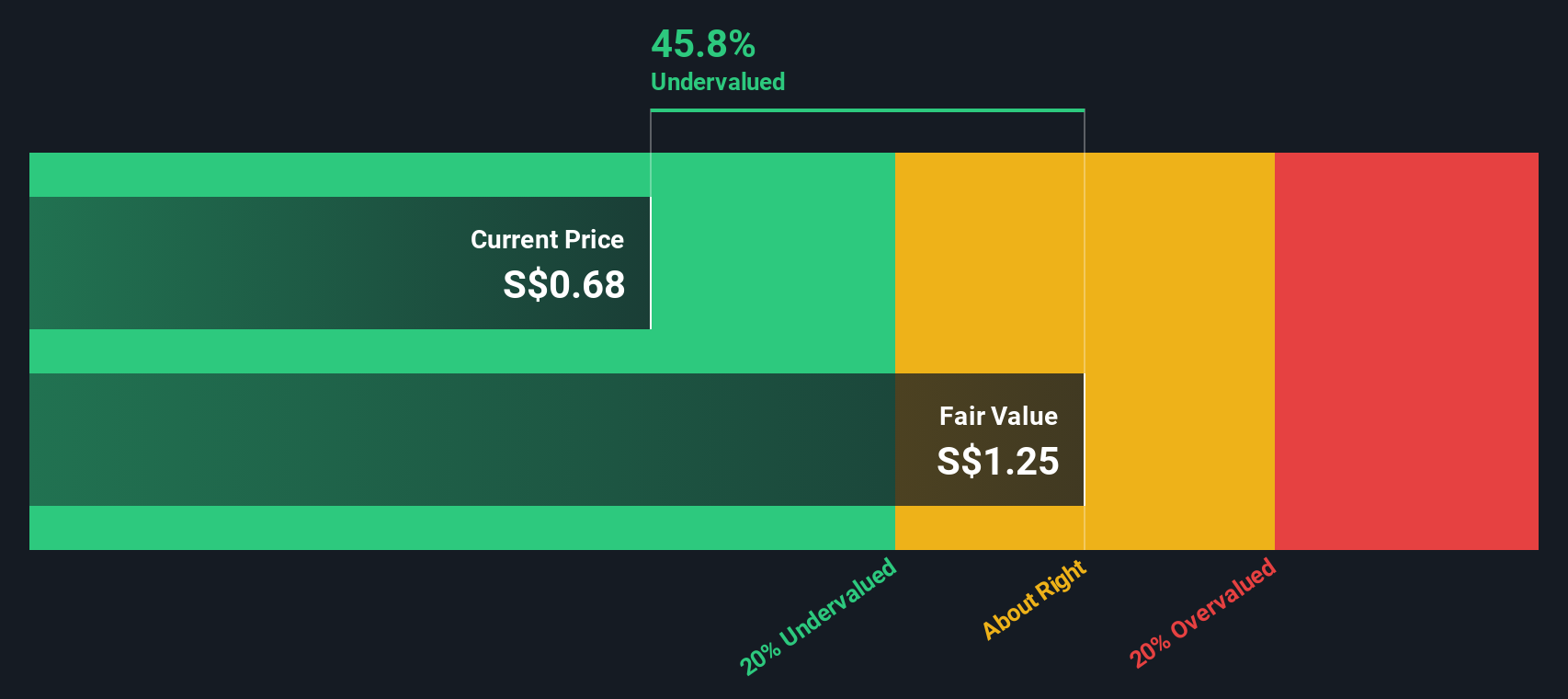

Riverstone Holdings (SGX:AP4)

Simply Wall St Value Rating: ★★★★★★

Overview: Riverstone Holdings is a company primarily engaged in the manufacturing of gloves, with additional operations in other sectors, and has a market capitalization of approximately S$1.06 billion.

Operations: Riverstone Holdings derives its revenue primarily from the gloves segment, generating MYR 1.06 billion, with a smaller contribution from other sources. The company's cost of goods sold (COGS) is significant, impacting its gross profit margins, which have shown notable fluctuations over time. As of recent data, the gross profit margin stands at 31.79%. Operating expenses include general and administrative costs and sales & marketing expenses that influence net income outcomes.

PE: 14.1x

Riverstone Holdings, a small company with potential for growth, recently reported mixed earnings. Sales for the second quarter were MYR 244.82 million, slightly down from last year, while net income fell to MYR 45.37 million from MYR 72.5 million. Despite these results, insider confidence is evident as Co-Founder Teek Son Wong purchased one million shares valued at US$718,899 in early August 2025. The appointment of Dumrongsak Aroonprasertkul as Non-Executive Director may enhance strategic growth in Thailand despite funding risks due to external borrowing reliance.

- Dive into the specifics of Riverstone Holdings here with our thorough valuation report.

Understand Riverstone Holdings' track record by examining our Past report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 98 Undervalued Global Small Caps With Insider Buying by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:AP4

Riverstone Holdings

An investment holding company, engages in the manufacture and distribution of cleanroom and healthcare gloves in Malaysia, Thailand, and China.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives