David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that MicroPort Scientific Corporation (HKG:853) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

What Is MicroPort Scientific's Debt?

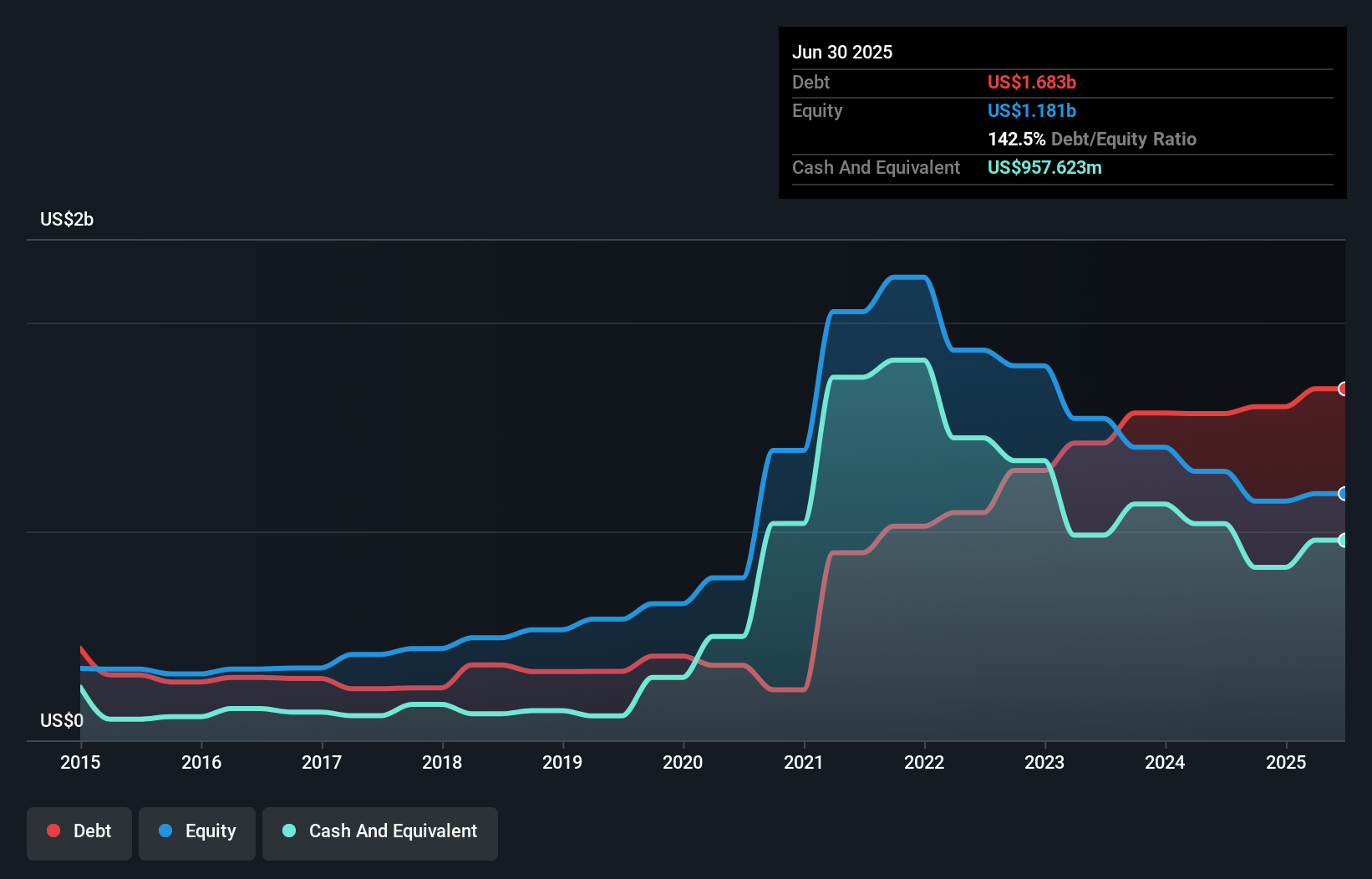

The image below, which you can click on for greater detail, shows that at June 2025 MicroPort Scientific had debt of US$1.68b, up from US$1.56b in one year. However, because it has a cash reserve of US$957.6m, its net debt is less, at about US$725.2m.

How Strong Is MicroPort Scientific's Balance Sheet?

We can see from the most recent balance sheet that MicroPort Scientific had liabilities of US$1.32b falling due within a year, and liabilities of US$1.27b due beyond that. On the other hand, it had cash of US$957.6m and US$403.9m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$1.23b.

MicroPort Scientific has a market capitalization of US$2.59b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if MicroPort Scientific can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

View our latest analysis for MicroPort Scientific

In the last year MicroPort Scientific's revenue was pretty flat, and it made a negative EBIT. While that's not too bad, we'd prefer see growth.

Caveat Emptor

Importantly, MicroPort Scientific had an earnings before interest and tax (EBIT) loss over the last year. Indeed, it lost US$68m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. So we think its balance sheet is a little strained, though not beyond repair. However, it doesn't help that it burned through US$104m of cash over the last year. So to be blunt we think it is risky. For riskier companies like MicroPort Scientific I always like to keep an eye on whether insiders are buying or selling. So click here if you want to find out for yourself.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:853

MicroPort Scientific

Engages in the innovating, manufacturing, and marketing medical devices globally in the People’s Republic of China, Europe, Middle East and Africa, Japan, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026