- Hong Kong

- /

- Medical Equipment

- /

- SEHK:6929

Some OrbusNeich Medical Group Holdings Limited (HKG:6929) Shareholders Look For Exit As Shares Take 28% Pounding

OrbusNeich Medical Group Holdings Limited (HKG:6929) shares have had a horrible month, losing 28% after a relatively good period beforehand. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

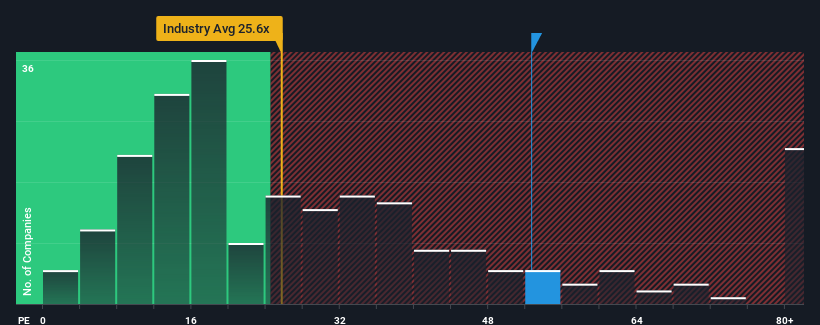

Even after such a large drop in price, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 9x, you may still consider OrbusNeich Medical Group Holdings as a stock to avoid entirely with its 52.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With its earnings growth in positive territory compared to the declining earnings of most other companies, OrbusNeich Medical Group Holdings has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for OrbusNeich Medical Group Holdings

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, OrbusNeich Medical Group Holdings would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period has seen an excellent 85% overall rise in EPS, in spite of its uninspiring short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 15% each year as estimated by the only analyst watching the company. That's shaping up to be materially lower than the 21% each year growth forecast for the broader market.

In light of this, it's alarming that OrbusNeich Medical Group Holdings' P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

What We Can Learn From OrbusNeich Medical Group Holdings' P/E?

Even after such a strong price drop, OrbusNeich Medical Group Holdings' P/E still exceeds the rest of the market significantly. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of OrbusNeich Medical Group Holdings' analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for OrbusNeich Medical Group Holdings with six simple checks will allow you to discover any risks that could be an issue.

Of course, you might also be able to find a better stock than OrbusNeich Medical Group Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade OrbusNeich Medical Group Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6929

OrbusNeich Medical Group Holdings

An investment holding company, engages in the manufacturing, trading, sales, and marketing of medical devices/instruments for the treatment of coronary and peripheral vascular diseases in Japan, Europe, the Middle East, Africa, the Asia Pacific, the People’s Republic of China, and the United States.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives