- Hong Kong

- /

- Medical Equipment

- /

- SEHK:6929

Market Cool On OrbusNeich Medical Group Holdings Limited's (HKG:6929) Earnings

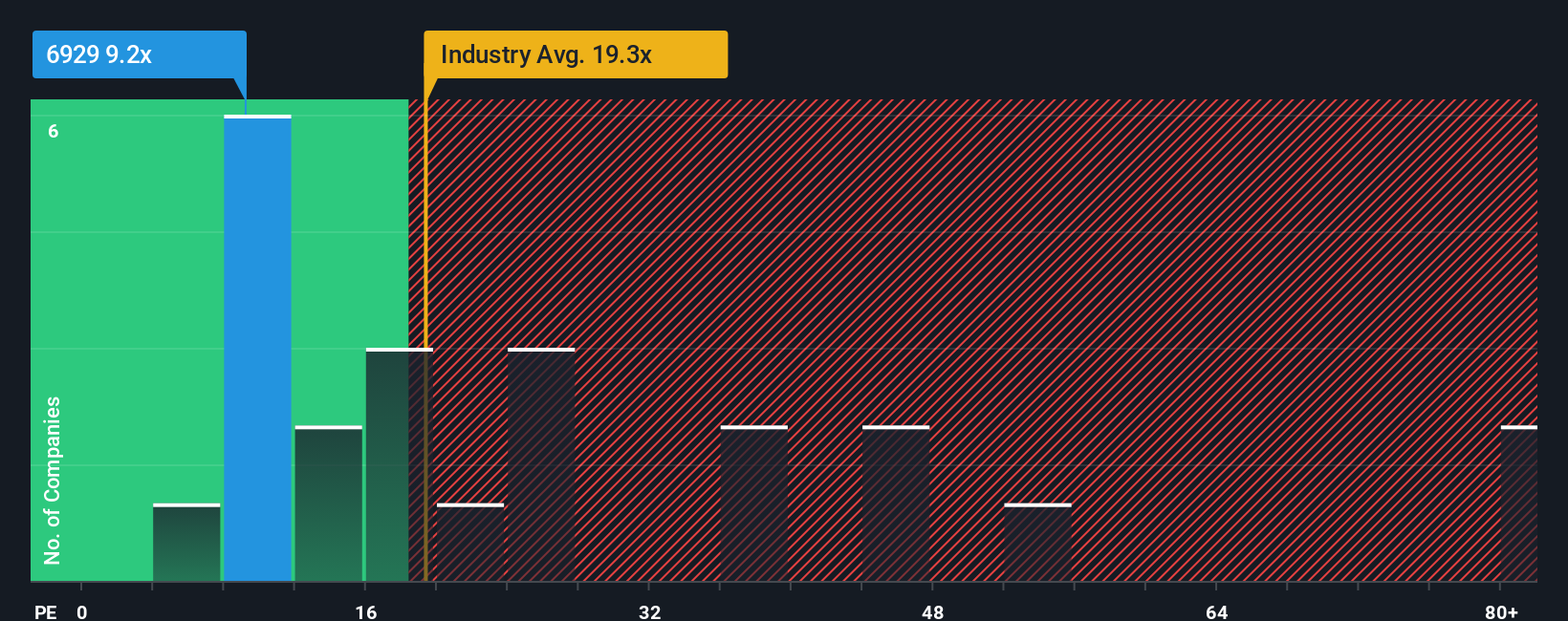

OrbusNeich Medical Group Holdings Limited's (HKG:6929) price-to-earnings (or "P/E") ratio of 9.2x might make it look like a buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 13x and even P/E's above 25x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

OrbusNeich Medical Group Holdings certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for OrbusNeich Medical Group Holdings

How Is OrbusNeich Medical Group Holdings' Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like OrbusNeich Medical Group Holdings' to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 5.4%. Pleasingly, EPS has also lifted 10,383% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to climb by 23% per annum during the coming three years according to the two analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 14% per year, which is noticeably less attractive.

With this information, we find it odd that OrbusNeich Medical Group Holdings is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From OrbusNeich Medical Group Holdings' P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that OrbusNeich Medical Group Holdings currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Before you take the next step, you should know about the 2 warning signs for OrbusNeich Medical Group Holdings (1 is potentially serious!) that we have uncovered.

If these risks are making you reconsider your opinion on OrbusNeich Medical Group Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6929

OrbusNeich Medical Group Holdings

An investment holding company, engages in the manufacture, trading, sale, and marketing of medical devices/instruments for the treatment of coronary and peripheral vascular diseases.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026