- Hong Kong

- /

- Healthcare Services

- /

- SEHK:6078

Does Hygeia Healthcare Holdings (HKG:6078) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Hygeia Healthcare Holdings (HKG:6078). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Hygeia Healthcare Holdings

Hygeia Healthcare Holdings' Improving Profits

Over the last three years, Hygeia Healthcare Holdings has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. Thus, it makes sense to focus on more recent growth rates, instead. Hygeia Healthcare Holdings' EPS has risen over the last 12 months, growing from CN¥0.76 to CN¥0.93. That's a 23% gain; respectable growth in the broader scheme of things.

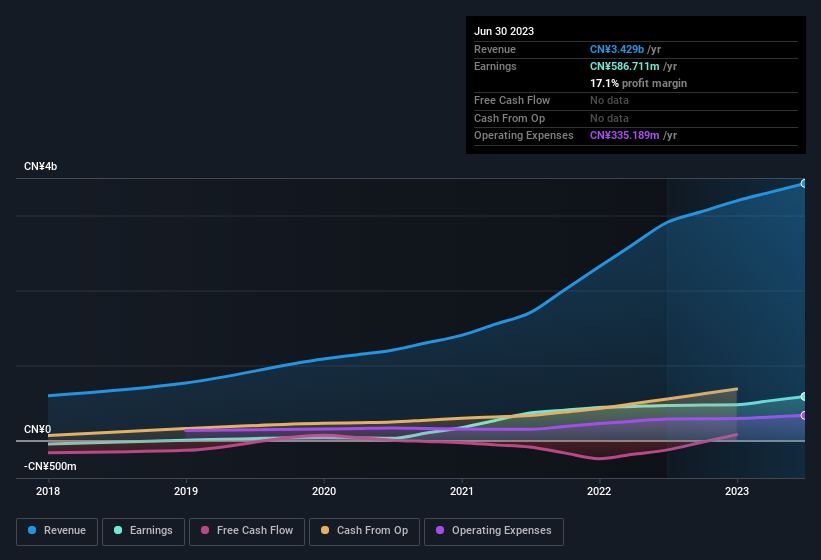

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Hygeia Healthcare Holdings remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 18% to CN¥3.4b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Hygeia Healthcare Holdings?

Are Hygeia Healthcare Holdings Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

One gleaming positive for Hygeia Healthcare Holdings, in the last year, is that a certain insider has buying shares with ample enthusiasm. In other words, the Chairman & Co-CEO, Yiwen Zhu, acquired CN¥9.0m worth of shares over the previous 12 months at an average price of around CN¥39.21. Seeing such high conviction in the company is a huge positive for shareholders and should instil confidence in their mission.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Hygeia Healthcare Holdings insiders own more than a third of the company. In fact, they own 45% of the shares, making insiders a very influential shareholder group. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. And their holding is extremely valuable at the current share price, totalling CN¥12b. This is an incredible endorsement from them.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. The cherry on top is that the CEO, Yiwen Zhu is paid comparatively modestly to CEOs at similar sized companies. Our analysis has discovered that the median total compensation for the CEOs of companies like Hygeia Healthcare Holdings with market caps between CN¥15b and CN¥47b is about CN¥5.2m.

Hygeia Healthcare Holdings offered total compensation worth CN¥3.7m to its CEO in the year to December 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Should You Add Hygeia Healthcare Holdings To Your Watchlist?

As previously touched on, Hygeia Healthcare Holdings is a growing business, which is encouraging. In addition, insiders have been busy adding to their sizeable holdings in the company. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for Hygeia Healthcare Holdings that you should be aware of.

Keen growth investors love to see insider buying. Thankfully, Hygeia Healthcare Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hygeia Healthcare Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6078

Hygeia Healthcare Holdings

Offers oncology healthcare services in the People's Republic of China.

Excellent balance sheet and fair value.

Market Insights

Community Narratives